Carnival Cruises 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARNIVAL

CORPORATION & PLC

2003 ANNUAL REPORT

Table of contents

-

Page 1

C A R N I VA L COR POR ATION & PLC 2003 A N N UA L R E PORT -

Page 2

T H E P O W E R O F O U R G L O B A L B R A N D S -

Page 3

... ship, the Carnival Miracle. The line currently has two new ships scheduled for delivery during the next two years at an estimated cost of $1 billion. Carnival ships cruise to destinations in the Bahamas, Canada, the Caribbean, the Mexican Riviera, New England, the Panama Canal, Alaska, and Hawaii... -

Page 4

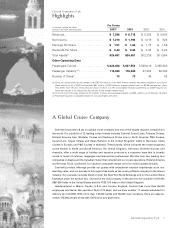

...merger related costs. (b) As of the end of the year, except for the number of ships and passenger capacity in 2003, which is as of February 15, 2004. (c) Passenger capacity is calculated based on two passengers per cabin. A Global Cruise Company Carnival Corporation & plc is a global cruise company... -

Page 5

... America, Europe and Australia, and a unique platform for developing new markets in the future. Today, Carnival Corporation & plc comprises 12 of the world's leading cruise lines and positions us with the most recognized cruise brands in North and South America, the United Kingdom, Germany, Italy... -

Page 6

... annual capacity increase of 17.5 percent. Included in 2004's historic order book is a new "Spirit-class" vessel for Carnival Cruise Lines, Carnival Miracle; three new "Love Boats" for Princess Cruises, the Diamond, Caribbean, and Sapphire Princesses; a second 2,702-passenger Costa Cruises ship... -

Page 7

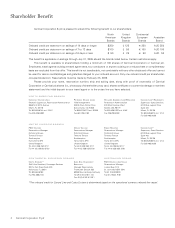

... Corporation or Carnival plc shares (i.e., photocopy of shareholder proxy card, shares certificate or a current brokerage or nominee statement) and the initial deposit to your travel agent or to the cruise line you have selected. NORTH AMERICAN BRANDS C A R N I VA L C R U I S E L I N E S PRINCESS... -

Page 8

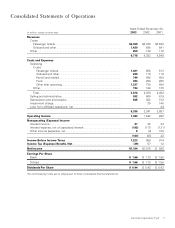

... Statements of Operations (in millions, except per share data) Years Ended November 30, 2003 2002 2001 Revenues Cruise Passenger tickets...Onboard and other ...Other...Costs and Expenses Operating Cruise Passenger tickets...Onboard and other . . Payroll and related . . Food ...Other ship... -

Page 9

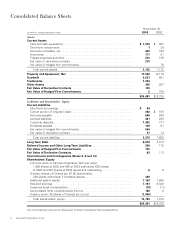

...of Derivative Contracts ...Commitments and Contingencies (Notes 8, 9 and 14) Shareholders' Equity Common stock of Carnival Corporation; $.01 par value; 1,960 shares at 2003 and 960 at 2002 authorized; 630 shares at 2003 and 587 shares at 2002 issued and outstanding ...Ordinary shares of Carnival plc... -

Page 10

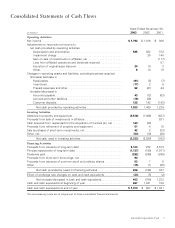

... to net cash provided by operating activities Depreciation and amortization ...Impairment charge ...Gain on sale of investments in affiliates, net ...Loss from affiliated operations and dividends received ...Accretion of original issue discount ...Other ...Changes in operating assets and liabilities... -

Page 11

... 30, 2002 ...Comprehensive income Net income...Foreign currency translation adjustment...Unrealized losses on marketable securities, net ...Changes related to cash flow derivative hedges, net...Total comprehensive income . . Cash dividends declared ...Acquisition of Carnival plc ...Issuance of stock... -

Page 12

... company's shares continue to be publicly traded on the New York Stock Exchange ("NYSE") for Carnival Corporation and the London Stock Exchange for Carnival plc. In addition, Carnival plc ADS's are traded Cruise Brands Carnival Cruise Lines ("CCL") ...Princess Cruises ("Princess") ...Holland America... -

Page 13

... profits and losses on transactions within our consolidated group and with affiliates are eliminated in consolidation. Commencing in 2003, we changed the reporting format of our consolidated statements of operations to present our significant revenue sources and their directly related variable costs... -

Page 14

...our acquisition of Carnival plc, which was also allocated to our cruise reporting units (see Note 3). There was no other change to our goodwill carrying amount since November 30, 2001, other than the changes resulting from using different foreign currency translation rates at each balance sheet date... -

Page 15

..., 2003 and 2002, the amount of advertising costs included in prepaid expenses was not material. Foreign Currency Translations and Transactions For our foreign subsidiaries and affiliates using the local currency as their functional currency, assets and liabilities are translated at exchange rates in... -

Page 16

...prior year amounts to conform to the current year presentation. Note 3-DLC Transaction The contracts governing the DLC structure provide that Carnival Corporation and Carnival plc each continue to have separate boards of directors, but the boards and senior executive management of both companies are... -

Page 17

...markets and a DLC structure, which allows for continued participation in an investment in the global cruise industry by Carnival plc's shareholders who wish to continue to hold shares in a UK-listed company. 14 Carnival Corporation & plc Carnival plc was the third largest cruise company in the world... -

Page 18

... an income tax benefit for contractual expenditures during 2002 incurred on the construction of a new ship. (d) The 2003 pro forma net income included a $13 million nonrecurring expense related to a DLC litigation matter and $19 million of income related to the receipt of nonrecurring net insurance... -

Page 19

... guaranteed by P&O Princess Cruises International Limited ("POPCIL"), a 100% direct wholly-owned subsidiary of Carnival plc. On June 19, 2003, POPCIL, Carnival Corporation and Carnival plc executed a deed of guarantee under which POPCIL agreed to guarantee all indebtedness and related obligations of... -

Page 20

... The 1.75% Notes, which were issued in April 2003, are convertible at a conversion price of $53.11 per share, subject to adjustment, during any fiscal quarter for which the closing price of the Carnival Corporation common stock is greater than a specified trigger price for a defined duration of time... -

Page 21

... the effective interest method, over the term of the notes or the noteholders first put option date, whichever is earlier. In addition, all loan issue discounts are amortized to interest expense using the effective interest rate method over the term of the notes. 18 Carnival Corporation & plc -

Page 22

... denominated in euros, which is Costa's functional currency and, therefore, we have not entered into a forward foreign currency contract to hedge this commitment. The estimated total cost has been translated into U.S. dollars using the November 30, 2003 exchange rate. Carnival Corporation & plc 19 -

Page 23

...3,004-passenger ship with Fincantieri for a Summer 2006 delivery date at an estimated total cost of 450 million euros. In connection with our cruise ships under contract for construction, we have paid $876 million through November 30, 2003 and anticipate paying the remaining estimated total costs as... -

Page 24

... or alternatively provide mortgages in the aggregate amount of $90 million on two of Carnival Corporation's ships. In the unlikely event that we were to terminate the three lease agreements early or default on our obligations, we would, as of November 30, 2003 have to pay a total of $168 million in... -

Page 25

... the sale of air and other transportation, shore excursions and pre-and post cruise land packages. These rules will first be effective for us in fiscal 2004. AIDA, A'ROSA, Ocean Village, P&O Cruises, P&O Cruises Australia and Swan Hellenic are all strategically and commercially managed in the UK and... -

Page 26

...on prices quoted by financial institutions for these instruments. Note 13-Segment Information Our cruise segment included thirteen cruise brands since April 17, 2003, and six Carnival Corporation cruise brands from December 1, 2001 to April 16, 2003, which have been aggregated as a single reportable... -

Page 27

...with a land tour package by Holland America Tours and Princess Tours, and shore excursion and port hospitality services provided to cruise passengers by these tour companies. These intersegment revenues are eliminated from other revenues in the line "Intersegment elimination." (b) Revenue amounts in... -

Page 28

...U.S. dollar to sterling exchange rate. (d) Included 2.2 million of Carnival plc options at a weighted-average exercise price of $18.06 per share. (e) On December 1, 2003, as a result of the Princess cruise operations being transferred to the Carnival Corporation side of the DLC structure, options to... -

Page 29

... and the New Section only closed to new membership. Holland America Line also participates in a Dutch shipboard officers defined benefit multiemployer pension plan. Our multiemployer yearly pension fund plan expenses are based on the amount of contributions we are required to make annually into the... -

Page 30

... Information Years Ended November 30, 2003 2002 2001 (in millions) 585 1 588 $ 1.73 $ 1.73 2 587 $1.58 $1.58 Cash paid for Interest, net of amount capitalized ...Income taxes, net ...Other noncash investing and financing activities Common stock received as payment of stock option exercise price... -

Page 31

Report of Independent Certified Public Accountants To the Boards of Directors and Shareholders of Carnival Corporation and Carnival plc In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of operations, cash flows and shareholders' equity present ... -

Page 32

... in this 2003 Annual Report. Forward-looking statements include those statements which may impact the forecasting of our earnings per share, net revenue yields, booking levels, pricing, occupancy, operating, financing and tax costs, costs per available lower berth day, estimates of ship depreciable... -

Page 33

...Cruises Australia fleet, the transfer of a Holland America newbuild shipyard slot to Princess for a new ship deployment in 2006, the consolidation of our German and London office operations and the sale of our German river boat business, global procurement savings and the implementation of many best... -

Page 34

...flat compared to 2003 pro forma costs. The increase in expected net cruise costs per ALBD is due to the weaker U.S. dollar. Carnival Corporation's 2% Notes become convertible if the share price of its common stock closes above $43.05 for 20 days out of the last 30 trading days of the quarter. If the... -

Page 35

... value includes numerous uncertainties, unless a viable actively traded market exists for the asset or for a comparable reporting unit, which is usually not the case for cruise ships, cruise lines and trademarks. For example, in determining fair values of ships and cruise lines utilizing discounted... -

Page 36

... our ships. The cruise ticket price includes accommodations, meals, entertainment and many onboard activities, and • the sale of goods and/or services primarily on board our ships, which include bar and beverage sales, casino gaming, shore excursions, gift shop and spa sales, photo and art sales... -

Page 37

... 17.3% increase in its standalone ALBD capacity in 2003 compared to 2002, partially offset by lower cruise ticket prices and, to a lesser extent, a reduced number of passengers purchasing air transportation from Carnival Corporation. Included in onboard and other revenues were concession revenues of... -

Page 38

... its standalone ALBD capacity in 2003 compared to 2002. In addition, higher fuel prices added approximately $44 million to the Carnival Corporation standalone expenses in 2003 compared to 2002. Finally, the increase in each of the individual cruise operating expense line items was primarily a result... -

Page 39

... primarily of a $8 million loss, including related expenses, resulting from the sale of Holland America Line's former Nieuw Amsterdam, partially offset by $4 million of income related to the termination of an over funded pension plan. Income Taxes The income tax benefit of $57 million recognized in... -

Page 40

... We are principally exposed to market risks from fluctuations in foreign currency exchange rates, bunker fuel prices and interest rates. We seek to minimize foreign currency and interest rate risks through our normal operating and financing activities, including netting certain exposures to take... -

Page 41

...to be affected by foreign currency exchange rate fluctuations. Given the recent decline in the U.S. dollar relative to the euro, the U.S. dollar cost to order new cruise ships at current exchange rates has increased significantly. We currently have on order new cruise ships for delivery through 2006... -

Page 42

... in market interest rates. Reported GAAP Reconciling Information Gross and net revenue yields were computed as follows: (in millions, except ALBDs and yields) Gross and net cruise costs per ALBD were computed as follows: (in millions, except ALBDs and costs per ALBD) Years Ended November 30, 2003... -

Page 43

... the April 17, 2003 DLC transaction date. The 2002 pro forma information is computed by adding Carnival plc's 2002 results, adjusted for acquisition adjustments, to the 2002 Carnival Corporation reported results. For additional information related to the pro forma statements of operations see Note... -

Page 44

... ...Operating income ...Net income(d) ...Earnings per share(d) Basic ...Diluted ...Dividends declared per share...Cash from operations ...Capital expenditures ...Other Operating Data(a)(b) Available lower berth days(f) North America ...Europe and Australia ...Total ...Passengers carried ...Occupancy... -

Page 45

...for sale, which is computed by multiplying passenger capacity by revenue-producing ship operating days in the period. North America brands in 2003 include CCL, Holland America Line, Princess, Seabourn and Windstar. Europe brands in 2003 include AIDA, A'ROSA, Costa, Cunard, Ocean Village, P&O Cruises... -

Page 46

... our Holland America Tours and Princess Tours units are highly seasonal, with a vast majority of those revenues generated during the late spring and summer months in conjunction with the Alaska cruise season. Quarterly financial results for fiscal 2003 were as follows: (in millions, except per share... -

Page 47

... financial statements: UK Term Acquisition accounting ...Associate/Joint venture ...Called up share capital ...Creditors ...Debtors ...Finance lease ...Financial year ...Gearing ...Interest payable ...Interest receivable ...Profit ...Profit and loss account ...Profit and loss account reserves Profit... -

Page 48

... Americas New York, New York 10019-6064 U.S.A. Other Shareholder Information Copies of our joint Annual Report on Form 10-K, joint Quarterly Reports on Form 10-Q, joint Current Reports on Form 8-K, Carnival plc Annual Accounts and all amendments to those reports, press releases and other documents... -

Page 49

C A R N I VA L COR POR ATION & PLC Carnival Place 3655 N.W. 87th Avenue Miami, Florida 33178-2428 U.S.A. www.carnivalcorp.com Carnival House 5 Gainsford Street London SE1 2NE UK www.carnivalplc.com AUSTRALIA