Canon 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 Canon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CANON ANNUAL REPORT 2015 11

STRATEGY BUSINESS SEGMENT CORPORATE STRUCTURE FINANCIAL SECTION CORPORATE DATA

A high-speed continuous feed printer at Océ Customer Experience

Center. (Poing, Germany)

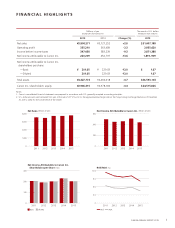

World Market for Video Surveillance (Millions of U.S. dollars)

20,000

15,000

10,000

5,000

0

2014 2015 2016 2017

Network Video Surveillance Analog Video Surveillance

Source: IHS Technology

2018

Commercial Printing Business

In offi ce equipment, Canon aims for stable growth in the

medium term, having identifi ed a shift to color models as a

growth driver. Yet we also recognize a risk of market shrink-

age in the long term, and so we have worked to cultivate

new businesses where Canon’s technologies can be used to

full advantage.

Offset printing has traditionally dominated the commer-

cial printing market for publications such as books, newspa-

pers, catalogues, and posters. However, digital printing, with

its advantages in terms of lead time and cost, is growing year

by year amid an increasing trend toward fl exible, low-vol-

ume printing on varied materials. In addition, we can expect

demand for consumables to be generated by the enormous

volume of printing. Canon therefore added Océ to the Group

in 2010, an acquisition that brought with it Océ’s more than

130 years of history as well as industry-leading technologies

including ultra-fast printing technology and software to keep

productivity high. Integration of Océ has enabled Canon to

prepare a lineup ranging from copying machines, laser printers,

and inkjet printers to commercial printing equipment.

Amid accelerating growth in digital commercial printing,

Canon will take aggressive action in growth fi elds through mea-

sures such as enhancing its lineup of printers capable of han-

dling a wide range of materials including plastic and metal.

Network Camera Business

Amid growing needs for security and safety globally, the net-

work camera market is undergoing a rapid shift from analog

to digital in concert with advancement in digital technology

and the network environment. The market including solu-

tion is projected to grow at a rate of nearly 20% per year and

reach ¥3 trillion by 2018, propelled by the spread of cloud ser-

vices and advances in big data processing, along with expected

expansion in software and solutions. Canon, with its strengths

in optical, sensor, and image-processing technologies, has

set its sights on the network camera market, welcoming two

top fi rms in this space to the Group through M&A activities.

Milestone, the world’s foremost provider of video management

software, was the fi rst, joining the Group in 2014. It was

followed in 2015 by Axis, the market leader in network

camera with outstanding communication technologies and

more than 80,000 business partners worldwide. Canon, Axis,

and Milestone will work together to generate synergies and

forge the market’s strongest lineup while working to create

products in new business segments. In addition, we will fully

harness the management resources of all three companies to

accelerate business growth.