Carphone Warehouse 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

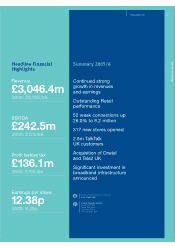

% OF CONTRIBUTION FROM

RECURRING REVENUES*

(% OF TOTAL)

’06’05’04’03

49.7

57.6 59.4 59.7

CONTRIBUTION FROM

RECURRING REVENUES*

UP 32.4% (£m)

’06’05’04’03

77.1

121.4

161.2

213.5

in sales and gross profit, but the strong trading

performance of the last two years creates ever higher

hurdles to clear. Growth in Ongoing (our ARPU sharing

agreements with networks) and Insurance will continue

to be driven by subscription connections.

On the fixed line side, the progress of the new

broadband proposition from TalkTalk will be crucial to

enhancing the long-term value of the Group. The outlook

is promising and the early customer take-up has far

exceeded our expectations, but we expect a more

concerted competitive response from other industry

players as the year progresses, and the major risks of

this new initiative lie in our ability to execute successfully.

In our MVNO operations we expect a year of intensive

customer recruitment as we build a business to

deliver meaningful profitability in the future. Our

German service provision business, The Phone

House Telecom, is already highly profitable, and we

will continue to add customers to the base here, too.

However, profits are likely to be flat year-on-year, as

the amortisation of subscriber acquisition costs is

forecast to rise on the back of the strong subscriber

push of the last two years.

A strong corporate culture has always been a vital

part of Carphone Warehouse’s success, and it is

to the credit of all of our employees that this has

been maintained during a period of high growth and

expansion. We have made significant demands of

everyone across the business this year and the

response has been uniformly positive. With the

acquisitions and our own organic growth, I am

delighted to welcome a further 3,000 people to

the Group in the last 12 months, and the rate of

recruitment shows no sign of abating given the

opportunities ahead of us. We are lucky to have

such a dedicated and talented workforce and

I would like to say thank you to all of them for

their continued efforts.

been totally consistent with our retail strategy: to favour

volume over margin, and pass on the benefits of scale

and investment to our customers. This is particularly

true in local loop unbundling, where the investment

profile favours those who are able to take significant

market share. The costs in the short-term will be

significant, with an estimated operating loss from the

project in the current year of £50m, and a cash outflow

of £110m. However, we are confident that the long

term economics of the business are highly attractive.

We have set an initial target of 3.5m residential

telecoms customers by March 2009, of which we

anticipate over half will be on the new bundled

package. Our focus now is on successful execution:

installing our equipment in BT’s exchanges as rapidly

as possible, building up call centre capacity and

expertise, and closely managing the process for

migrating customers from BT’s platform onto our own.

Importantly, our investment in infrastructure stands to

benefit our business-to-business telecoms operations

as well. We have a significant overlap between our

business and residential customers, thus giving us

two opportunities to generate a good return on our

investment. Opal’s background is one of voice services

into businesses, but with an unbundled platform we

believe that there is a sizeable opportunity to sell data

services into the corporate market. Our plans in this

respect will evolve over the next 12 months.

Outlook

These are exciting times for Carphone Warehouse.

Prospects for the Distribution division are good.

Mobile networks continue to compete aggressively

for customers, stimulating the replacement cycle with

lower prices and better tariffs. The market is also

becoming more fragmented, with MVNOs increasingly

prevalent and adding to the breadth of choice available

to customers. Handset manufacturers are more active

than ever, and are now innovating in fashion and

design as much as in technology and functionality.

As outlined above, we will seek to take advantage of

these attractive market conditions through further rapid

expansion of our store base and the development

of additional distribution channels. Our guidance of

15% growth in mobile connections for the coming

year reflects the overall growth in our store portfolio.

As always, we will strive to generate growth in

connections per store to drive like-for-like growth

Chief Executive’s Review continued www.cpwplc.com 7

Highlights and Strategy

Charles Dunstone, Chief Executive Officer

FASHION BECOMING A KEY

HANDSET MARKET DRIVER

BROADBAND CUSTOMER

TAKE-UP HAS FAR EXCEEDED

OUR EXPECTATIONS

STRONG CORPORATE CULTURE

A VITAL PART OF OUR SUCCESS

*Periods prior to 2004/05

restated for comparability