Carnival Cruises 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Debt issuance costs are generally amortized to interest expense using the straight-line method, which

approximates the effective interest method, over the term of the debt. In addition, all debt issue discounts are

amortized to interest expense using the effective interest rate method over the term of the notes.

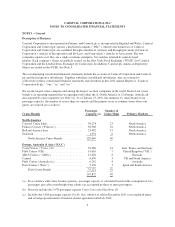

Committed Ship Financings

We have unsecured long-term export credit committed ship financings, for which we have the option to draw in

euros and/or U.S. dollars depending on the facility, in order to pay for a portion of our ships’ purchase prices.

These commitments, if drawn, are generally repayable semi-annually over 12 years. We have the option to cancel

each one at specified dates prior to the underlying ship’s delivery date.

At January 23, 2012, our committed ship financings are as follows:

Cruise Brands and Ships

Fiscal Year

Scheduled for

Funding Amount

(in millions)

North America

Carnival Cruise Lines

Carnival Breeze ...................................................... 2012 $ 560

Princess

Royal Princess ....................................................... 2013 538

Newbuild ........................................................... 2014 538

North America Cruise Brands ......................................... 1,636

EAA

AIDA

AIDAmar ........................................................... 2012 389

Newbuild ........................................................... 2013 318

Newbuild ........................................................... 2015 452

Newbuild ........................................................... 2016 452

P&O Cruises (UK)

Newbuild ........................................................... 2015 554

Costa

Newbuild ........................................................... 2014 522

EAA Cruise Brands ................................................. 2,687

$4,323

Revolving Credit Facilities

In 2011, concurrent with the early termination of our existing multi-currency revolving credit facility for $2.0

billion (comprised of $1.2 billion, €400 million and £200 million), Carnival Corporation, Carnival plc and certain

of Carnival plc’s subsidiaries entered into a five-year multi-currency revolving credit facility for $2.5 billion

(comprised of $1.6 billion, €450 million and £150 million) (the “Facility”). The Facility currently bears interest

at LIBOR/EURIBOR plus a margin of 65 bps. The margin will vary based on changes to Carnival Corporation’s

and Carnival plc’s long-term senior unsecured credit ratings. We are required to pay a commitment fee of 35% of

the margin per annum on any undrawn portion. If more than one-third or if more than two-thirds of the Facility is

drawn, we will incur an additional 15 bps or 30 bps utilization fee, respectively, on the total amount outstanding.

At November 30, 2011, we also had two other revolving credit facilities with an aggregate $161 million available

that mature through 2015. At November 30, 2011, $2.4 billion was available under our Facility and our other

revolving credit facilities, net of outstanding commercial paper.

18