Charles Schwab 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

LETTER FROM THE

CHIEF EXECUTIVE OFFICER

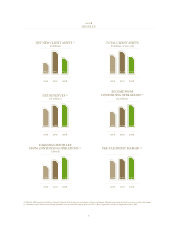

2008 FINANCIAL RESULTS

Based on these strong client metrics, The Charles

Schwab Corporation posted a second consecutive

year of record financial operating results. For the 2

months ending December 3,2008, results included

the following:

• Netrevenuesof$5.2 billion, up 3 percent versus

the prior year.

• Incomefromcontinuingoperationsof$.2 billion,

for a 0 percent year-over-year gain.

• Dilutedearningspersharefromcontinuing

operations of $.06, up 5 percent from 92 cents

per share the prior year.

• Arecordpre-taxprotmarginof39.4 percent,

compared to 37. percent one year ago.

KEYS TO SUCCESS

So how did Schwab succeed when so many other

companies failed or faltered? Four factors contributed

to our success.

1. We started the year on a firm financial footing.

Schwab entered this shaky environment with pre-

tax margins approaching 40 percent, a strong balance

sheet, and limited exposure to the more “toxic” financial

instruments that brought down so many competitors.

We believe that’s the direct result of common-sense

financial strategies and conservative risk management,

which Chief Financial Officer Joe Martinetto describes in

more detail in his accompanying letter.

Because we came into this crisis as a strong, solid, and

secure firm, we were able to operate from a position

of strength. So when the deadline approached to apply

for funding from the federal Troubled Asset Relief

Program, we declined to participate.

2. We were there for people when they needed us most.

During these tough times, millions of people turned

to Schwab for help. Calls to our service representatives

increased 5 percent to more than 0.3 million, while our

automated systems handled an additional 6.8 million

calls. New online accounts grew by more than 30 percent

on schwab.com – nearly two-thirds from “new to firm”

clients. Traffic increased at our branches, too, where we

handled more than 5 million client interactions. In addition

to offering guidance through regular publications, we

invited more than .2 million households to a webcast or

local event with Schwab experts.

We seized other opportunities to build stronger client

relationships. When businesses failed or filed for

bankruptcy, we helped their employees determine

their options with their 40(k) investments. When

many financial advisors decided to leave Wall Street,

Schwab provided what they needed to start their

own independent firms, or we matched them with

an existing firm. And when extreme market volatility

spurred investors to move their money from equities

to federally insured products, we made it easy with

Schwab CD OneSource®, a virtual marketplace of

FDIC-insured CDs from banks across the country.

While serving clients remains our primary focus,

we know there are millions more who need help,

particularly with financial literacy and personal finance

skills. We continued our popular education and

scholarship program with Boys & Girls Clubs of

America, and we expanded the information available

Total Net Revenues = $5,150

Asset management and administration fees

Net interest revenue

Trading revenue

Other

2008 NET REVENUES

(in millions)

,

, ,