Chesapeake Energy 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROWTH

VALUE

OPPORTUNITY

CHESAPEAKE ENERGY CORPORATION

ANNUAL REPORT2005

Table of contents

-

Page 1

CHESAPEAKE ENERGY CORPORATION ANNUAL REPORT 2005 GROWTH VALUE OPPORTUNITY -

Page 2

...largest independent producer of natural gas in the U.S. Headquartered in Oklahoma City, the company's operations are focused on exploratory and developmental drilling and corporate and property acquisitions in the Mid-Continent, Permian Basin, South Texas, Texas Gulf Coast, Barnett Shale, Ark-La-Tex... -

Page 3

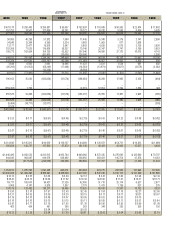

... expense per mcfe Number of employees (full-time at end of period) Cash dividends declared per common share Stock price (at end of period - split adjusted) * See page 11 for the definition of this non-GAAP measure. **Excludes unrealized gains (losses) on oil and gas hedging. 2005 $ 3,272,585 1,392... -

Page 4

...,197) 3,926 (68,249) (13,334) (77,657) (933,854) - - (933,854) - (933,854) (12,077) - $ (945,931) $ (9.97) - $ (9.97) $ (9.97) - $ (9.97) $ 94,639 117,500 $ 812,615 919,076 (248,568) 1,091,348 $ 660,991 $ 1.68 $ 10.48 94,421 5,976 130,277 $ 1.97 $ 0.39 $ 0.06 $ 0.15 $ 1.19 481 $ 0.04... -

Page 5

...of new wells in the U.S., drilling 902 operated wells and participating in another 1,066 nonoperated wells, utilizing an average rig count of 73 operated rigs and 66 non-operated rigs; • Was one of the most active consolidators in the industry, investing $4.9 billion in acquisitions of oil and gas... -

Page 6

GROWTH VALUE OPPORTUNITY 2 CHK 2005 ANNUAL REPORT -

Page 7

... a few of the topics that dominated the news in 2005. Each of these topics dramatically impacted the worldwide energy business and all touched Chesapeake and its shareholders as well. Following a mild winter, U.S. natural gas prices began 2005 just below $6 per mmbtu and remained relatively stable... -

Page 8

... hiring aggressively in 2006. CHESAPEAKE'S BUSINESS STRATEGY AND NATURAL GAS FOCUS Chesapeake's business strategy is probably the easiest to understand among all large-cap public exploration and production (E&P) companies. We grow onshore in the U.S. through a balance of drilling and acquisitions... -

Page 9

...reasoned that the major oil companies would begin withdrawing from the search for increasingly scarce natural gas reserves in North America and refocus their natural gas strategies on building global natural gas franchises around more abundant worldwide natural gas reserves that could be transformed... -

Page 10

GROWTH VALUE OPPORTUNITY 6 CHK 2005 ANNUAL REPORT -

Page 11

...U.S. natural gas production shortfall. We then prepared for the opportunity by hiring hundreds of the most talented landmen, geoscientists and engineers we could find and by making acquisitions of producing properties, companies and unproved leasehold. Our consistent approach has enabled us to build... -

Page 12

...natural gas resource play in the U.S. east of the Rockies. Chesapeake has significantly strengthened its technical capabilities during the past eight years by dramatically increasing its land, geoscience and engineering staff to more than 600 employees. In "Additionally, we are the only E&P company... -

Page 13

... 2005 third quarter, we announced the largest transaction in the company's history - the acquisition of Appalachian natural gas producer Columbia Natural Resources (CNR). Through this transaction, Chesapeake acquired daily net production of 125 mmcfe, an extensive 6,500 mile network of natural gas... -

Page 14

... achieve success in Appalachia. TOM WARD For the first time in 13 years as the CEO of Chesapeake, I am writing this letter without the benefit of my 23-year partnership with Chesapeake's co-founder and former President and Chief Operating Officer, Tom Ward. In early February 2006, Tom announced his... -

Page 15

... the commitment and talents of over 3,500 top-notch employees, an engaged and insightful Board, a time-tested and successful business strategy, a value-added risk-management program, a steadily improving balance sheet and increasingly valuable onshore U.S. natural gas assets. Chesapeake also offers... -

Page 16

... company's Northwest Oklahoma district focuses on the massive Sahara unconventional gas resource project. In this play, we have drilled more than 1,000 successful wells and have more than 8,000 undrilled locations remaining. Active in Sahara since 1998, Chesapeake is now the dominant operator with... -

Page 17

.../05 Net Leasehold Acres: 305,000, +205%, 4% CHK 2005 ANNUAL REPORT 13 AREA 9 BARNETT SHALE During 2005, we rapidly expanded our presence in the prolific Barnett Shale play, which is the nation's most active area of unconventional gas development and is centered around Fort Worth, Texas. Chesapeake... -

Page 18

... of life in the communities and states in which we work. In another example of leadership, Chesapeake's employees led the way in the Central Oklahoma United Way's 2005 fundraising efforts, making history by being the first corporation in Oklahoma City to give $1 million. 14 CHK ANNUAL REPORT -

Page 19

... truck giveaway program in 2006 and broaden its support into new operating areas. HUMANITARIAN RELIEF In another example of leadership, Chesapeake's employees led the way in the Central Oklahoma United Way's 2005 fundraising efforts, making history by being the first corporation in Oklahoma City... -

Page 20

...active natural gas exploration company, Chesapeake uses advanced drilling techniques aimed at reducing the operational footprint at all of our well sites. For example, Chesapeake's engineers are experts at using horizontal and directional drilling techniques. Horizontal and directional drilling have... -

Page 21

... most popular recruiting tool for new employees and our most appreciated campus amenity for employees at our headquarters. The Living Well program, Chesapeake's newest and most comprehensive employee health promotion program, is designed to give our employees the opportunity and incentive to achieve... -

Page 22

... Board and Chief Executive Officer Oklahoma City, OK RICHARD K. DAVIDSON 1,3 Chairman of the Board Union Pacific Corporation Omaha, NE FRANK KEATING 2,3 Former Governor, Oklahoma President and CEO American Council of Life Insurers Washington, DC BREENE M. KERR 1 Private Investor Easton, MD CHARLES... -

Page 23

...1850 Tulsa, Oklahoma 74136 (918) 524-1200 STOCK TRANSFER AGENT AND REGISTRAR Communication concerning the transfer of shares, lost certificates, duplicate mailings or change of address notifications should be directed to the transfer agent. UMB Bank, N.A. P. O. Box 419064 Kansas City, Missouri 64141...