Cardinal Health 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Cardinal Health annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cardinal Health, Inc. and Subsidiaries

Management's Discussion and Analysis of Financial Condition

and Results of Operations

12

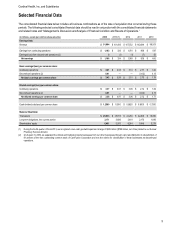

Distribution, Selling, General and Administrative

("SG&A") Expenses

SG&A Expenses Change

(in millions) 2014 2013 2012 2014 2013

SG&A expenses $ 3,028 $ 2,875 $ 2,677 5% 7%

SG&A expenses increased during fiscal 2014 over fiscal 2013

primarily due to acquisitions ($129 million).

SG&A expenses increased during fiscal 2013 over fiscal 2012

primarily due to acquisitions ($84 million) and investment

spending ($17 million).

Segment Profit and Consolidated Operating

Earnings

Segment Profit and

Operating Earnings Change

(in millions) 2014 2013 2012 2014 2013

Pharmaceutical $ 1,745 $ 1,734 $ 1,558 1% 11 %

Medical 444 372 332 19% 12 %

Total segment

profit 2,189 2,106 1,890 4% 11 %

Corporate (304) (1,110) (98) N.M. N.M.

Total operating

earnings $ 1,885 $ 996 $ 1,792 89% (44)%

Segment Profit

We evaluate segment performance based upon segment profit,

among other measures. See Note 15 of the "Notes to

Consolidated Financial Statements" for additional information

on segment profit.

Pharmaceutical Segment Profit

The increase in fiscal 2014 over fiscal 2013 reflected the positive

impact of sales growth, which primarily reflects growth from

existing customers, and was largely offset by the impact of the

Walgreens contract expiration. The impact of gross margin rate,

apart from the impact of the Walgreens contract expiration, was

flat for fiscal 2014. Gross margin rate was positively impacted

by strong performance from generic programs, including the

impact of generic pharmaceutical price appreciation, and was

adversely impacted by customer pricing changes.

The principal drivers for the increase in fiscal 2013 over fiscal

2012 were strong performance in our generic pharmaceutical

programs and increased margin from branded pharmaceutical

distribution agreements. These benefits were partially offset by

the unfavorable impact of pharmaceutical distribution pricing

changes and significant market softness in our Nuclear

Pharmacy Services division.

Medical Segment Profit

The principal driver for the increase in fiscal 2014 over fiscal

2013 was the positive impact of acquisitions.

The principal drivers for the increase in fiscal 2013 over fiscal

2012 were the positive impact of acquisitions and decreased

cost of commodities used in our self-manufactured products,

partially offset by the unfavorable impact of pricing changes,

driven in part by customer and product mix. Segment profit was

also moderated by softness in procedural-based utilization. The

2.3 percent excise tax on certain manufactured or imported

medical devices that became effective January 1, 2013 had a

slightly unfavorable impact on segment profit.

Corporate

As discussed further below, the principal driver for the change

in Corporate in fiscal 2014 and fiscal 2013 was an $829

million non-cash goodwill impairment charge recognized in

fiscal 2013 related to our Nuclear Pharmacy Services division.

Consolidated Operating Earnings

In addition to revenue, gross margin and SG&A expenses

discussed above, operating earnings were impacted by the

following:

(in millions) 2014 2013 2012

Restructuring and employee severance $ 31 $ 71 $ 21

Amortization and other acquisition-related

costs 223 158 33

Impairments and loss on disposal of assets 15 859 21

Litigation (recoveries)/charges, net (21) (38) (3)

Restructuring and Employee Severance

In addition to other restructuring activities during fiscal 2014 and

2013, we recognized restructuring costs of $10 million and $40

million, respectively, related to the restructuring plan in our

Medical segment. We also recognized $11 million of employee-

related costs related to a restructuring plan within our Nuclear

Pharmacy Services division during the fourth quarter of fiscal

2013.

Amortization and Other Acquisition-Related Costs

Amortization of acquisition-related intangible assets was $187

million, $118 million and $78 million for fiscal 2014, 2013 and

2012, respectively. The increase in amortization during 2014

and 2013 was primarily due to intangible assets from the

acquisition of AssuraMed. We also recognized transaction costs

associated with the purchase of AssuraMed of $20 million during

fiscal 2013.

Amortization and other acquisition-related costs for fiscal 2012

included income recognized upon adjustment of the contingent

consideration obligation incurred in connection with the

Healthcare Solutions Holding, LLC ("P4 Healthcare")

acquisition ($71 million). In early fiscal 2013, we terminated and

settled the remaining contingent consideration obligation for $4

million.