Cardinal Health 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Cardinal Health annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Essential to care™

Table of contents

-

Page 1

Essential to care â„¢ -

Page 2

... 3,000 laboratories 80,000 from over PRODUCTS & 7,500 physician offices 2 billion WE MANUFACTURE OR SOURCE NEARLY individual Consumer healthcare Home medical equipment & Over-the-counter PRODUCTS EACH YEAR $91.1 billion in revenue $2.5 billion in operating cash flow $1.1 billion returned to... -

Page 3

Dear Shareholders of Cardinal Health: Fiscal 2014 was an enormously important year for Cardinal Health. Our organization exceeded its financial goals for the year along multiple dimensions: revenue, gross margin dollars, non-GAAP operating earnings, operating margin rate and cash flow. Of ... -

Page 4

...our healthcare landscape and, of course, for Cardinal Health. During fiscal 2014, we were able to deliver a 30 percent revenue growth in the Specialty Solutions Group. We have expanded our presence in specialty biopharmaceuticals, particularly in building out our tools to interface with patients who... -

Page 5

... share gains from new private label product launches, new channel penetration and growth within our strategic accounts. We saw full year sales growth of 6 percent and launched over 500 new SKUs. During this past year, we have seen the challenges many of our hospital, IDN and surgery center customers... -

Page 6

... director for Cardinal Health. Glenn was a man of tremendous talent but also one of unusual humility. All of us will miss his quick mind and his insightful counsel, as well as his friendship. Our CFO, Jeff Henderson, announced his plans to retire next August, after the completion of fiscal year 2015... -

Page 7

..., Medical Segment Stephen T. Falk Executive Vice President, General Counsel and Corporate Secretary Calvin Darden (H) Retired Senior Vice President, U.S. Operations, United Parcel Service, Inc. Jeffrey W. Henderson Chief Financial Officer Bruce L. Downey (A) Partner, New Spring Health Capital II... -

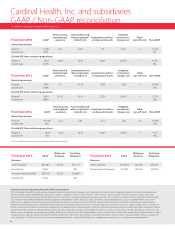

Page 8

Cardinal Health, Inc. and subsidiaries GAAP / Non-GAAP reconciliation (in millions, except per common share amounts) Fiscal year 2014 Operating earnings Amount Growth rate GAAP Restructuring and employee severance Amortization and other acquisition- Impairments and loss related costs on disposal... -

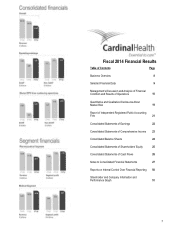

Page 9

...Comprehensive Income Consolidated Balance Sheets Consolidated Statements of Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Reports on Internal Control Over Financial Reporting Shareholder and Company Information and Performance Graph Page 8 9 10... -

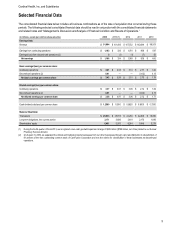

Page 10

..., 2013 and 2012, respectively. Except as otherwise specified, information in this annual report is provided as of June 30, 2014. We report our financial results in two segments: Pharmaceutical and Medical. • operates nuclear pharmacies and cyclotron facilities through its Nuclear Pharmacy Services... -

Page 11

... of tax) related to our Nuclear Pharmacy Services division. On August 31, 2009, we separated the clinical and medical products businesses from our other businesses through a pro rata distribution to shareholders of 81 percent of the then outstanding common stock of CareFusion Corporation and met the... -

Page 12

... home, expands Medical segment's ability to serve this patient base. The AssuraMed division is now known as our Cardinal Health at Home division ("Home division"). This acquisition increased revenue and operating earnings during fiscal 2014. The increase in amortization and other acquisition-related... -

Page 13

... offset by increased pharmaceutical distribution revenue from new customers (approximately $3.8 billion) and revenue growth within our Specialty Solutions division ($961 million). Medical Segment Revenue for fiscal 2013 compared to fiscal 2012 reflects the benefit of acquisitions ($459 million... -

Page 14

... of pharmaceutical distribution pricing changes and significant market softness in our Nuclear Pharmacy Services division. Medical Segment Profit The principal driver for the increase in fiscal 2014 over fiscal 2013 was the positive impact of acquisitions. Restructuring and Employee Severance In... -

Page 15

... related to our Nuclear Pharmacy Services division, as discussed further in the Overview section and in Note 5 of the "Notes to Consolidated Financial Statements". We also recognized an $8 million loss during fiscal 2013 to write down commercial software under development within our Pharmaceutical... -

Page 16

...and Commercial Paper On October 15, 2013, we reduced our committed receivables sales facility program through Cardinal Health Funding, LLC from $950 million to $700 million in light of the Walgreens contract expiration. In addition to our committed receivables sales facility program, our sources of... -

Page 17

... to pay CVS commencing in October 2014 in connection with the establishment of Red Oak Sourcing, but does not include contingent payments that may become payable under the joint venture. See Note 1 of the "Notes to Consolidated Financial Statements" for additional information. Recent Financial... -

Page 18

... as a percentage of customer receivables Allowance as a percentage of revenue $ 2014 156 51 51 2.8% 0.17% $ 2013 152 34 41 2.3% 0.15% $ 2012 143 30 22 2.2% 0.13% have experienced a pharmaceutical price decline, the result generally will be an increase in future cost of products sold as our older... -

Page 19

... Our reporting units are: Pharmaceutical operating segment (excluding our Nuclear Pharmacy Services division and Cardinal Health China - Pharmaceutical division); Nuclear Pharmacy Services division; Cardinal Health China Pharmaceutical division; Medical operating segment (excluding our Home division... -

Page 20

.... The actual forfeitures in future reporting periods could be higher or lower than our current estimates. See Note 16 of the "Notes to Consolidated Financial Statements" for additional information regarding share-based compensation. This valuation allowance primarily relates to federal, state and... -

Page 21

... changes. We maintain a hedging program to manage volatility related to these market exposures which employs operational, economic and derivative financial instruments in order to mitigate risk. See Notes 1 and 12 of the "Notes to Consolidated Financial Statements" for further discussion regarding... -

Page 22

Cardinal Health, Inc. and Subsidiaries Quantitative and Qualitative Disclosures About Market Risk contracts are not directly tied to a commodity index. We believe our total gross range of exposure to commodities, including the items listed in the table above, is $400 million to $500 million at June... -

Page 23

... Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders of Cardinal Health, Inc. We have audited the accompanying consolidated balance sheets of Cardinal Health, Inc. and subsidiaries as of June 30, 2014 and 2013, and the related consolidated statements... -

Page 24

..., except per common share amounts) Revenue Cost of products sold Gross margin Operating expenses: Distribution, selling, general and administrative expenses Restructuring and employee severance Amortization and other acquisition-related costs Impairments and loss on disposal of assets Litigation... -

Page 25

Cardinal Health, Inc. and Subsidiaries Consolidated Statements of Comprehensive Income (in millions) Net earnings Other comprehensive ... income $ 9 (7) 2 1,168 $ 18 13 31 365 $ (34) (6) (40) 1,029 $ 2014 1,166 $ 2013 334 $ 2012 1,069 The accompanying notes are an integral part of these consolidated... -

Page 26

Cardinal Health, Inc. ... of long-term obligations and other short-term borrowings Other accrued liabilities Total current...shares, Issued-364 million shares at June 30, 2014 and 2013 Retained earnings Common shares in treasury, at cost: 27 million shares and 25 million shares at June 30, 2014 and 2013... -

Page 27

...June 30, 2012 Net earnings Other comprehensive income, net of tax Employee stock plans activity, including tax impact of $19 million Treasury shares acquired Dividends declared Other Balance at June 30, 2013 Net earnings Other comprehensive income, net of tax Employee stock plans activity, including... -

Page 28

... on sale of investments Impairments and loss on disposal of assets Share-based compensation Provision for deferred income taxes Provision for bad debts Change in fair value of contingent consideration obligation Change in operating assets and liabilities, net of effects from acquisitions: Decrease... -

Page 29

... to Red Oak Sourcing, and minimal funding has been provided to capitalize the entity. Cardinal Health, Inc. is a healthcare services company providing pharmaceutical and medical products and services that help pharmacies, hospitals and other healthcare providers focus on patient care while reducing... -

Page 30

... The customers in the table below are primarily serviced through our Pharmaceutical segment. Percent of Revenue 2014 CVS Walgreen Co. 28% 4% 2013 23% 20% 2012 22% 21% Percent of Gross Trade Receivables at June 30 2014 22% -% 2013 19% 24% Cash Discounts Our pharmaceutical distribution contract with... -

Page 31

... they share similar economic characteristics. Our reporting units are: Pharmaceutical operating segment (excluding our Nuclear Pharmacy Services division and Cardinal Health China - Pharmaceutical division); Nuclear Pharmacy Services division; Cardinal Health China Pharmaceutical division; Medical... -

Page 32

... returns. Vendor Incentives Fees for services and other incentives received from vendors relating to the purchase or distribution of inventory represent product discounts and are recorded as a reduction of cost of products sold in the consolidated statements of earnings upon sale of the related... -

Page 33

... restructuring and employee severance. See Note 16 for additional information regarding share-based compensation. Sales Returns and Allowances Revenue is recorded net of sales returns and allowances. Our customer return policies generally require that the product be physically returned, subject to... -

Page 34

...costs to prepare the product for shipment to the end customer. Shipping and handling costs were $430 million, $419 million and $389 million, for fiscal 2014, 2013 and 2012, respectively. Revenue received for shipping and handling was immaterial for all periods presented. Financial statements of our... -

Page 35

... position or results of operations. In March 2013, the FASB issued amended accounting guidance related to a parent company's accounting for the cumulative translation adjustment upon derecognition of certain subsidiaries or group of assets within a foreign entity or of an Earnings per Common Share... -

Page 36

... and distributor of extravascular closure devices, expands the Medical segment's portfolio of self-manufactured products. AssuraMed On March 18, 2013, we completed the acquisition of AssuraMed, Inc. ("AssuraMed") for $2.07 billion, net of cash acquired, in an all-cash transaction. We funded the... -

Page 37

...-related costs primarily consist of termination benefits provided to employees who have been involuntarily terminated and duplicate payroll costs during transition periods. In connection with our Medical segment restructuring plan discussed in Note 3, the property in Waukegan, Illinois meets... -

Page 38

... related to the P4 Healthcare trade name, an asset within our Pharmaceutical segment. We rebranded P4 Healthcare under the Cardinal Health Specialty Solutions name. improvements to existing technologies. See Note 2 for further discussion of this acquisition. Fiscal 2013 The increase in the Medical... -

Page 39

...: Customer relationships Trademarks, trade names and patents Non-compete agreements Developed technology and other Total definite-life intangibles Total other intangible assets $ 982 209 15 101 1,307 1,318 $ 230 49 10 56 345 345 $ 752 160 5 45 962 973 $ 11 11 $ - - $ 11 11 Gross Intangible... -

Page 40

... issuances of commercial paper as well as other short-term borrowings for general corporate purposes. On November 6, 2012, we renewed our $950 million committed receivables sales facility program through Cardinal Health Funding, LLC ("CHF") until November 6, 2014. On October 15, 2013, we reduced... -

Page 41

... we recorded an out-of-period increase in income tax expense of $14 million (of which generally less than $1 million pertained to each of the first three quarters of fiscal 2013 and each of the quarters in fiscal 2012 through 2008), which related to uncertain tax benefits, and a decrease in retained... -

Page 42

...2013 654 22 97 (30) (93) - 650 $ $ 2012 747 16 68 (3) (172) (2) 654 9. Commitments, Contingent Liabilities and Litigation Commitments The future minimum rental payments for operating leases having initial or remaining non-cancelable lease terms in excess of one year at June 30, 2014 for fiscal 2015... -

Page 43

... discussions regarding the feasibility of a settlement, with the DEA and the DOJ. State of West Virginia vs. Cardinal Health, Inc. In June 2012, the West Virginia Attorney General filed, and in January 2014 amended, complaints against 13 pharmaceutical wholesale distributors, including us, in the... -

Page 44

...in deferred compensation liabilities. These mutual funds primarily invest in the equity securities of companies with large market capitalization and high quality fixed income debt securities. The fair value of these investments is determined using quoted market prices. 12. Financial Instruments We... -

Page 45

Cardinal Health, Inc. and Subsidiaries Notes to Consolidated Financial Statements Accordingly, we enter into derivative contracts to manage the price risk associated with these forecasted purchases. The following table summarizes the fair value of our assets and liabilities related to derivatives ... -

Page 46

Cardinal Health, Inc. and Subsidiaries Notes to Consolidated Financial Statements The following tables summarize the outstanding cash flow hedges at June 30: 2014 (in millions) Forward interest rate swaps Foreign currency contracts Commodity contracts Notional Amount $ 300 182 24 Maturity Date Jun ... -

Page 47

... fiscal 2014, 2013 and 2012 were zero, 9 million and 10 million, respectively. 15. Segment Information Our operations are principally managed on a products and services basis and are comprised of two operating segments, which are the same as our reportable segments: Pharmaceutical and Medical. The... -

Page 48

... segment also operates nuclear pharmacies and cyclotron facilities, provides pharmacy services to hospitals and other healthcare facilities, and provides services to healthcare companies supporting the marketing, distribution and payment for specialty pharmaceutical products. Through our Cardinal... -

Page 49

... benefit related to share-based compensation was $33 million, $32 million and $31 million for fiscal 2014, 2013 and 2012, respectively. Stock Options Employee stock options granted under the Plans generally vest in equal annual installments over three years and are exercisable for periods ranging... -

Page 50

... related to restricted share and restricted share unit activity: (in millions) 2014 2013 2012 Total compensation cost, net of estimated forfeitures, related to nonvested restricted share and share unit awards not yet recognized, pre-tax $ Weighted-average period over which restricted share and share... -

Page 51

... financial data for fiscal 2014 and 2013. The sum of the quarters may not equal year-to-date due to rounding. (in millions, except per First common share amounts) Quarter Fiscal 2014 Revenue Gross margin Distribution, selling, general and administrative expenses Earnings from continuing operations... -

Page 52

... June 30, 2014 and 2013 and the related consolidated statements of earnings, comprehensive income, shareholders' equity and cash flows for each of the three years in the period ended June 30, 2014 of Cardinal Health, Inc. and subsidiaries and our report dated August 13, 2014 expressed an unqualified... -

Page 53

Cardinal Health, Inc. and Subsidiaries Shareholder and Company Information and Performance Graph Shareholder and Company Information Our common shares are listed on the New York Stock Exchange under the symbol "CAH." The following table reflects the range of the reported high and low closing prices... -

Page 54

This page intentionally left blank. -

Page 55

This page intentionally left blank. -

Page 56

This page intentionally left blank. -

Page 57

... receive email alerts when the company posts news releases, SEC filings and certain other information on its website. For non-investor related inquiries, please call the company's main telephone number at 614.757.5000. Transfer agent and registrar Shareholders with inquiries regarding address... -

Page 58

2014 Annual Report © 2014 Cardinal Health. All rights reserved. CARDINAL HEALTH, the Cardinal Health LOGO and Essential to care are trademarks or registered trademarks of Cardinal Health. All other marks are the property of their respective owners. Lit. No. 5DIG14-17408 (09/2014)