Carphone Warehouse 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

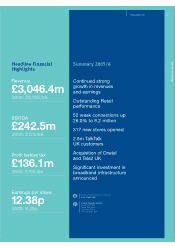

52 WEEK SUBSCRIPTION

CONNECTIONS

UP 23.6% (000s)

’06’05’04’03

1,909

2,413 2,770

3,423

52 WEEK TOTAL CONNECTIONS

UP 26.0% (000s)

’06’05’04’03

4,364

5,350

6,503

8,191

AVERAGE SPACE UP 16.2% (sqm)

’06’05’04’03

63,233 66,170 75,619

87,871

Distribution Division continued

Connections (000s)

52 weeks 52 weeks 53 weeks

to to to

1 April 26 March 2 April

2006 2005 2005

Subscription 3,423 2,770 2,816

Pre-pay 4,252 3,227 3,272

SIM-free 516 506 512

Group 8,191 6,503 6,600

We opened 362 new stores during the year and

closed 45. The total number of stores increased

from 1,461 at March 2005 to 1,778 by March 2006.

The total includes 140 franchise stores (March 2005:

70 franchises). Total average selling space excluding

franchises increased by 13.3% to 83,128 sqm

(2005: 73,399 sqm) and sales per square metre

increased by 4.7% to £16,547 (2005: £15,807).

Total average selling space including franchises

increased by 16.2% to 87,871 sqm (2005: 75,619

sqm) and sales per square metre increased by 2.0%

to £15,654 (2005: £15,343).

Total Retail revenues grew by 18.6% and gross profit

by 23.1%. Like-for-like, after stripping out the impact

of new store openings and the 53rd week last year,

revenues grew by 5.9% and gross profit by 9.0%.

The increase in revenues was driven by the strong

connections growth through the year, though offset

by a fall in revenue per connection from £189.7

to £185.2 driven by a change in mix.

Average cash gross profit per connection rose

from £54.0 to £54.7. Gross profit per connection

for subscription and pre-pay rose 2.9% and 6.9%

respectively, with the average increase of 1.4%

reflecting a higher proportion of pre-pay sales.

Contribution from Retail grew by 26.4% to £127.5m.

The contribution margin rose from 8.7% to 9.3%,

reflecting the strong growth in like-for-like gross profit.

The ratio between contribution and gross profit, which

gives a more meaningful indication of cost efficiency

given the variability of revenues per connection,

improved from 30.6% to 31.4%. Overall Retail direct

costs grew by 21.6%, driven by the greater store

base and like-for-like growth in commission payments

to our sales consultants. Within these figures, total

rent costs increased by 17.3%, reflecting the rapid

increase in space over the last two years.

In the UK, our store portfolio increased from 601

stores to 669 stores. New stores continue to generate

an attractive return and the impact on existing outlets is

minimal. We see ample opportunity for further expansion

despite our significant presence, and aim to open a

further 80 stores in the UK in the current year. Our focus

is on retail park units, arterial routes and smaller towns.

Our businesses outside the UK continued to grow

strongly. Spain is now our second largest market

by some distance, with a portfolio of 338 stores.

Connections were up 23.7% on a 52 week basis.

During the year we acquired Planet Phone, a small

chain of stores acting as an exclusive distributor

for Telefonica Moviles.

Our French operations enjoyed a year of better growth

after a subdued period of trading, as competition

between the networks began to intensify. We opened

35 stores, taking the portfolio to 220, and achieved

52 week connections growth of 15.5%, with a better

performance in the second half. We are encouraged

by recent trends in France, with the launch of a

number of MVNOs, including our own Virgin Mobile

joint venture, set to stimulate the market further.

In The Netherlands and Sweden, our next most

important retail markets, connections fell marginally

year-on-year, after prolonged periods of strong market

growth. Both businesses continue to hold good

market positions and made significant contributions

to overall Retail profitability. They have returned to

growth in the new financial year, and we continue

to invest in new stores in these territories.

Across our other five markets, comprising Belgium,

Germany, Ireland, Portugal and Switzerland, we

generated 52 week connections growth of 22.4%,

with all countries trading well. Switzerland, in particular,

achieved a very good turnaround from the poor

performance in the previous year, and after 12 months

of recovery we now intend to invest in further organic

growth in that market.

Online connections increased by 61.7% year-on-year

to 0.76m on a 52 week basis. Revenues were

The Carphone Warehouse Group PLC Annual Report 2006

10

LIKE-FOR-LIKE GROSS

PROFIT UP 9.0%

5 YEAR SUBSCRIPTIONS

GROWTH OF 17.1%