Carnival Cruises 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 ANNUAL REPORT

Table of contents

-

Page 1

2014 ANNUAL REPORT -

Page 2

CARNIVAL CORPORATION & PLC 2014 ANNUAL REPORT TABLE OF CONTENTS COMPANY ...HIGHLIGHTS ...CHIEF EXECUTIVE OFFICER'S LETTER TO SHAREHOLDERS ...SHAREHOLDER BENEFIT ...CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED STATEMENTS OF INCOME ...CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME ...CONSOLIDATED ... -

Page 3

... America Line, Princess Cruises, Seabourn, AIDA Cruises, Costa Cruises, Cunard, P&O Cruises (Australia) and P&O Cruises (UK). Together, these brands operate 100 ships totaling 212,000 lower berths with ten new ships scheduled to enter service between late February 2015 and November 2018. Carnival... -

Page 4

.... New product initiatives and innovative marketing campaigns implemented across our brands over the past year are driving increased demand. We experienced a sustained improvement in booking trends throughout 2014 and are gaining momentum in our efforts to drive ticket prices and onboard revenues... -

Page 5

... in 2014. We launched new marketing campaigns in multiple regions. In North America, Carnival Cruise Line was the National Cruise Line advertiser of the Winter Olympics telecast while Princess Cruises launched its first television campaign in 10 years. In addition, both Costa Cruises in Europe and... -

Page 6

... of Holland America Line and Neil Palombo, the new head of Costa Cruises - three strong additions to our very capable leadership team. Our business, or any business, is all about the people. One out of every two guests who cruise anywhere in the world cruise on one of our nine brands and 100 ships... -

Page 7

... least two weeks prior to cruise departure date. This benefit is available to shareholders holding a minimum of 100 shares of Carnival Corporation or Carnival plc. Employees, travel agents cruising at travel agent rates, tour conductors or anyone cruising on a reduced-rate or complimentary basis are... -

Page 8

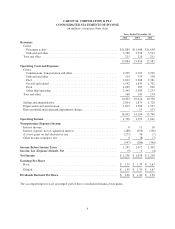

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) Years Ended November 30, 2014 2013 2012 Revenues Cruise Passenger tickets ...Onboard and other ...Tour and other ...Operating Costs and Expenses Cruise Commissions, transportation and other ...Onboard ... -

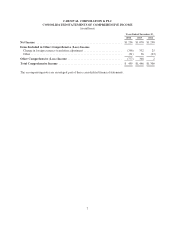

Page 9

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Years Ended November 30, 2014 2013 2012 Net Income ...Items Included in Other Comprehensive (Loss) Income Change in foreign currency translation adjustment ...Other ...Other Comprehensive (Loss) Income ...Total... -

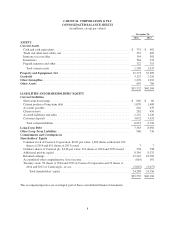

Page 10

CARNIVAL CORPORATION & PLC CONSOLIDATED BALANCE SHEETS (in millions, except par values) November 30, 2014 2013 ASSETS Current Assets Cash and cash equivalents ...Trade and other receivables, net ...Insurance recoverables ...Inventories ...Prepaid expenses and other ...Total current assets ...... -

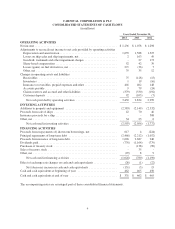

Page 11

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Years Ended November 30, 2014 2013 2012 OPERATING ACTIVITIES Net income ...$ 1,236 $ 1,078 $ 1,298 Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization ...1,635 ... -

Page 12

...Purchases and sales under the Stock Swap program ...Purchases of treasury stock under the Repurchase Program and other ...Balances at November 30, 2013 ...Net income ...Other comprehensive loss ...Cash dividends declared ...Other ...Balances at November 30, 2014 ...$6 6 1 7 $7 Ordinary shares $357... -

Page 13

... 38 100% Number of Cruise Ships 24 18 15 5 62 15 10 7 3 3 38 100 Cruise Brands North America Carnival Cruise Line ...Princess Cruises ("Princess") ...Holland America Line ...Seabourn ...North America Cruise Brands ...EAA Costa Cruises ("Costa") ...AIDA Cruises ("AIDA") ...P&O Cruises (UK) ...Cunard... -

Page 14

..., money market funds and time deposits. Inventories Inventories consist substantially of food and beverages, hotel and restaurant products and supplies, fuel and gift shop merchandise held for resale, which are all carried at the lower of cost or market. Cost is determined using the weighted-average... -

Page 15

... product innovations to our guests. Ship improvement costs that we believe add value to our ships, such as those discussed above, are capitalized to the ships and depreciated over the shorter of their or the ships' estimated remaining useful life, while costs of repairs and maintenance, including... -

Page 16

... in cruise passenger ticket revenues at the time of the cancellation. Our sale to guests of air and other transportation to and from airports near the home ports of our ships and the related cost of purchasing these services are included in cruise passenger ticket revenues and cruise transportation... -

Page 17

...2014, 2013 and 2012, respectively. Administrative expenses represent the costs of our shoreside ship support, reservations and other administrative functions, and includes salaries and related benefits, professional fees and occupancy costs, which are typically expensed as incurred. Foreign Currency... -

Page 18

... a per share basis, the company with the ability to make a higher net distribution is required to make a payment to the other company to equalize the possible net distribution to shareholders, subject to certain exceptions. At the closing of the DLC transaction, Carnival Corporation and Carnival plc... -

Page 19

... in 2014, 2013 and 2012, respectively, and are substantially all included in other ship operating expenses. During 2012, we wrote-off the net carrying value of a ship related to the January 2012 ship incident and received â,¬395 million (or $508 million) of hull and machinery insurance proceeds... -

Page 20

... ...Euro floating rate (b)(g) ...Private Placement Notes Fixed rate ...Euro fixed rate (b) ...Publicly-Traded Notes Fixed rate ...Other ...Short-Term Borrowings Euro bank loans (h) ...U.S. dollar-denominated commercial paper (h) ...Total Debt ...Less short-term borrowings ...Less current portion of... -

Page 21

... at any time upon nine months notice. (h) The interest rate associated with our short-term borrowings represents an aggregate-weighted average interest rate. At November 30, 2014, the scheduled annual maturities of our debt were as follows (in millions): 2015 2016 Fiscal 2017 2018 2019 Thereafter... -

Page 22

At January 22, 2015, our committed ship financings are as follows: Fiscal Year Scheduled for Funding Cruise Brands and Ships North America Carnival Cruise Line Carnival Vista ...Holland America Line Koningsdam ...Seabourn Newbuild (a) ...North America Cruise Brands ...EAA AIDA AIDAprima (a) ...... -

Page 23

... November 30, 2014, be responsible for a termination payment of $31 million. In 2017, Carnival Corporation has the right to exercise options that would terminate these LILO transactions at no cost to it. If the credit rating of one of the financial institutions who is directly paying the contingent... -

Page 24

... U.S. hotel and transportation business of Holland America Princess Alaska Tours through U.S. corporations. Our North American cruise ship businesses and certain ship-owning subsidiaries are engaged in a trade or business within the U.S. Depending on its itinerary, any particular ship may generate... -

Page 25

... Income Tax Cunard, P&O Cruises (UK) and P&O Cruises (Australia) are divisions of Carnival plc and have elected to enter the UK tonnage tax on a rolling 10-year term and, accordingly, reapply every year. Companies to which the tonnage tax regime applies pay corporation taxes on profits calculated by... -

Page 26

...in commissions, transportation and other costs and other ship operating expenses. NOTE 9 - Shareholders' Equity Carnival Corporation's Articles of Incorporation authorize its Board of Directors, at its discretion, to issue up to 40 million shares of preferred stock. At November 30, 2014 and 2013, no... -

Page 27

... 2014, there were 8.4 million ordinary shares of Carnival plc authorized for future issuance under its employee benefit plans. On November 15, 2012, our Boards of Directors declared a special dividend to holders of Carnival Corporation common stock and Carnival plc ordinary shares of $0.50 per share... -

Page 28

...30, 2014 and 2013 being slightly higher and slightly lower, respectively, than the floating interest rates on these debt obligations, including the impact of any changes in our credit ratings. The fair values of our publicly-traded notes were based on their unadjusted quoted market prices in markets... -

Page 29

... initial trade prices. Subsequent valuations are based on observable inputs and other variables included in the valuation models such as interest rate, yield and commodity price curves, forward currency exchange rates, credit spreads, maturity dates, volatilities and netting arrangements. We use the... -

Page 30

... bareboat charter payments, which is considered a Level 3 input. Due to the expected absorption of Ibero Cruises' ("Ibero") operations into Costa in November 2014, and certain ship specific facts and circumstances, such as size, age, condition, viable alternative itineraries and historical operating... -

Page 31

...all cruise brands that carried goodwill, except for Carnival Cruise Line, Cunard and P&O Cruises (UK). Qualitative factors such as industry and market conditions, macroeconomic conditions, changes to the weighted-average cost of capital ("WACC"), overall financial performance, changes in fuel prices... -

Page 32

... (Australia), P&O Cruises (UK) and Princess. As of that date, we performed our annual trademark impairment reviews for these cruise brands, which included performing a qualitative assessment for AIDA, P&O Cruises (Australia) and Princess. Qualitative factors such as industry and market conditions... -

Page 33

...Currency Risks" below for additional information regarding these derivatives. (c) We have euro interest rate swaps designated as cash flow hedges whereby we receive floating interest rate payments in exchange for making fixed interest rate payments. At November 30, 2014 and 2013, these interest rate... -

Page 34

... financial statements as of November 30, 2014 and 2013 and for the years ended November 30, 2014, 2013 and 2012 where such impacts were not significant. Fuel Price Risks Our exposure to market risk for changes in fuel prices substantially all relates to the consumption of fuel on our ships. We use... -

Page 35

... fuel consumption as follows: Transaction Dates Barrels (in thousands) Weighted-Average Floor Prices Weighted-Average Ceiling Prices Percent of Estimated Fuel Consumption Covered Maturities (a) Fiscal 2015 November 2011 ...February 2012 ...June 2012 ...April 2013 ...May 2013 ...October 2014... -

Page 36

..., market volatility, economic trends, our overall expected net cash flows by currency and other offsetting risks. We use foreign currency derivative contracts and have used nonderivative financial instruments to manage foreign currency exchange rate risk for some of our ship construction payments... -

Page 37

... all of our remaining newbuild currency exchange rate risk relates to eurodenominated newbuild construction payments for a Carnival Cruise Line, Holland America Line and Seabourn newbuild, which represent a total unhedged commitment of $1.7 billion. The cost of shipbuilding orders that we may place... -

Page 38

...all of our cruise brands and other segments. Our North America cruise segment includes Carnival Cruise Line, Holland America Line, Princess and Seabourn. Our EAA cruise segment includes AIDA, Costa, Cunard, P&O Cruises (Australia), P&O Cruises (UK) and prior to November 2014, Ibero. These individual... -

Page 39

... of our ships and ships under construction. Revenues by geographic areas, which are based on where our guests are sourced and not the cruise brands on which they sailed, were as follows (in millions): Years Ended November 30, 2014 2013 2012 North America ...Europe ...Australia and Asia ...Other... -

Page 40

... the quoted market price of the Carnival Corporation or Carnival plc shares and expected total shareholder return rank relative to certain peer companies on the date of grant and the probability of our annual earnings target for each year over a three-year period being achieved. Our 2014 PBS awards... -

Page 41

.... A combined summary of Carnival Corporation and Carnival plc stock option activity during the year ended November 30, 2014 related to stock options previously granted was as follows: WeightedAverage Remaining Contractual Term (in years) Shares Weighted-Average Exercise Price Aggregate Intrinsic... -

Page 42

... are not expected to be material to our consolidated financial statements. Total expense for all defined benefit pension plans, including the multiemployer plans, was $69 million, $62 million and $45 million in 2014, 2013 and 2012, respectively. Defined Contribution Plans We have several defined... -

Page 43

... Our basic and diluted earnings per share were computed as follows (in millions, except per share data): Years Ended November 30, 2014 2013 2012 Net income for basic and diluted earnings per share ...$1,236 $1,078 $1,298 Weighted-average common and ordinary shares outstanding ...Dilutive effect of... -

Page 44

... our consolidated financial statements, has also audited the effectiveness of our internal control over financial reporting as of November 30, 2014 as stated in their report, which is included in this 2014 Annual Report. Arnold W. Donald President and Chief Executive Officer January 29, 2015 David... -

Page 45

REPORT OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM To the Boards of Directors and Shareholders of Carnival Corporation and Carnival plc: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, comprehensive income, cash flows and... -

Page 46

... maintenance expenses and refurbishment costs as our fleet ages; lack of continuing availability of attractive, convenient and safe port destinations on terms that are favorable or consistent with our expectations; continuing financial viability of our travel agent distribution system, air service... -

Page 47

... offset by our ship sales. During 2014, we introduced Princess Cruises' 3,560-passenger Regal Princess and Costa Cruises' 3,692-passenger Costa Diadema. We are building new, innovative, purpose-built ships that are larger and more efficient and have a wider range of onboard amenities and features... -

Page 48

... ships home ported in China, which will represent a 140% increase in guest capacity over a two-year period and will offer our Chinese guests diversified cruise products with two brands targeting two different segments of travelers. As part of our China cruise strategy, we are exploring opportunities... -

Page 49

...in established cruise regions, such as North America and Western Europe. We believe the increasing deployment of ships into the emerging Asia market may further moderate the level of supply in North America and Western Europe. Outlook for the 2015 First Quarter and Full Year On December 19, 2014, we... -

Page 50

... upon their replacement cost, their age and their original estimated useful lives. If materially different conditions existed, or if we materially changed our assumptions of ship useful lives and residual values, our depreciation expense, loss on retirement of ship components and net book value of... -

Page 51

...-traded market exists, which is usually not the case for cruise ships, cruise brands and trademarks. Our ships' fair values are typically estimated based either on ship sales price negotiations or discounted future cash flows. The principal assumptions used to calculate our discounted future cash... -

Page 52

...: - sales of passenger cruise tickets and, in some cases, the sale of air and other transportation to and from airports near our ships' home ports and cancellation fees. The cruise ticket price typically includes accommodations, most meals, some non-alcoholic beverages and most onboard entertainment... -

Page 53

... of passenger cruise bookings, which represent costs that are directly associated with passenger cruise ticket revenues, and include travel agent commissions, air and other transportation related costs, fees, taxes and other charges that vary with guest head counts and related credit and debit card... -

Page 54

...of two Costa ships and the sale of one P&O Cruises (Australia) 1,462-passenger capacity ship all in 2012. Our North America brands' capacity increase was caused by: - - the full year impact from one Carnival Cruise Line 3,690-passenger capacity ship delivered in 2012 and the partial year impact from... -

Page 55

...currency impact; $49 million - increase in air transportation revenues from guests who purchased their tickets from us; $39 million - increase in cruise ticket pricing and $23 million - slight increase in occupancy. The remaining 18% of 2014 total revenues were comprised of onboard and other cruise... -

Page 56

...in air transportation costs related to guests who purchased their tickets from us; $87 million - lower fuel prices; $58 million - lower fuel consumption per ALBD; $56 million - nonrecurrence in 2014 of additional costs and expenses related to the 2013 voyage disruptions, net of third-party insurance... -

Page 57

... are travel agent commissions, cost of air and other transportation, certain other costs that are directly associated with onboard and other revenues and credit and debit card fees. Substantially all of our remaining cruise costs are largely fixed, except for the impact of changing prices and food... -

Page 58

... and Qualitative Disclosures About Market Risk" for a further discussion of the 2015 impact of foreign currency exchange rate changes. We believe that the goodwill, trademark and other impairment charges and restructuring expenses recognized in 2014, 2013 and 2012 are special charges and, therefore... -

Page 59

...): Years Ended November 30, 2014 2013 Constant Constant Dollar 2013 Dollar 2014 2012 Passenger ticket revenues ...Onboard and other revenues ...Gross cruise revenues ...Less cruise costs Commissions, transportation and other . . Onboard and other ...Net passenger ticket revenues ...Net onboard... -

Page 60

... Years Ended November 30, 2014 2013 Constant Constant Dollar 2013 Dollar 2014 2012 Cruise operating expenses ...$ Cruise selling and administrative expenses ...Gross cruise costs ...Less cruise costs included above Commissions, transportation and other ...Onboard and other ...Losses on ship sales... -

Page 61

...3.7% increase from our North America brands and a 2.8% increase from our EAA brands, which included increases in primarily all the net onboard revenue categories. The slight decrease in net passenger ticket revenue yields was driven by our North America brands' promotional pricing environment in the... -

Page 62

... - increase in air transportation revenues from guests who purchased their tickets from us. Our cruise ticket pricing decline was driven by promotional pricing at Carnival Cruise Line. The remaining 26% of 2013 total revenues were comprised of onboard and other cruise revenues, which increased... -

Page 63

... decreases in commissions, transportation and other related expenses driven by lower cruise ticket pricing, partially offset by increases in air transportation costs related to guests who purchased their tickets from us; - $34 million - nonrecurrence in 2013 of the 2012 Costa Allegra ship impairment... -

Page 64

... other related expenses driven by lower cruise ticket pricing and a decrease in air transportation costs related to guests who purchased their tickets from us; - $72 million - lower fuel consumption per ALBD; - $58 million - lower fuel prices; - $34 million - nonrecurrence in 2013 of the 2012 Costa... -

Page 65

... by our North America brands' 3.8% net yield decrease, which was driven by promotional pricing at Carnival Cruise Line. In addition, our EAA brands' net passenger ticket revenue yields decreased 2.8%, which was affected by the ongoing challenging economic environment in Europe. Although Costa's net... -

Page 66

...our historical results, projections and financial condition, we believe that our future operating cash flows and liquidity will be sufficient to fund all of our expected capital projects including shipbuilding commitments, ship improvements, debt service requirements, working capital needs and other... -

Page 67

...30, 2014 exchange rates. As of November 30, 2014, as adjusted for our new ship orders through January 22, 2015, our total annual capital expenditures consist of ships under contract for construction, estimated improvements to existing ships and shoreside assets and for 2015, 2016, 2017 and 2018 are... -

Page 68

... shares are trading at a price that is at a premium or discount to the price of Carnival plc ordinary shares or Carnival Corporation common stock, as the case may be. Any realized economic benefit under the Stock Swap programs is used for general corporate purposes, which could include repurchasing... -

Page 69

... newbuild currency exchange rate risk relates to eurodenominated newbuild construction payments for a Carnival Cruise Line, Holland America Line and Seabourn newbuild, which represent a total unhedged commitment of $1.7 billion. The functional currency cost of each of these ships will increase... -

Page 70

... in fuel prices substantially all relates to the consumption of fuel on our ships. We expect to consume approximately 3.2 million metric tons of fuel in 2015. Based on a 10% hypothetical change in our December 19, 2014 guidances' forecasted average fuel price, we estimate that our 2015 fuel expense... -

Page 71

... be read in conjunction with those consolidated financial statements and the related notes. Years Ended November 30, 2014 2013 2012 2011 2010 (dollars in millions, except per share, per ton and currency data) Statements of Income Data Revenues ...Operating income ...Net income (a) ...Earnings per... -

Page 72

... 30, 2014, 2013, and 2012. (ii) Represents impairment charges related to the sale of Costa Marina and Pacific Sun. (iii) Represents the 2010 gain on the sale of P&O Cruises (UK)'s Artemis. (b) Includes a special dividend of $0.50 per share. (c) Net of $508 million of insurance proceeds received for... -

Page 73

... of Directors. Our dividends were and will be based on a number of factors, including our earnings, liquidity position, financial condition, tone of business, capital requirements, credit ratings and the availability and cost of obtaining new debt. We cannot be certain that Carnival Corporation and... -

Page 74

...taking the number of shares owned, assuming Carnival Corporation dividends are reinvested, multiplied by the market price of the shares. 5 -YEAR CUMULATIVE TOTAL RETURNS $300 $250 DOLLARS $200 $150 $100 2009 2010 2011 2012 2013 2014 Carnival Corporation Common Stock FTSE 100 Index S&P 500... -

Page 75

... share of Carnival plc, with the Price Performance of $100 invested in each of the indexes noted below. The Price Performance is calculated in the same manner as previously discussed. 5 -YEAR CUMULATIVE TOTAL RETURNS $300 $250 DOLLARS $200 $150 $100 2009 2010 2011 2012 2013 2014 Carnival... -

Page 76

...-service for maintenance, which we schedule during non-peak demand periods. In addition, substantially all of Holland America Princess Alaska Tours' revenue and net income is generated from May through September in conjunction with the Alaska cruise season. Quarterly financial results for 2014 were... -

Page 77

... impairment charges ...Unrealized losses (gains) on fuel derivatives, net ...Non-GAAP net income ...Weighted-average shares outstanding - diluted ...Earnings per share - diluted U.S. GAAP earnings per share ...Losses (gains) on ship sales and ship impairments, net ...Trademark and other impairment... -

Page 78

-

Page 79

...Other Shareholder Information Copies of our joint Annual Report on Form 10-K, joint Quarterly Reports on Form 10-Q, joint Current Reports on Form 8-K, Carnival plc Annual Accounts and all amendments to those reports, press releases and other documents, as well as information on our cruise brands are... -

Page 80

Carnival Place 3665 N.W. 87th Avenue Miami Florida 33178-2428 U.S.A. www.carnivalcorp.com Carnival House 100 Harbour Parade Southampton S015 1ST UK www.carnivalplc.com