CenturyLink 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009, up nearly 9 percent over the combined company

total at year-end 2008.

We expect to deploy advanced services through an

innovative product development plan that builds on the

scale and scope of our fiber network. For example, we

recently launched Internet Protocol Television (IPTV)

service in Jefferson City, Missouri, using the same

video head-end that we use to provide IPTV service

to Columbia, Missouri. Our past investments in high-

quality network infrastructure are enabling us to expand

our IPTV service to several additional markets in the

near term without incurring a substantial increase in

capital expenditures.

We also offer a full suite of business and enterprise

services over our networks. Our advanced business

services include nationwide Ethernet, which enables

our enterprise customers to quickly and securely share

information between multiple internal locations or with

customers and suppliers around the country. Similarly,

our Multiprotocol Label Switching (MPLS) service, which

provides traffic management capabilities across multiple

network protocols, helps business customers minimize

bottlenecks, speed up traffic flows and more effectively

manage their networks. Our comprehensive managed

services enable customers to concentrate on their

business priorities and leave their network operations

to CenturyLink. With our expanded fiber network, we

can now serve many of our large enterprise customers

entirely on our network, giving us greater control over

costs, service delivery and customer experience.

Operating Model Creates Efficiencies

and Clear Customer Focus

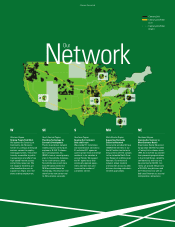

Upon completion of the Embarq acquisition, we

implemented our regional operating model across

CenturyLink’s operations, which now includes five

regions and 22 market clusters across our 33 states.

This local model creates a clear market focus and

drives sales and service decision-making closer to the

customer. With our locally focused market approach

and integrated billing and customer care systems, we

can successfully implement proactive and competitive

direct-response marketing on a market-by-market basis.

In addition to local market support, we provide national

account service to our large enterprise and wholesale

customers. Our focus here is also on putting the cus-

tomer at the center of all we do. In 2009, CenturyLink’s

Wholesale Operations was recognized by ATLANTIC-

ACM, a leading telecommunications research consul-

tancy and benchmarking firm, as best-in-class based on

customer feedback about our sales representatives,

customer service, provisioning and billing.

In Support of Thoughtful Regulatory Reform

We support efforts to develop a national broadband

plan and modernize regulations governing the Universal

Service Fund and intercarrier compensation. These regu-

latory efforts should thoughtfully promote affordable

broadband connectivity to as many people as possible,

taking into account the unique challenges of serving rural

and mid-size communities and respecting the fundamen-

tal principle that reform should include fair compensation

for the use of others’ networks. Advanced networks like

ours are the product of years of capital investment and

technology deployment, and require ongoing investment

to continually improve and meet growing demand. We

believe the underlying value of network assets should

play a central role in determining the appropriate path for

regulatory reform. We look forward to a constructive res-

olution to many of these regulatory issues in the future.

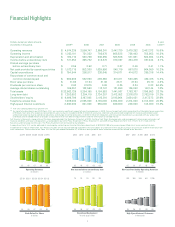

Financial Strength Provides Strategic Flexibility

CenturyLink’s financial strength is reflected in our stable

and predictable cash flows. Our free cash flow per share

has grown significantly over the past six years due to

our vigilance in aligning our cost structure to changing

market conditions. Our dividend payout provides one of

the highest yields in the S&P 500, yet CenturyLink has

one of the lowest payout ratios among our industry

Our Financial

Position:

Strong, Flexible

Our net cash provided by

operating activities in 2009

was $1.574 billion (which

includes six months of oper-

ations from our Embarq

properties), representing

a five-year compounded

annual growth rate of

10.3 percent.

Our Board of Directors

approved a 3.6 percent divi-

dend increase in February

2010, raising our dividend

to $2.90 per share.

Our leadership team has

spent a combined total

of 200 years in the

communications industry,

many of which involved

making acquisitions and

managing integrations.

CenturyLink is financially strong and one of the few

companies in the communications industry with an

investment-grade credit rating.

INVESTMENT-GRADE $2.90 200

4

“We expect to deploy advanced services through an innovative

product development plan that builds on the scale and scope of

our fiber network.”

Stronger Connected

CASH FLOW PER

SHARE YEARS