Carnival Cruises 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 6 – Commitments

Ship Commitments

At November 30, 2011, we had 10 ships under contract for construction with an aggregate passenger capacity of

31,987. The estimated total cost of these ships is $6.6 billion, which includes the contract prices with the

shipyards, design and engineering fees, capitalized interest, construction oversight costs and various owner

supplied items. We have paid $0.5 billion through November 30, 2011 and anticipate paying $1.8 billion, $1.1

billion, $1.4 billion, $1.2 billion and $0.5 billion of the remaining estimated total costs in fiscal 2012, 2013,

2014, 2015 and 2016, respectively.

Operating Leases, Port Facilities and Other Commitments

Rent expense under our operating leases, primarily for office and warehouse space, was $59 million, $61 million

and $54 million in fiscal 2011, 2010 and 2009, respectively.

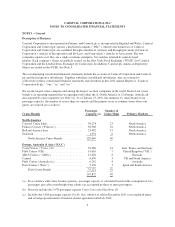

At November 30, 2011, minimum amounts payable for our operating leases, with initial or remaining terms in

excess of one year, and for the annual usage of port facilities and other contractual commitments with remaining

terms in excess of one year, were as follows (in millions):

Fiscal

2012 2013 2014 2015 2016 Thereafter Total

Operating leases ................. $ 41 $ 39 $ 34 $ 31 $ 28 $180 $ 353

Port facilities and other ............ 120 118 104 101 103 743 1,289

$161 $157 $138 $132 $131 $923 $1,642

NOTE 7 – Contingencies

Litigation

In the normal course of our business, various claims and lawsuits have been filed or are pending against us. Most

of these claims and lawsuits are covered by insurance and, accordingly, the maximum amount of our liability, net

of any insurance recoverables, is typically limited to our self-insurance retention levels. Management believes the

ultimate outcome of these claims and lawsuits will not have a material adverse impact on our consolidated

financial statements.

Contingent Obligations – Lease Out and Lease Back Type (“LILO”) Transactions

In April 2011, Carnival Corporation and certain participants voluntarily unwound $87 million of one of its LILO

contingent liability transactions. Accordingly, at November 30, 2011 Carnival Corporation had estimated

contingent obligations totaling $425 million, excluding termination payments as discussed below, to participants

in LILO transactions for two of its ships. At the inception of these leases, the aggregate of the net present value

of these obligations was paid by Carnival Corporation to a group of major financial institutions, who agreed to

act as payment undertakers and directly pay these obligations. As a result, these contingent obligations are

considered extinguished, and neither the funds nor the contingent obligations have been included in our

accompanying Consolidated Balance Sheets.

In the event that Carnival Corporation were to default on its contingent obligations and assuming performance by

all other participants, we estimate that we would, as of November 30, 2011, be responsible for a termination

payment of $61 million. In 2017, we have the right to exercise options that would terminate these two LILO

transactions at no cost to us.

In certain cases, if the credit ratings of the financial institutions who are directly paying the contingent

obligations fall below AA-, then Carnival Corporation will be required to replace these financial institutions with

19