Charles Schwab 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

LETTER FROM THE

CHIEF EXECUTIVE OFFICER

through our schwabmoneywise.com website. Last year,

Charles Schwab Foundation also awarded scholarships

to 0 teens who received a perfect score on the National

Financial Literacy Challenge test.

3. Our business model helped us weather the storm.

In keeping with our purpose to help everyone be

financially fit, we’ve created a simple yet flexible business

model that serves individual investors, independent

investment advisors, and company benefit plan sponsors.

Investor Services, our traditional retail investing and

brokerage unit, helps make financial services more

accessible, affordable, and understandable for individual

investors. Last year, Investor Services generated about two-

thirds of our total revenue and profits, and it accounted

for total client assets of $482.6 billion at year-end.

We also generated strong results through our

“business-to-business” segment, which has

been reorganized into Institutional Services.

We consolidated support capabilities for our

institutional clients, including independent, fee-

based advisors and company retirement plan

sponsors, to deliver the best of Schwab’s institutional

services across our client base. The combined units

represented $654.4 billion in total assets under

management at year-end.

Serving different types of clients generates different sources

of revenue. That, in turn, helps provide more stability for

our performance during up and down market cycles.

4. We were disciplined and diligent in managing expenses.

Over the course of the year, the Federal Reserve

cut interest rates repeatedly in a series of moves

to promote capital liquidity in the markets. Rates

eventually came down to less than one-quarter of

percent, putting additional pressure on our net

interest income, which accounted for roughly 30

percent of revenue in 2008. In addition, the steep

decline in market valuations took its toll on client

portfolios, and that will continue to impact our

asset management fees, which contributed about

45 percent of revenue last year.

In response to this extraordinary environment, our

sustained expense discipline enabled us to finish the

year with a record 39.4 percent pre-tax profit margin as

well as a 3 percent return on equity. Expense discipline

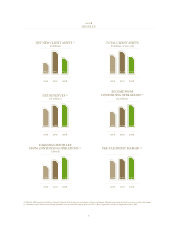

Schwab’s traditional retail brokerage serves individual investors directly through our schwab.com website, at more

than 300 Schwab branches, or by phone. At year-end, Investor Services held $482.6 billion in client assets.

Advisor Services serves more than 5,500 independent investment advisory firms. At year-end, it custodied $477.2

billion in client assets.

Corporate and Retirement Services provides retirement, equity compensation, and other financial services to

corporations and their employees. At year-end, it accounted for $77.2 billion in assets under management.

INvESTOR SERvICES

Annual Revenues: $3.4 billion

Annual Revenues: $1.3 billion

Annual Revenues: $504 million

INSTITUTIONAL SERvICES

ADvISOR SERvICES

CORPORATE AND RETIREMENT SERvICES