Charles Schwab 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIFFERENT

A

KINDof FIRM

2008 ANNUAL REPORT

Table of contents

-

Page 1

KINDof FIRM 2 0 0 8 A N N U A L R E P O R T DIFFERENT A -

Page 2

... ii Letter From the CEO 2008 Results Letter From the CFO Financial Highlights Growth In Client Assets & Accounts Executive Management Form 0-K Board of Directors Corporate Contacts & Information Forward-Looking Statements: In addition to historical information, this Annual Report to Stockholders... -

Page 3

...Schwab, up 88 percent over October 2007. For the full year, investors opened more than 889,000 new brokerage accounts, up 0 percent year-over-year, while total brokerage accounts rose 5 percent to 7.4 million. Corporate and Retirement Services added a record 200,000 participants in 40(k) plans... -

Page 4

...฀margin฀of฀39.4 percent, compared to 37. percent one year ago. 2008 NET REVENUES (in millions) Total Net Revenues = $5,150 Asset management and administration fees Net interest revenue Trading revenue Other KEYS TO SUCCESS So how did Schwab succeed when so many other companies... -

Page 5

... retail brokerage serves individual investors directly through our schwab.com website, at more than 300 Schwab branches, or by phone. At year-end, Investor Services held $482.6 billion in client assets. INSTITUTIONAL SERvICES ADvISOR SERvICES Annual Revenues: $1.3 billion Advisor Services serves... -

Page 6

... service and careful expense management boosted our income and earnings per share to new highs. So many Schwab employees have been on the front lines - and supported the front lines - during this ï¬nancial crisis, and our clients have noticed your hard work. Time and again, we've heard positive... -

Page 7

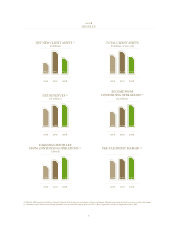

... 2007 2008 (1) Effective 2007, amounts include the Company's mutual fund clearing services business' daily net settlements. All prior period amounts have been recast to reï¬,ect this change. (2) Amounts are presented on a continuing operations basis to exclude the impact of the sale of U.S. Trust... -

Page 8

... and services to help investors achieve their ï¬nancial goals. By 2007, we earned less than 20 percent of our revenues from client trading activity, down from 53 percent in 999. At the same time, asset management and administration fees tied to our mutual fund and advice offerings had risen... -

Page 9

... improves, but the old expression "That's why it's called management" comes to mind - if all we had to do was set and then rigidly follow a formula, you'd rightfully be asking what the Schwab executive team was doing with the rest of our time. Whatever 2009 and beyond holds in store for us, I can... -

Page 10

... dividend per common share Weighted-average common shares outstanding - diluted Closing market price per share (at year end) Book value per common share (at year end) Net revenue growth Pre-tax proï¬t margin from continuing operations Return on stockholders' equity Full-time equivalent employees... -

Page 11

...Mutual fund clearing services Other third-party mutual funds Total Mutual Fund Marketplace Total mutual fund assets (1) Equity and other securities Fixed income securities Margin loans outstanding Total client assets Client Assets by Business Investor Services Advisor Services Corporate & Retirement... -

Page 12

... Chief Executive Ofï¬cer • JAY L. ALLEN Executive Vice President, Human Resources and Employee Services BENJAMIN L. BRIGEMAN Executive Vice President, Investor Services JOHN S. CLENDENING Executive Vice President, Shared Strategic Services CARRIE E. DWYER Executive Vice President, General Counsel... -

Page 13

... THE CHARLES SCHWAB CORPORATION (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 94-3025021 (I.R.S. Employer Identification Number) 120 Kearny Street, San Francisco, CA 94108 (Address of principal executive offices and... -

Page 14

...CHARLES SCHWAB CORPORATION Annual Report On Form 10-K For Fiscal Year Ended December 31, 2008 TABLE OF CONTENTS Part I Item 1. Business General Corporate Overview Acquisition and Divestitures Business Strategy and Competitive Environment Products and Services Regulation Sources of Net Revenues... -

Page 15

... million active brokerage accounts (a) , 1.4 million corporate retirement plan participants, and 447,000 banking accounts. Significant subsidiaries of CSC include: Charles Schwab & Co., Inc. (Schwab), which was incorporated in 1971, is a securities broker-dealer with 306 domestic branch offices in... -

Page 16

... offerings; ï,· Banking - first mortgages, home equity lines of credit, pledged-asset loans, certificates of deposit, demand deposit accounts, high-yield investor checking accounts linked to brokerage accounts, and credit cards; ï,· Trust - trust custody services, personal trust reporting services... -

Page 17

... information, education, technology, service, and pricing which meet the specific needs of clients who trade actively. Schwab offers integrated Web- and software-based trading platforms, which incorporate intelligent order routing technology, real-time market data, options trading, premium stock... -

Page 18

... managed accounts and cash products. Corporate and Retirement Services Through the Corporate and Retirement Services segment, the Company provides retirement plan services, plan administrator services, advice services, education, stock plan services, and mutual fund clearing services, and supports... -

Page 19

THE CHARLES SCHWAB CORPORATION The Company's equity compensation product offers plan sponsors full-service recordkeeping for stock plans: stock options, restricted stock, performance shares and stock appreciation rights. Specialized services for executive transactions and reporting, grant ... -

Page 20

... deposits in banking and brokerage accounts, short-term borrowings, and long-term debt). The Company generates trading revenues through commissions earned for executing trades for clients and principal transaction revenues from trading activity in fixed income securities. For revenue information... -

Page 21

... in cash held in banking or brokerage client accounts and/or a dramatic increase in the Company's client lending activities (including margin and personal lending). The Company also experiences liquidity demands as a result of brokerage client asset flows. In the ordinary course of business, clients... -

Page 22

...limited in the amount it can reduce interest rates on deposit accounts and still offer a competitive return. To the extent certain money market mutual funds replace maturing securities with lower yielding securities and the overall yield on such funds falls to a level at or below the management fees... -

Page 23

...fee structures to enhance its competitive position. Increased price competition from other financial services firms, such as reduced commissions to attract trading volume or higher deposit rates to attract client cash balances, could impact the Company's results of operations and financial condition... -

Page 24

... the Company's stock price are the following: ï,· speculation in the investment community or the press about, or actual changes in, the Company's competitive position, organizational structure, executive team, operations, financial condition, financial reporting and results, effectiveness of cost... -

Page 25

...San Francisco, CA (1) Service centers: Phoenix, AZ (2, 3) Denver, CO (2) Austin, TX (2) Indianapolis, IN (2) Orlando, FL (2) Other: Richfield, OH (4) (1) Includes Schwab headquarters. (2) Includes a regional telephone service center. (3) Includes two data centers and an administrative support center... -

Page 26

...to Consolidated Financial Statements - 17. Employee Incentive, Deferred Compensation, and Retirement Plans and 27. Quarterly Financial Information (Unaudited)." The following graph shows a five-year comparison of cumulative total returns for CSC's common stock, the Dow Jones U.S. Investment Services... -

Page 27

...to pay the exercise price and/or to satisfy tax withholding obligations by employees who exercise stock options (granted under employee stock incentive plans), which are commonly referred to as stock swap exercises. Total Number of Shares Purchased (in thousands) Average Price Paid per Share - 13... -

Page 28

... equity Assets to stockholders' equity ratio Long-term debt to total financial capital (long-term debt plus stockholders' equity) Employee Information Full-time equivalent employees(5) (at year end, in thousands) Net revenues per average full-time equivalent employee (in thousands) 2008 2007 2006... -

Page 29

...the Company's appeal in the marketplace. Additionally, fluctuations in certain components of client assets (e.g., Mutual Fund OneSource funds) directly impacts asset management and administration fee revenues. Clients' daily average trades is an indicator of client engagement with securities markets... -

Page 30

... paid on funding sources. Asset management and administration fees and net interest revenue are impacted by securities valuations, interest rates, the Company's ability to attract new clients, and client activity levels. The Company generates trading revenues through commissions earned for executing... -

Page 31

... ENVIRONMENT The adverse market conditions in 2008 discussed above continue to negatively impact the Company's revenues. The Company earns mutual fund service fees and asset management fees based upon daily balances of certain client assets. Fluctuations in these client asset balances caused by... -

Page 32

...the 2008 presentation. Asset Management and Administration Fees Asset management and administration fees include mutual fund service fees and fees for other asset-based financial services provided to individual and institutional clients. The Company earns mutual fund service fees for transfer agent... -

Page 33

...-bearing brokerage client cash balances and proceeds from stock-lending activities, as well as stockholders' equity. The amount of excess cash held in certain Schwab brokerage client accounts that is swept into money market deposit accounts at Schwab Bank and (through May 2007) at U.S. Trust has... -

Page 34

...part of the Company's capital restructuring in 2007. Certain interest-bearing assets and liabilities of U.S. Trust retained by the Company in 2007 and 2006: The excess cash held in certain Schwab brokerage client accounts was previously swept into a money market deposit account at U.S. Trust. In May... -

Page 35

THE CHARLES SCHWAB CORPORATION Management's Discussion and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Millions, Except Ratios, or as Noted) comprised of revenues from client fixed income securities trading activity. Factors that influence principal transaction ... -

Page 36

..., long-term incentive plan, stock-based compensation, and employee stock purchase plan expense. (2) Includes full-time, part-time and temporary employees, and persons employed on a contract basis, and excludes employees of outsourced service providers. Salaries and wages increased in 2008 from 2007... -

Page 37

..., trading, and support services to independent investment advisors. The Corporate and Retirement Services segment provides retirement plan services, plan administrator services, stock plan services, and mutual fund clearing services and supports the availability of Schwab proprietary mutual funds on... -

Page 38

... 2006 primarily due to higher client servicing and other related expenses, as well as higher market development expense. Advisor Services Net revenues increased in 2008 by $129 million, or 12%, from 2007 due to increases in trading revenue and asset management and administration fees, offset by the... -

Page 39

... costs to service additional corporate retirement plan participants resulting from the acquisition of the 401(k) Company, offset by lower incentive compensation expense. Net revenues increased in 2007 by $133 million, or 36%, from 2006 due to increases in asset management and administration fees... -

Page 40

...cash deposits to cover daily funding needs and to support growth in the Company's business. Generally, CSC does not hold liquidity at its subsidiaries in excess of amounts deemed sufficient to support the subsidiaries' operations, including any regulatory capital requirements. Schwab and Schwab Bank... -

Page 41

... usually settle, or can be closed out, within a few business days. Liquidity needs relating to client trading and margin borrowing activities are met primarily through cash balances in brokerage client accounts, which were $19.2 billion, $19.5 billion, and $19.9 billion at December 31, 2008, 2007... -

Page 42

... accounts is swept into a money market deposit account at Schwab Bank. At December 31, 2008, these balances totaled $18.4 billion. Additionally, Schwab Bank has access to traditional funding sources such as deposits, federal funds purchased, and repurchase agreements. Schwab Bank has access to short... -

Page 43

... funds were drawn under this facility during 2008. Capital Resources The Company monitors both the relative composition and absolute level of its capital structure. Management is focused on limiting the Company's use of capital and currently targets a long-term debt to total financial capital ratio... -

Page 44

... price of $1.7 billion. Pursuant to the tender offer rules, CSC was prohibited from making open market repurchases of its common stock during the tender offer period and until August 15, 2007. Under the Stock Purchase Agreement executed on July 2, 2007 with Chairman and former CEO Charles R. Schwab... -

Page 45

...which focuses on the credit exposures resulting from client activity (e.g., margin lending activities and loans to banking clients), the investing activities of certain of the Company's proprietary funds, corporate credit activities (e.g., counterparty and corporate investing activities), and market... -

Page 46

...or Company information, and unauthorized activities, such as transactions exceeding acceptable risks or authorized limits. External fraud includes misappropriation of client or Company assets by third parties, including through unauthorized access to Company systems and data and client accounts. The... -

Page 47

...mainly results from margin lending activities, securities lending activities, mortgage lending activities, its role as a counterparty in financial contracts and investing activities, and indirectly from the investing activities of certain of the proprietary funds that the Company sponsors. To manage... -

Page 48

...% The Company has exposure to credit risk associated with its securities available for sale portfolio, which totaled $14.4 billion at December 31, 2008. This portfolio includes U.S. agency and non-agency mortgage-backed securities, corporate debt securities, long term certificates of deposit, asset... -

Page 49

...Except Ratios, or as Noted) Schwab performs clearing services for all securities transactions in its client accounts. Schwab has exposure to credit risk due to its obligation to settle transactions with clearing corporations, mutual funds, and other financial institutions even if Schwab's client or... -

Page 50

... procedures address issues such as business conduct and ethics, sales and trading practices, marketing and communications, extension of credit, client funds and securities, books and records, anti-money laundering, client privacy, employment policies, and contracts management. Despite the Company... -

Page 51

... April 1st as its annual goodwill impairment testing date. In testing for a potential impairment of goodwill on April 1, 2008, management estimated the fair value of each of the Company's reporting units (generally defined as the Company's businesses for which financial information is available and... -

Page 52

...(see "Critical Accounting Estimates"); ï,· the impact on the Company's results of operations of recording stock option expense (see "Item 8 - Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - 17. Employee Incentive, Deferred Compensation, and Retirement Plans... -

Page 53

...CHARLES SCHWAB CORPORATION Management's Discussion and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Millions, Except Ratios, or as Noted) the amount of loans to the Company's brokerage and banking clients; the level of brokerage client cash balances and deposits... -

Page 54

... of the Company's securities lending activities. Equity market valuations may also affect the level of brokerage client trading activity, margin borrowing, and overall client engagement with the Company. Additionally, the Company earns mutual fund service fees and asset management fees based upon... -

Page 55

... the rates paid on brokerage client cash balances and banking deposits had reached minimal levels by year-end 2008. With liability costs essentially fixed, lower rates earned on interest-bearing assets would have a direct impact on net interest income. The Company remains positioned to experience... -

Page 56

... for Sale and Securities Held to Maturity Note 6. Loans to Banking Clients and Related Allowance for Credit Losses Note 7. Equipment, Office Facilities, and Property Note 8. Other Assets Note 9. Deposits from Banking Clients Note 10. Payables to Brokers, Dealers, and Clearing Organizations... -

Page 57

THE CHARLES SCHWAB CORPORATION Consolidated Statements of Income (In Millions, Except Per Share Amounts) Year Ended December 31, Net Revenues Asset management and administration fees Interest revenue Interest expense Net interest revenue Trading revenue Other Total net revenues Expenses Excluding ... -

Page 58

...31, Assets Cash and cash equivalents Cash and investments segregated and on deposit for regulatory purposes (including resale agreements of $6,701 in 2008 and $2,722 in 2007) Receivables from brokers, dealers, and clearing organizations Receivables from brokerage clients - net Other securities owned... -

Page 59

... by investing activities Cash Flows from Financing Activities Net change in deposits from banking clients Issuance of long-term debt Repayment of long-term debt Excess tax benefits from stock-based compensation Dividends paid Purchase of treasury stock Proceeds from stock options exercised and... -

Page 60

THE CHARLES SCHWAB CORPORATION Consolidated Statements of Stockholders' Equity (In Millions) Accumulated Additional Common Stock Shares Amount Paid-In Capital Retained Earnings Treasury Stock, at cost Unamortized Stock-based Compensation Other Comprehensive Loss Total Balance at December 31, 2005 ... -

Page 61

... brokerage, banking, and related financial services. Charles Schwab & Co., Inc. (Schwab) is a securities broker-dealer with 306 domestic branch offices in 45 states, as well as a branch in each of the Commonwealth of Puerto Rico and London, U.K. In addition, Schwab serves clients in Hong Kong... -

Page 62

...in trading revenue. Securities available for sale are recorded at fair value based on quoted prices for similar securities in active markets and other observable market data. Securities available for sale include U.S. agency and non-agency mortgage-backed securities, corporate debt securities, asset... -

Page 63

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Nonaccrual loans: Loans are placed on nonaccrual status upon becoming 90 days past due as to interest or principal (unless the ... -

Page 64

.... Long-term incentive compensation: Eligible officers received long-term incentive plan units under a long-term incentive plan (LTIP). These awards are restricted from transfer or sale and vest annually over a three- to four-year performance period. Each award provides for a one-time cash payment... -

Page 65

... in 2008 and $6 million in 2007. 2008 440 124 62 626 2007 $ 413 175 87 $ 675 $ $ The Company's positions in Schwab Fundsïƒ' money market funds arise from certain overnight funding of clients' redemption, check-writing, and debit card activities. Fixed income, equity, and other securities include... -

Page 66

... Per Share Data, Option Price Amounts, Ratios, or as Noted) Securities sold, but not yet purchased of $2 million at December 31, 2008 and $6 million at December 31, 2007, consisted primarily of mutual fund shares that are distributed to clients to satisfy their dividend reinvestment requests. These... -

Page 67

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) A summary of securities with unrealized losses, aggregated by category and period of continuous unrealized loss is as follows: ... -

Page 68

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) management considers these to be of the highest credit quality given the guarantee of principal and interest by the U.S. agencies... -

Page 69

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 6. Loans to Banking Clients and Related Allowance for Credit Losses An analysis of the composition of the loan portfolio is as ... -

Page 70

... assets $ 1,071 (1) Accounts receivable include accrued service fee income and receivable from loan servicer. 2007 254 326 110 53 42 23 42 850 $ $ 9. Deposits from Banking Clients Deposits from banking clients consist of money market, high-yield investor checking, and other savings deposits... -

Page 71

... The funds under this facility are available for general corporate purposes, including repayment of Commercial Paper Notes discussed above. The financial covenants in this facility require Schwab to maintain a minimum net capital ratio, as defined, Schwab Bank to be well capitalized, as defined, and... -

Page 72

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) To manage short-term liquidity, Schwab maintains uncommitted, unsecured bank credit lines with a group of six banks totaling $1.1... -

Page 73

...of the clearing houses, which are issued by multiple banks. At December 31, 2008, the aggregate face amount of these LOCs totaled $550 million. In connection with its securities lending activities, Schwab is required to provide collateral to certain brokerage clients. Schwab satisfies the collateral... -

Page 74

...a limited number of plaintiffs who sold securities at prices in excess of the initial offering price or who purchased securities outside the class period. 14. Financial Instruments Subject to Off-Balance Sheet Risk, Credit Risk, or Market Risk Securities lending: Through Schwab, the Company loans... -

Page 75

... broker-dealers to fulfill short sales of its clients. The market value of these borrowed securities was $259 million and $320 million at December 31, 2008 and 2007, respectively. Client trade settlement: The Company is obligated to settle transactions with brokers and other financial institutions... -

Page 76

... extend credit (firm commitments). Firm commitments are legally binding agreements to lend to a client that generally have fixed expiration dates or other termination clauses, may require payment of a fee and are not secured by collateral until funds are advanced. Collateral held includes marketable... -

Page 77

... that the Company has the ability to access. This category includes active exchange-traded money market funds, mutual funds, and equity securities. Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly... -

Page 78

... from/ to brokers, dealers and clearing organizations, receivables and payables from/ to brokerage clients, interest and non-interest bearing deposits from banking clients, and drafts, accounts, taxes, interest, and compensation payable. Assets and liabilities in these categories are short-term in... -

Page 79

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Loans to banking clients primarily include adjustable-rate first-mortgage and HELOC loans. Loans to banking clients are recorded ... -

Page 80

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 16. Accumulated Other Comprehensive Loss Accumulated other comprehensive loss represents cumulative gains and losses that are ... -

Page 81

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 17. Employee Incentive, Deferred Compensation, and Retirement Plans A summary of the Company's stock-based compensation expense... -

Page 82

...'s stock incentive plans provide for granting restricted stock awards to employees, officers, and directors. Restricted stock awards are restricted from transfer or sale and generally vest annually over a three- to four-year period, but some vest based upon the Company achieving certain financial or... -

Page 83

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) is 85% of the fair market value of the shares on the last trading day of the offering period. At December 31, 2008, the Company ... -

Page 84

... to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Income tax expense from discontinued operations was $18 million in 2008 and related to the determination of the final income tax gain on the sale of U.S. Trust. The... -

Page 85

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The Company's unrecognized tax benefits, which are included in accrued expenses and other liabilities, represent the difference ... -

Page 86

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 20. Regulatory Requirements CSC is a savings and loan holding company and Schwab Bank, CSC's depository institution subsidiary,... -

Page 87

..., trading, and support services to independent investment advisors. The Corporate and Retirement Services segment provides retirement plan services, plan administrator services, stock plan services, and mutual fund clearing services and supports the availability of Schwab proprietary mutual funds on... -

Page 88

..., Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Financial information for the Company's reportable segments is presented in the following table: Year Ended December 31, Net revenues: Investor Services Advisor Services Corporate & Retirement Services Unallocated and other Total... -

Page 89

... service fees Investment management and trust fees Other asset management and administration fees Interest revenue: Cash and cash equivalents Cash and investments segregated Receivables from brokers, dealers and clearing organizations Receivables from brokerage clients Securities available for sale... -

Page 90

... on a straight-line basis over 16 years. The goodwill was allocated to the Corporate and Retirement Services segment. 24. Discontinued Operations On July 1, 2007, the Company completed the sale of all of the outstanding common stock of U.S. Trust for $3.3 billion in cash. The components of... -

Page 91

... CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) for 2007 and 2006, respectively. The interest revenue amount was calculated using the Company's funds transfer pricing methodology... -

Page 92

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Condensed Balance Sheets December 31, Assets Cash and cash equivalents Receivables from brokers, dealers, and clearing ... -

Page 93

... of long-term debt Excess tax benefits from stock-based compensation Dividends paid Purchase of treasury stock Proceeds from stock options exercised and other Other financing activities Net cash used for financing activities (Decrease) increase in Cash and Cash Equivalents Cash and Cash Equivalents... -

Page 94

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 27. Quarterly Financial Information (Unaudited) Fourth Quarter Third Quarter Second Quarter First Quarter Year Ended December ... -

Page 95

... that our audits provide a reasonable basis for our opinions. A company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by... -

Page 96

... control over financial reporting is a process designed under the supervision of and effected by the Company's chief executive officer and chief financial officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of published financial statements in... -

Page 97

.... Management's Report on Internal Control Over Financial Reporting and the Report of Independent Registered Public Accounting Firm are included in "Item 8 - Financial Statements and Supplementary Data." Item 9B. Other Information None. PART III Item 10. Directors, Executive Officers, and Corporate... -

Page 98

... - Human Resources and Employee Services Executive Vice President - Investor Services Executive Vice President, General Counsel and Corporate Secretary Executive Vice President and Chief Financial Officer Executive Vice President - Institutional Services Executive Vice President and Chief Marketing... -

Page 99

... Retirement Services of CSC from 2007 until November 2008 and of Schwab from 2006 until November 2008. Mr. McCool served as Senior Vice President - Corporate Services of Schwab from 2004 until 2006. Mr. McCool also served as President and Chief Executive Officer of The Charles Schwab Trust Company... -

Page 100

THE CHARLES SCHWAB CORPORATION Item 14. Principal Accountant Fees and Services The information required to be furnished pursuant to this item is incorporated by reference from a portion of the Proxy Statement under "The Board of Directors - Auditor Selection and Fees." PART IV Item 15. Exhibits ... -

Page 101

... Agreement for Non-Employee Directors Under The Charles Schwab Corporation 2004 Stock Incentive Plan, filed as Exhibit 10.267 to the Registrant's Form 10-K for the year ended December 31, 2004 and incorporated herein by reference. The Charles Schwab Corporation Directors' Deferred Compensation Plan... -

Page 102

THE CHARLES SCHWAB CORPORATION Exhibit Number 10.295 Exhibit Form of Notice and Nonqualified Stock Option Agreement for Joseph R. Martinetto under The Charles Schwab Corporation 2004 Stock Incentive Plan dated May 18, 2007, filed as Exhibit 10.295 to the Registrant's Form 10-Q for the quarter ... -

Page 103

... 10.308 to the Registrant's Form 10-K for the year ended December 31, 2007 and incorporated herein by reference. Form of Notice and Premium-Priced Stock Option Agreement under The Charles Schwab Corporation 2004 Stock Incentive Plan, filed as Exhibit 10.309 to the Registrant's Form 10-K for the year... -

Page 104

...CHARLES SCHWAB CORPORATION Exhibit Number 10.321 Exhibit The Charles Schwab Corporation Long Term Incentive Plan, as amended and restated as of October 23, 2008 (supersedes Exhibit 10.303). The Charles Schwab Corporation Deferred Compensation Plan II, as amended and restated as of October 23, 2008... -

Page 105

... II Walter W. Bettinger II, President and Chief Executive Officer Signature / Title /s/ Joseph R. Martinetto Joseph R. Martinetto, Executive Vice President and Chief Financial Officer (principal financial and accounting officer) /s/ Charles R. Schwab Charles R. Schwab, Chairman /s/ William... -

Page 106

THE CHARLES SCHWAB CORPORATION Index to Financial Statement Schedule Page Schedule II - Valuation and Qualifying Accounts Supplemental Financial Data for Charles Schwab Bank (Unaudited) F-2 F-3 - F-8 Schedules not listed are omitted because of the absence of the conditions under which they are ... -

Page 107

... accounts of brokerage clients (2) (1) (2) $ 2 $ 4 $ - $ (4) $ 2 Represents collections of previously written-off accounts. Excludes banking-related valuation and qualifying accounts. See "Item 8 - Financial Statements and Supplementary Data Notes to Consolidated Financial Statements... -

Page 108

... Savings and Loan Holding Companies. The accompanying unaudited financial information represents Charles Schwab Bank (Schwab Bank), which is a subsidiary of The Charles Schwab Corporation. Schwab Bank is a federal savings bank which commenced operations in 2003. 1. Three-year Net Interest Revenue... -

Page 109

...is as follows: 2008 Compared to 2007 Increase (Decrease) Due to Change in: Average Volume Interest-earning assets: Cash due from banks Short term investments Federal funds sold Resale agreements (1) Securities available for sale Securities held to maturity (2) Loans to banking clients Other interest... -

Page 110

...446 $ $ 244 244 $ $ $ December 31, 2007 Securities available for sale: U.S. agency mortgage-backed securities Non-agency mortgage-backed securities Corporate debt securities Certificates of deposit U.S. agency notes Total securities available for sale Amortized Cost $ 2,889 3,503 804 345 15 7,556... -

Page 111

...sale: U.S. agency mortgage-backed securities (1) Non-agency mortgage-backed securities (1) Corporate debt securities Certificates of deposit Asset-backed securities U.S. agency notes Total fair value Total amortized cost Weighted-average yield (2) Securities held to maturity: Asset-backed securities... -

Page 112

... Not meaningful. 6. Deposits from Banking Clients 2008 Amount Rate 2007 Amount Rate $ 12,047 $ 12,047 1.98% $ $ 2006 Amount Rate 9,137 9,137 2.19% Analysis of average daily deposits: Certificates of deposits of $100,000 or more Money market and other savings deposits Total deposits 19,203 $ 19... -

Page 113

... SCHWAB CORPORATION Supplemental Financial Data for Charles Schwab Bank (Unaudited) (Dollars in Millions) 7. Ratios 2008 40.36% 1.76% 4.35% 2007 34.31% 1.83% 5.33% 2006 26.34% 1.57% 5.96% 2005 14.23% 1.08% 7.60% December 31, Return on average stockholder's equity Return on average total assets... -

Page 114

... Ended December 31, 2008 2007 2006 2005 2004 Earnings from continuing operations before taxes on earnings $ 2,028 $ 1,853 $ 1,476 $ 1,027 $ 547 Fixed charges Interest expense: Deposits from banking clients Payables to brokerage clients Short-term borrowings Long-term debt Other Total... -

Page 115

... subsidiaries of the Registrant: Schwab Holdings, Inc. (holding company for Charles Schwab & Co., Inc.), a Delaware corporation Charles Schwab & Co., Inc., a California corporation Charles Schwab Investment Management, Inc., a Delaware corporation Charles Schwab Bank, a Federal Savings Association -

Page 116

... Statement No. 333-144303 /s/ Deloitte & Touche LLP San Francisco, California February 24, 2009 (The Charles Schwab Corporation Deferred Compensation Plan II) (The Charles Schwab Corporation 2004 Stock Incentive Plan) (Charles Schwab Profit Sharing and Employee Stock Ownership Plan) (The Charles... -

Page 117

...; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 24, 2009 /s/ Walter W. Bettinger II Walter W. Bettinger II President and Chief Executive Officer -

Page 118

... b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 24, 2009 /s/ Joseph R. Martinetto Joseph R. Martinetto Executive Vice President and Chief Financial Officer -

Page 119

... in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company for the periods presented therein. (2) /s/ Walter W. Bettinger II Walter W. Bettinger II President and Chief Executive Officer Date: February 24, 2009 A signed original of... -

Page 120

... Report fairly presents, in all material respects, the financial condition and results of operations of the Company for the periods presented therein. (2) /s/ Joseph R. Martinetto Joseph R. Martinetto Executive Vice President and Chief Financial Officer Date: February 24, 2009 A signed original... -

Page 121

... and Chief Executive Ofï¬cer, Capmark Financial Group Inc., a ï¬nancial services company Age: 6. Director since 2005; term expires in 200. Member of the Audit Committee; Nominating & Corporate Governance Committee. Nancy H. Bechtle Former President and Chief Executive Ofï¬cer, San Francisco... -

Page 122

... 2009, at 2 Main Street, San Francisco, CA. To register, visit www.schwabevents.com. Stock Ownership Services All stockholders of record are welcome to participate in The Charles Schwab Corporation Dividend Reinvestment and Stock Purchase Plan, managed by Wells Fargo Bank, N.A. For information... -

Page 123

© 2009 The Charles Schwab Corporation. All rights reserved. Strategy + Design by Unboundary, Inc., Atlanta, GA | Printing by Lithographix, Inc. | This entire report is printed on recycled paper. -

Page 124

0 Montgomery Street San Francisco, CA 9404 ( 45) 636-7000 • www.schwab.com www.aboutschwab.com MKT10448-21