Cathay Pacific 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 Cathay Pacific Airways Limited Annual Report 2002

•Aircraft depreciation and operating leases

decreased due to the disposal of the classic

aircraft and the non recurrence of an impairment

charge booked in 2001.

•Net finance charges were higher as a result of

a lower return on the Company’s liquid funds.

•Cathay Pacific’s cost per ATK reduced from

HK$2.36 to HK$2.13 due to lower fuel prices

and cost saving initiatives.

Associated companies

•The share of profits from associated companies

increased significantly by 75.8% to

HK$269 million.

•Profitability of both HAECO and Dragonair

improved as a result of higher workload and

increased traffic respectively.

Dividends

•Dividends paid and proposed for the year are

HK$2,402 million representing a dividend cover

of 1.7 times.

•Dividends per share increased from HK¢17.5

to HK¢72.

Assets

•To t al assets as at 31st December 2002

amounted to HK$71,628 million.

•During the year, additions to fixed assets were

HK$2,710 million, comprising HK$2,630 million

for aircraft and related equipment and

HK$80 million for properties and other

equipment.

Financial Review

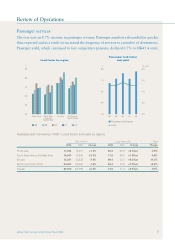

-1,000

6,000

-3

00

1,000 3

2,000 6

3,000 9

4,000 12

5,000 15

18

0201009998

Group interest cover

Interest cover

Operating profit/(loss)

Net finance charges

HK$ million Times

Group total assets

25%

Current

assets

9%

Properties

and other

equipment

61%

Aircraft

and related

equipment

1%

Intangible

assets

4% Long-term

investments