Cardinal Health 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Cardinal Health annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cardinal Health, Inc. and Subsidiaries

Management's Discussion and Analysis of Financial Condition

and Results of Operations

10

The discussion and analysis presented below refers to, and

should be read in conjunction with, the consolidated financial

statements and related notes included in this annual report.

Unless otherwise indicated, throughout this Management's

Discussion and Analysis of Financial Condition and Results of

Operations, we are referring to our continuing operations.

Overview

We are a healthcare services company providing

pharmaceutical and medical products and services that help

pharmacies, hospitals and other healthcare providers focus on

patient care while reducing costs, enhancing efficiency and

improving quality. We also provide medical products to patients

in the home.

We report our financial results in two segments: Pharmaceutical

and Medical.

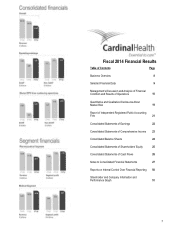

During fiscal 2014, revenue decreased 10 percent to $91.1

billion largely due to the previously disclosed expiration of our

pharmaceutical distribution contract with Walgreen Co.

("Walgreens") on August 31, 2013.

Gross margin increased 5 percent to $5.2 billion reflecting the

positive impact of acquisitions and strong performance from

generic programs, offset in part by the impact of the Walgreens

contract expiration.

Operating earnings increased to $1.9 billion and earnings from

continuing operations increased to $1.2 billion due primarily to

an $829 million ($799 million, net of tax) non-cash goodwill

impairment charge related to our Nuclear Pharmacy Services

division in fiscal 2013.

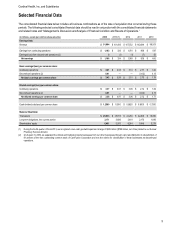

Our cash and equivalents balance was $2.9 billion at June 30,

2014 compared to $1.9 billion at June 30, 2013. The increase

in cash and equivalents during fiscal 2014 was driven by net

cash provided by operating activities of $2.5 billion, which

includes the decrease in our net working capital associated with

the Walgreens contract expiration. Net cash provided by

operating activities was deployed for share repurchases ($673

million), acquisitions ($519 million) and dividends ($415 million).

We plan to continue to execute a balanced deployment of

available capital to position ourselves for sustainable

competitive advantage and to enhance shareholder value.

Walgreens Contract

The Walgreens contract expiration unfavorably impacted

period-over-period comparisons of revenue and operating

earnings for fiscal 2014, but favorably affected net cash provided

by operating activities due to a significant reduction in net

working capital. Because revenue from Walgreens was $3.3

billion during the first quarter of fiscal 2014, we expect the

contract expiration to have an adverse impact on our period-

over-period comparisons of revenue and operating earnings

during the first quarter of fiscal 2015.

Joint Venture With CVS Caremark

In July 2014, we established Red Oak Sourcing, LLC (“Red Oak

Sourcing”), a U.S.-based generic pharmaceutical sourcing

entity with CVS Caremark Corporation (“CVS”) with an initial

term of 10 years. Both companies have contributed sourcing

and supply chain expertise to the 50/50 joint venture and have

committed to source generic pharmaceuticals through

arrangements negotiated by it. Red Oak Sourcing will negotiate

generic pharmaceutical supply contracts on behalf of both

companies, but will not own products or hold inventory on behalf

of either company. We are required to pay 39 quarterly payments

of $25.6 million to CVS commencing in October 2014 and, only

if certain milestones are achieved, to pay additional

predetermined amounts to CVS beginning in fiscal 2016. The

fixed payments of $25.6 million will be expensed evenly

commencing with the ramp-up of the venture, which we expect

to begin by the end of the first quarter of fiscal 2015. No physical

assets were contributed by either company to Red Oak

Sourcing, and minimal funding has been provided to capitalize

the entity.

Acquisitions

We have completed several acquisitions since July 1, 2011, the

largest of which were AssuraMed, Inc. ("AssuraMed") in fiscal

2013 and Access Closure, Inc. ("AccessClosure") in fiscal 2014.

On May 9, 2014, we completed the acquisition of AccessClosure

for $320 million in an all-cash transaction. We funded the

acquisition with cash on hand. The acquisition of

AccessClosure, a manufacturer and distributor of extravascular

closure devices, expands the Medical segment's portfolio of self-

manufactured products.

On March 18, 2013, we completed the acquisition of AssuraMed

for $2.07 billion, net of cash acquired, in an all-cash transaction.

We funded the acquisition through the issuance of $1.3 billion

in fixed rate notes and cash on hand. The acquisition of

AssuraMed, a provider of medical supplies to homecare

providers and patients in the home, expands Medical segment's

ability to serve this patient base. The AssuraMed division is now

known as our Cardinal Health at Home division ("Home

division"). This acquisition increased revenue and operating

earnings during fiscal 2014. The increase in amortization and

other acquisition-related costs during fiscal 2014 was primarily

due to intangible assets from this acquisition. We expect the

amortization of acquisition-related intangible assets to continue

to be a significant expense in future periods.

See Note 2 of the "Notes to Consolidated Financial Statements"

for additional information on these acquisitions.

Goodwill

As part of our annual goodwill impairment test during fiscal 2013,

we concluded that the entire goodwill amount of our Nuclear

Pharmacy Services division was impaired, resulting in a non-