Carnival Cruises 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

those of Carnival Corporation’s. In addition, Carnival Corporation and Carnival plc have each extended their

respective deeds of guarantee to the other’s pre-DLC indebtedness and certain other monetary obligations, or

alternatively have provided standalone guarantees in lieu of utilization of these deeds of guarantee, thus

effectively cross guaranteeing all Carnival Corporation and Carnival plc indebtedness and certain other monetary

obligations. Each deed of guarantee provides that the creditors to whom the obligations are owed are intended

third party beneficiaries of such deed of guarantee.

The deeds of guarantee are governed and construed in accordance with the laws of the Isle of Man. Subject to the

terms of the deeds of guarantee, the holders of indebtedness and other obligations that are subject to the deeds of

guarantee will have recourse to both Carnival plc and Carnival Corporation, though a Carnival plc creditor must

first make written demand on Carnival plc and a Carnival Corporation creditor on Carnival Corporation. Once

the written demand is made by letter or other form of notice, the holders of indebtedness or other obligations may

immediately commence an action against the relevant guarantor. Accordingly, there is no requirement under the

deeds of guarantee to obtain a judgment, take other enforcement actions or wait any period of time prior to taking

steps against the relevant guarantor. All actions or proceedings arising out of or in connection with the deeds of

guarantee must be exclusively brought in courts in England.

Under the terms of the DLC transaction documents, Carnival Corporation and Carnival plc are permitted to

transfer assets between the companies, make loans to or investments in each other and otherwise enter into

intercompany transactions. The companies have entered into some of these types of transactions and may enter

into additional transactions in the future to take advantage of the flexibility provided by the DLC arrangement,

and to operate both companies as a single unified economic enterprise in the most effective manner. In addition,

under the terms of the Equalization and Governance Agreement and the deeds of guarantee, the cash flow and

assets of one company are required to be used to pay the obligations of the other company, if necessary.

Given our DLC arrangement, we believe that providing separate financial statements for each of Carnival

Corporation and Carnival plc would not present a true and fair view of the economic realities of their operations.

Accordingly, separate financial statements for both Carnival Corporation and Carnival plc have not been

presented.

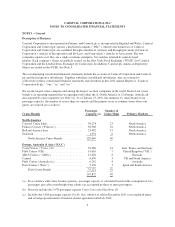

NOTE 4 – Property and Equipment

Property and equipment consisted of the following (in millions):

November 30,

2011 2010

Ships, including ship improvements ......................................... $39,764 $37,348

Ships under construction .................................................. 526 696

40,290 38,044

Land, buildings and improvements, including leasehold improvements and port

facilities ............................................................. 898 858

Computer hardware and software, transportation equipment and other .............. 1,016 934

Total property and equipment .............................................. 42,204 39,836

Less accumulated depreciation and amortization ............................... (10,150) (8,869)

$ 32,054 (a) $30,967 (a)

(a) At November 30, 2011 and 2010, the net carrying values of ships and ships under construction for our North

America, EAA, Cruise Support and Tour and Other segments were $17.9 billion, $12.8 billion, $0.2 billion

and $0.1 billion and $17.5 billion, $12.1 billion, $0.2 billion and $0.2 billion, respectively.

14