Carphone Warehouse 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chief Executive’s Review

Iam pleased to report that we have achieved another

year of strong growth. The Group floated over five

years ago now, and has grown at a rate that we could

never have predicted. However, we are absolutely

committed to approaching business as we always

have done: by being entrepreneurial, quick to act

and opportunistic, within a broad strategic framework.

We retain the same flat structure and accountability

that has allowed us to thrive in the dynamic markets

of the last fifteen years.

More importantly perhaps, we maintain a private

company mentality when it comes to investment

and growth opportunities. Our focus is primarily

on long-term value creation. As a result, we will

continue to invest in new business areas where we

are confident of generating incremental growth in

future cash earnings, even if short-term returns are

depressed as a result. Business opportunities do not

conveniently arise in a timely or regular fashion, so it

is an important aspect of our role as a management

team to communicate the scale, timing and impact

of new business initiatives so that investors can make

informed decisions when short-term earnings are

depressed by investment.

Strategic context

Our strategic approach is built on three

primary objectives:

•To continue to grow market share in all our

geographical markets, by investing in new store

openings, generating like-for-like growth from

our existing estate, and developing additional

distribution channels;

•To maximise the lifetime value of our customers,

both by providing a level of service that encourages

repeat business, and by identifying relevant new

products and services where our brand, service

and distribution give us an advantage over other

suppliers; and

•To become the leading alternative provider of fixed

line telecommunications services in the UK.

I wrote last year about the importance of combining

our key assets – stores, people, fixed line infrastructure

and supplier relationships – to provide a range of

services where we believe we have a sustainable

advantage. However, there is a further and crucial

element to this approach which is coming to define

the way we do business.

Whether in retail or telecoms, our goal is to create the

best possible value proposition for our customers. We

do this by aiming to control costs and drive volume

over margin. As scale or investment benefits accrue,

we look to reinvest those benefits in improving the

customer proposition and driving more volume, rather

than increasing margin. This creates a virtuous circle.

This is a familiar strategy in the retail industry, where a

number of companies with this mindset have achieved

very strong positions in their subsectors. At the same

time, there are numerous examples of companies that

have been too profitable for too long, thus becoming

uncompetitive and allowing new entrants to come in

and undercut them.

In the telecoms industry, the prevailing attitude seems

to be to price services according to what customers

are prepared to pay, and margins across the board are

generally high. Our approach, as highlighted in April

2006’s broadband launch, is to charge customers as

little as possible while still making a reasonable return

for the business. Thus our infrastructure investment

over the next 12 months gives us the opportunity to

pass on the bulk of our savings on regulated costs,

rather than improve our customer margins.

Growing our retail presence

At the start of the year we set a target of 250 store

openings across our ten markets, maintaining the

acceleration in roll-out from the previous year. In the

end we significantly exceeded this target, opening

317 stores in the last 12 months. Of these, we

opened 68 stores in the UK and 99 in Spain.

Our distribution strategy has been enhanced over the

last two years by the growth of our Online operations

in the UK, and the development of a franchise store

model in a number of markets. Through organic

growth and acquisition, our Online operations have

achieved compound annual connections growth of

The Carphone Warehouse Group PLC Annual Report 2006

4

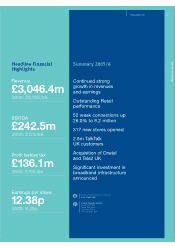

HEADLINE OPERATING PROFIT

UP 34.7% (£m)

’06’05’04’03

58.0

81.1

105.2

141.8

REVENUE UP 29.4% (£m)

’06’05’04’03

1,842 1,849

2,355

3,046

We maintain a private

company mentality when

it comes to investment

and growth opportunities