Carnival Cruises 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15Carnival Corporation & plc

to Carnival Corporation’s policies. Carnival plc’s reporting

period has been changed to Carnival Corporation’s

reporting period and the information presented below

covers the same periods of time for both companies.

This pro forma information has been prepared as if

the DLC transaction had occurred on December 1,

2002 and 2001, respectively, rather than April 17, 2003,

and has not been adjusted to reflect any net transaction

benefits. In addition, this pro forma information does

not purport to represent what the results of operations

actually could have been if the DLC transaction had

occurred on December 1, 2002 and 2001 or what those

results will be for any future periods.

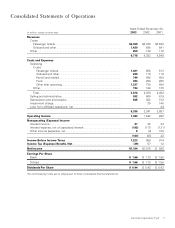

Years Ended

November 30,

(in millions, except earnings per share) 2003 2002

Pro forma revenues . . . . . . . . . . . . . . . . . . $7,596 $6,768

Pro forma net income(a)-(d) . . . . . . . . . . . . . $1,159 $1,271

Pro forma earnings per share

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.46 $ 1.60

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.45 $ 1.59

Pro forma weighted-average

shares outstanding

Basic . . . . . . . . . . . . . . . . . . . . . . . . . 797 795

Diluted . . . . . . . . . . . . . . . . . . . . . . . . 805 800

(a) In accordance with SFAS No. 141, pro forma net income

was reduced by $51 million in 2003 and $104 million in

2002 for Carnival plc’s nonrecurring costs related to its

terminated Royal Caribbean transaction and the completion

of the DLC transaction with Carnival Corporation, which

were expensed by Carnival plc prior to April 17, 2003.

(b) As a result of the reduction in depreciation expenses due

to the revaluation of Carnival plc’s ships carrying values,

pro forma net income has been increased by $16 million

in 2003 and $14 million in 2002.

(c) The 2002 pro forma net income included a $51 million non-

recurring income tax benefit related to an Italian incentive

tax law, which allowed Costa to receive an income tax ben-

efit for contractual expenditures during 2002 incurred on

the construction of a new ship.

(d) The 2003 pro forma net income included a $13 million non-

recurring expense related to a DLC litigation matter and

$19 million of income related to the receipt of nonrecurring

net insurance proceeds.

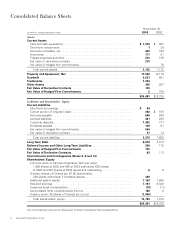

Note 4—Property and Equipment

Property and equipment consisted of the following

(in millions):

November 30,

2003 2002

Ships . . . . . . . . . . . . . . . . . . . . . . . . . . $18,134 $10,666

Ships under construction. . . . . . . . . . . . 886 713

19,020 11,379

Land, buildings and improvements,

and port facilities. . . . . . . . . . . . . . . . 504 315

Transportation equipment and other . . . 549 409

Total property and equipment . . . . . . . . 20,073 12,103

Less accumulated depreciation

and amortization . . . . . . . . . . . . . . . . (2,551) (1,987)

$17,522 $10,116

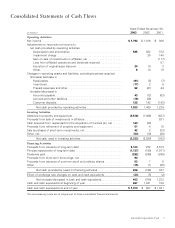

Capitalized interest, primarily on our ships under con-

struction, amounted to $49 million, $39 million and $29

million in fiscal 2003, 2002 and 2001, respectively. Ships

under construction include progress payments for the

construction of the ship, as well as design and engi-

neering fees, capitalized interest, construction oversight

costs and various owner supplied items. At November

30, 2003, seven ships with an aggregate net book value

of $1.94 billion were pledged as collateral pursuant to

mortgages related to $1.04 billion of debt and a $469

million contingent obligation (see Notes 7 and 9). During

fiscal 2003, $1.05 billion of ship collateral, which was

pledged against $697 million of Carnival plc debt was

released as collateral in exchange for revising the matu-

rity dates of this debt and providing Carnival Corporation

guarantees (see Note 7).

Maintenance and repair expenses and dry-dock

amortization were $251 million, $175 million and $160

million in fiscal 2003, 2002 and 2001, respectively.

Note 5—Impairment Charge

In fiscal 2002 we reduced the carrying value of one

of our ships by recording an impairment charge of $20

million. In fiscal 2001, we recorded an impairment

charge of $140 million, which consisted principally of

a $71 million reduction in the carrying value of ships, a

$36 million write-off of Seabourn goodwill, a $15 million

write-down of a Holland America Line note receivable,

and a $11 million loss on the sale of the Seabourn

Goddess I and II. The impaired ships’ and note receivable

fair values were based on third party appraisals, negoti-

ations with unrelated third parties or other available

evidence, and the fair value of the impaired goodwill

was based on our estimates of discounted future

cash flows.