Carphone Warehouse 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Key targets

More recently, as telecoms markets have become

liberalised, we have recognised the potential for selling

fixed line services over the counter. In the UK, within

three years we have built a business in TalkTalk that

has a realistic opportunity to be the number one

alternative home telecoms provider in the UK, as

I highlight below. But we are also now adding value

in six other markets through selling fixed line services

in store to enhance our recurring revenue platform.

One of our strategic challenges over the next two

years is to respond to the changes in market structure

that regulation is stimulating in each of these markets,

to ensure that we have the most appropriate business

model in place. For example, in some markets

customer spend is sufficiently high that we can

continue to be a pure reseller (with none of our own

network infrastructure) and still make an attractive

return. In other markets we may be better off simply

taking a commission from selling another provider’s

service than packaging our own. Either way, we

are generating an incremental income stream from

a predominantly fixed cost base.

Over the last 12 months we have brought a renewed

focus to our mobile virtual network operations (MVNOs),

where we buy wholesale capacity from mobile network

operators and repackage it under our own brand

and tariffs. The UK launch of Mobile World, a service

providing market-beating rates for calls to international

destinations from a mobile handset, was very successful,

and we intend to roll out a similar service in a number

of other countries this year. We relaunched Fresh,

our no-frills proposition, in October 2005, and again

demand exceeded our expectations. Although both

businesses are currently running at a loss, the lifetime

value of customers is greater than the profit on third

party pre-pay sales, making it an area of strategic

importance in the medium term.

Our biggest new initiative in the MVNO business is

the launch of Virgin Mobile in France, a joint venture

between Carphone Warehouse and the Virgin Group.

We believe that the French market offers us a

significant opportunity to build a valuable business,

combining the strength of the Virgin brand with

our own store network and market expertise. The

venture will make losses in the short term as we

invest aggressively in growing scale, but we expect

it to generate material incremental profits in the

longer term.

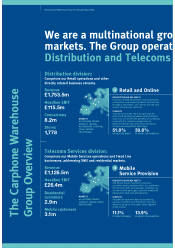

43.0% over the last three years. The Online channel

remains a significant opportunity in other markets,

which as yet we have not succeeded in grasping.

The franchise platform now extends to 140 stores

out of the total portfolio of 1,778.

Both of these channels complement the core Retail

chain by increasing our overall scale. As our market

share grows in each territory we carry greater weight

with the network operators and our terms improve,

allowing us to stimulate volume growth through

investment in the customer proposition. At the same

time, our handset purchasing power continues to

increase. Importantly, we are increasingly seeking

to differentiate our proposition through a focus on

handset range and availability. While price is clearly a

valuable benefit of scale, our ability to source exclusive

handsets or work in partnership with vendors to

develop new products will, we believe, be a more

significant driver of the business going forward. Our

ground-breaking deal with Motorola on the pink V3

over Christmas 2005 was a clear example of this

power and innovation.

Looking forward, we plan to open a further 250 stores

this year. Even in the UK, where we now have 669

stores, we continue to generate an excellent return on

our investment in new space. This gives us confidence

in our ability to grow our Retail presence and market

share across all our markets.

Maximising customer lifetime value

There are two core factors behind our focus on

customer lifetime value. Firstly, the consultative

nature of our interaction with customers allows us

to introduce additional products and services into the

sales mix, generating a significantly enhanced overall

return on our store investment. Secondly, the recurring

nature of these additional services improves the quality

and visibility of Group earnings.

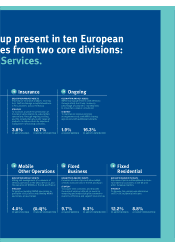

Historically the main avenue for additional profits

beyond the point of sale has been through our

Insurance service. Ten years since its inception, we

have built it up into a business with nearly two million

customers, revenues of £116.1m and contribution

of £45.5m. This service owes much to our stores and

our relationship with customers, and is the most

tangible evidence of our ability to leverage our retail

asset to deliver additional value to customers

and shareholders alike.

Chief Executive’s Review continued www.cpwplc.com 5

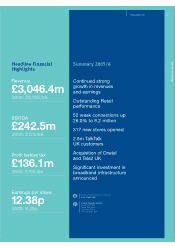

Highlights and Strategy

10%

MARKET SHARE OF

MOBILE PHONE MARKET

3.5m

TALKTALK UK CUSTOMERS

BY MARCH 2009

1m

VIRGIN MOBILE FRANCE

CUSTOMERS BY MARCH 2009