Carnival Cruises 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 Carnival Corporation & plc

against the relevant guarantor. There is no requirement

under the deeds of guarantee to obtain a judgment, take

other enforcement actions or wait any period of time

prior to taking steps against the relevant guarantor. All

actions or proceedings arising out of or in connection

with the deeds of guarantee must be exclusively brought

in courts in England.

Under the terms of the DLC transaction documents,

Carnival Corporation and Carnival plc are permitted to

transfer assets between the companies, make loans or

investments in each other and otherwise enter into inter-

company transactions. The companies have entered into

some of these types of transactions and expect to enter

into additional transactions in the future to take advan-

tage of the flexibility provided by the DLC structure and

to operate both companies as a single unified economic

enterprise in the most effective manner. In addition,

under the terms of the Equalization and Governance

Agreement and the deeds of guarantee, the cash flow

and assets of one company are required to be used to

pay the obligations of the other company, if necessary.

Given the DLC structure as described above, we

believe that providing separate financial statements

for each of Carnival Corporation and Carnival plc would

not present a true and fair view of the economic reali-

ties of their operations. Accordingly, separate financial

statements for both Carnival Corporation and Carnival

plc have not been presented.

Simultaneously with the completion of the DLC

transaction, a partial share offer (“PSO”) for 20% of

Carnival plc’s shares was made and accepted, which

enabled 20% of Carnival plc shares to be exchanged for

41.7 million Carnival Corporation shares. The 41.7 mil-

lion shares of Carnival plc held by Carnival Corporation

as a result of the PSO, which cost $1.05 billion, are

being accounted for as treasury stock in the accompany-

ing balance sheet. The holders of Carnival Corporation

shares, including the new shareholders who exchanged

their Carnival plc shares for Carnival Corporation shares

under the PSO, now own an economic interest equal to

approximately 79%, and holders of Carnival plc shares

now own an economic interest equal to approximately

21%, of Carnival Corporation & plc.

The management of Carnival Corporation and

Carnival plc ultimately agreed to enter into the DLC

transaction because, among other things, the creation

of Carnival Corporation & plc would result in a company

with complementary well-known brands operating glob-

ally with enhanced growth opportunities, benefits of

sharing best practices and generating cost savings,

increased financial flexibility and access to capital mar-

kets and a DLC structure, which allows for continued

participation in an investment in the global cruise indus-

try by Carnival plc’s shareholders who wish to continue

to hold shares in a UK-listed company.

Carnival plc was the third largest cruise company in

the world and operated many well-known global brands

with leading positions in the U.S., UK, Germany and

Australia. The combination of Carnival Corporation with

Carnival plc under the DLC structure has been accounted

for under U.S. generally accepted accounting principles

(“GAAP”) as an acquisition of Carnival plc by Carnival

Corporation pursuant to SFAS No. 141. The purchase

price of $25.31 per share was based upon the average of

the quoted closing market price of Carnival Corporation’s

shares beginning two days before and ending two days

after January 8, 2003, the date the Carnival plc board

agreed to enter into the DLC transaction. The number

of additional shares effectively issued in the combined

entity for purchase accounting purposes was 209.6 mil-

lion. In addition, Carnival Corporation incurred approxi-

mately $60 million of direct acquisition costs, which

have been included in the purchase price. The aggre-

gate purchase price of $5.36 billion, computed as

described above, has been allocated to the assets and

liabilities of Carnival plc as follows (in millions):

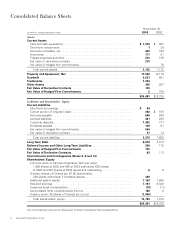

Ships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,669

Ships under construction . . . . . . . . . . . . . . . . . . . . 233

Other tangible assets . . . . . . . . . . . . . . . . . . . . . . . 868

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,248

Trademarks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,291

Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,879)

Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,072)

$ 5,358

During the fourth quarter of fiscal 2003 an appraisal

firm who we engaged completed its valuation work in

connection with establishing the estimated fair values

of Carnival plc’s cruise ships and non-amortizable and

amortizable intangible assets as of the April 17, 2003

acquisition date. Accordingly, we reduced the carrying

values of 15 Carnival plc ships, including three ships

which were under construction at the acquisition date,

by $689 million. Trademarks are non-amortizable and

represent the Princess, P&O Cruises, P&O Cruises

Australia, AIDA, and A’ROSA trademarks’ estimated fair

values. There were no significant amortizable intangible

assets identified in this appraisal firm’s valuation study.

The information presented below gives pro forma

effect to the DLC transaction between Carnival

Corporation and Carnival plc. Management has pre-

pared the pro forma information based upon the com-

panies’ reported financial information and, accordingly,

the pro forma information should be read in conjunction

with the companies’ financial statements.

As noted above, the DLC transaction has been

accounted for as an acquisition of Carnival plc by Carnival

Corporation, using the purchase method of accounting.

Carnival plc’s accounting policies have been conformed

Notes to Consolidated Financial Statements (continued)