CenturyLink 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders

With the July 1, 2009, merger between CenturyTel, Inc.

and Embarq Corporation, we achieved a new milestone

in our long history of growth through acquisition. This

acquisition, the largest in CenturyTel’s history, positioned

us as a communications industry leader with unique

advantages: a network of extensive scale and scope,

a strong portfolio of advanced communications and

entertainment services, a very strong financial position

and a talented team with a clear customer focus. Taken

together, these advantages form a solid foundation

for growth for our combined company, which began

operations in 2009 under the CenturyLink brand.

I want to thank our shareholders for recognizing the

potential of this merger and for approving the transac-

tion. I also want to thank our employees, whose hard

work, sacrifice, skill and dedication have enabled us to

accomplish so much over the past year. Thanks to their

efforts, we completed the Embarq acquisition, launched

the CenturyLink brand, successfully managed the first

two quarters of integration activities and delivered 2009

results that demonstrate the potential of the merger to

grow and transform our business.

It’s never easy to merge two large organizations and

certainly not during times of such great economic chal-

lenge. The success we achieved in 2009 demonstrates

what is possible for CenturyLink as one of the premier

providers of voice, broadband and video services in the

United States.

2009 Results Reflect Potential of Merger

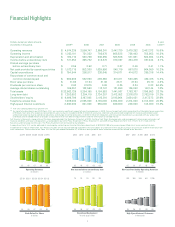

The Embarq acquisition created a leading communica-

tions services provider with approximately 7 million

access lines, 2.2 million broadband customers and

535,000 video subscribers in 33 states at year-end 2009.

More significant than the increase in the scale of our

business is the value we expect the merger to create.

We expect the transaction to be accretive to free cash

flow per share in the first full year after closing and to

create $475 million in operating expense synergies, reve-

nue opportunities and capital investment savings within

the first three years after completing the transaction.

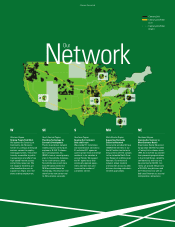

Our Network:

Unique, Valuable

Our long-haul network now

connects 90 percent of our

service areas, reducing

costs and creating revenue

opportunities.

We expanded our high-

speed optical network by

approximately 10,000 miles.

At year-end 2009, 89 per-

cent of our access lines

were broadband-enabled.

More than 50 percent of

these broadband-enabled

lines are capable of speeds

of 6 Mbps or higher.

90%10,000

Stronger Connected

2

Based on access lines, CenturyLink is the fourth largest

telecommunications company in the United States.

4th Largest 6 Mbps

Shareholders

To Our

MILES

On July 1, 2009, CenturyTel completed its acquisition of Embarq Corporation, creating one of the leading communi-

cations companies in the United States. Simultaneously, the company began operating under the name CenturyLink

(NYSE: CTL).

CenturyLink is a leading provider of high-quality voice, broadband and video services over its advanced communica-

tions networks to consumers and businesses in 33 states. CenturyLink, headquartered in Monroe, Louisiana, is

an S&P 500 Company and expects to be listed in the Fortune 500 list of America’s largest corporations. For more

information on CenturyLink, visit www.centurylink.com.