Cardinal Health 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Cardinal Health annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

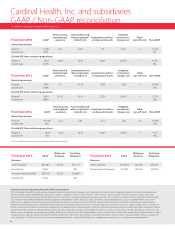

Cardinal Health, Inc. and subsidiaries

GAAP / Non-GAAP reconciliation

Fiscal year 2014 GAAP

Restructuring

and employee

severance

Amortization and

other acquisition-

related costs

Impairments and loss

on disposal of assets

Litigation

(recoveries) /

charges, net

Other

spin-o costs Non-GAAP

Operating earnings

Amount $1,885 $31 $223 $15 $(21) — $2,133

Growth rate 89% 4%

Diluted EPS from continuing operations

Amount $3.37 $0.06 $0.42 $0.03 $(0.04) — $3.84

Growth rate 247% 3%

Fiscal year 2013 GAAP

Restructuring

and employee

severance

Amortization and

other acquisition-

related costs

Impairments and loss

on disposal of assets

Litigation

(recoveries) /

charges, net

Other

spin-o costs Non-GAAP

Operating earnings

Amount $996 $71 $158 $859 $(38) — $2,046

Growth rate (44)% 10%

Diluted EPS from continuing operations

Amount $0.97 $0.13 $0.31 $2.39 $(0.07) — $3.73

Growth rate (68)% 16%

Fiscal year 2012 GAAP

Restructuring

and employee

severance

Amortization and

other acquisition-

related costs

Impairments and loss

on disposal of assets

Litigation

(recoveries) /

charges, net

Other

spin-o costs Non-GAAP

Operating earnings

Amount $1,792 $21 $33 $21 $(3) $2 $1,866

Growth rate 18% 13%

Diluted EPS from continuing operations

Amount $3.06 $0.04 $0.07 $0.04 $(0.01) — $3.21

Growth rate 12% 15%

The sum of the components may not equal the total due to rounding.

(in millions, except per common share amounts)

Important notice regarding forward-looking statements

This annual report contains forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments.

These statements may be identied by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue,” “likely,” and similar

expressions, and include statements reecting future results or guidance, statements of outlook and expense accruals. These matters are subject to risks and uncertainties that could

cause actual results to dier materially from those projected, anticipated or implied. These risks and uncertainties include competitive pressures in Cardinal Health’s various lines

of business; the ability to achieve the expected benets from the generic sourcing joint venture with CVS Caremark; the frequency or rate of pharmaceutical price appreciation or

deation and the timing of generic and branded pharmaceutical introductions; the non-renewal or a default under one or more key customer or supplier arrangements or changes to

the terms of or level of purchases under those arrangements; the ability to achieve the anticipated results from the AccessClosure and Sonexus Health acquisitions; uncertainties due to

government health care reform including federal health care reform legislation; changes in the distribution patterns or reimbursement rates for health care products and services; the

eects of any investigation or action by any regulatory authority; and changes in the cost of commodities such as oil-based resins, cotton, latex and diesel fuel. Cardinal Health is subject

to additional risks and uncertainties described in Cardinal Health’s Form 10-K, Form 10-Q and Form 8-K reports and exhibits to those reports. This presentation reects management’s

views as of August 13, 2014. Except to the extent required by applicable law, Cardinal Health undertakes no obligation to update or revise any forward-looking statement.

Fiscal year 2014 GAAP

Walgreens

Revenue

Excluding

Walgreens

Revenue

Total Company $91,084 $3,310 $87,774

Growth rate (10)% 8%

Pharmaceutical Segment $80,110 $3,310 $76,800

Growth rate (12)% 8%

Fiscal year 2013 GAAP

Walgreens

Revenue

Excluding

Walgreens

Revenue

Total Company $101,093 $20,160 $80,933

Pharmaceutical Segment $91,097 $20,160 $70,937

6