Callaway 1997 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1997 Callaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

R

ESULTSOF

O

PERATIONS

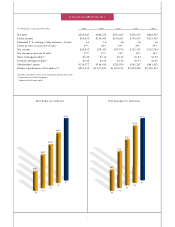

Years Ended December 31, 1997 and 1996

For the year ended December 31, 1997, net sales increased

24% to $842.9 million compared to $678.5 million for

the prior year.The growth in sales included increases in the

sales of metal woods, irons, and putters. Metal wood sales

increased $65.1 million primarily due to sales of Biggest

Big Be rt h a

T M

Titanium Dr i vers. Iron sales increased

$65.4 million primarily due to sales of Great Big Bertha

®

Tungsten•Titanium

TM

Irons, which generated revenues of

$59.3 million for the year ended December 31, 1997. Also

contributing to the increase in net sales was the acquisition of

certain assets and liabilities of Odyssey Sports, Inc. by the

Company’s wholly-owned subsidiary, Odyssey Golf, Inc.

(“Odyssey”), which contributed $20.5 million in net sales.

For the year ended December 31, 1997, gross profit

increased to $442.8 million from $361.2 million in 1996

and cost of goods sold was re l a t i vely unchanged as a perc e n t-

age of sales from the prior year.

The Company accrues a provision for warranty expense

at the time of sale of its products. Based on the Company’s

warranty policies and historical rates of product returns, the

Company believes its accrual for warranty expense to be

adequate.

Selling expenses increased to $120.6 million in 1997

f rom $80.7 million in 1996. As a percentage of net sales, s e l l-

ing expenses increased to 14% from 12%. The $39.9 million

i n c rease was primarily due to increased promotional and tour

expenses, higher costs related to the Company’s performance

centers and additional selling expenses associated with the

addition of Odyssey.

General and administrative expenses decreased to

$70.7 million in 1997 from $74.5 million in 1996. The

$3.8 million decrease was primarily due to reduced employe e

bonus and profit sharing expenses, partially offset by incre a s e d

start-up costs associated with the Company’s golf ball opera-

tions and the addition of Odyssey.

Re s e a rch and development expenses increased to

$30.3 million in 1997 as compared to $16.2 million in 19 9 6 .

This $14.1 million increase resulted from increased expendi-

tures related to casting technologies, golf ball development

and product engineering efforts.

Litigation settlement expense of $12.0 million re p re s e n t s

the Company’s third quarter settlement of certain

litigation brought against it and certain officers of the

Company by a former officer of the Company.

M

A N AG E M E N T

’

S

D

I S C U S S I O NA N D

A

N A L Y S I SO F

F

I N A N C I A L

C

O N D I T I O NA N D

R

E S U LTSO F

O

PE R AT I O N S

During the fourth quarter of 19 97, the Company

re ve rsed an accrual for bonus compensation of approx i m a t e l y

$8.0 million due to the fact that certain operating targets

were not met.

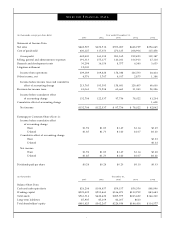

Years Ended December 31, 1996 and 1995

For the year ended December 31, 1996, net sales increased

23% to $678.5 million compared to $553.3 million for

the prior year.This increase was attributable primarily to

increased sales of Great Big Bertha

®

Titanium Drivers, and

Great Big Bertha

®

Fairway Woods which were introduced in

January1996, combined with increased sales of Big Bertha

®

Irons. These sales increases were offset by a decrease in net

sales of Big Bertha

®

War Bird

®

Metal Woods.

For the year ended December 31, 1996, gross profit

i n c reased to $361.2 million from $283.2 million for the prior

year and gross margin increased to 53% from 51%. The

increase in gross margin was primarily the result of decreases

in component costs and manufacturing labor and overhead

costs associated with increased production volume and

improved labor efficiencies.

The Company accrues a provision for warranty expense

at the time of sale of its products. Based on the Company’s

warranty policies and historical rates of product returns,

the Company believes its accrual for warranty expense to be

adequate.

Selling expenses increased to $80.7 million in 1996 fro m

$64.3 million in 1995. The $16.4 million increase was pri-

marily due to increased tour endorsement, TV adve rtising and

e m p l oyee compensation expenses. As a percentage of net sales,

selling expenses remained constant at 12%.

General and administrative expenses increased to

$74.5 million in 1996 from $55.9 million in 1995. The

$18.6 million increase was related primarily to incre a s e d

e m p l oyee compensation and benefits, consulting costs associ-

ated with the Company’s business development initiatives and

i n c reases in computer support, legal and other general and

a d m i n i s t r a t i ve expenses. As a percentage of net sales, general and

a d m i n i s t r a t i ve expenses increased to 11% from 10 % .

Re s e a rch and development expenses increased to

$16.2 million in 1996 as compared to $8.6 million in 1995.

This increase resulted from increased staffing and operat i o n a l

expenses consistent with the Company’s efforts to pursue

potential new business opportunities and the continued focus

on existing core products.

Net interest income increased to $5.0 million in 1996

compared to $3.5 million in 1995. The increase in interest

income was due to the investment of higher average cash

balances.