Callaway 1997 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1997 Callaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

Under the Promotion Plan, 774,000 shares we re available for

grant at December 31, 1997.The Non-Employee Directors

Stock Option Plan permits the granting of options to acquire

up to 840,000 shares of Common Stock, of which 204,000

we re available for grant at December 31, 19 97, to Di rectors o f

the Company who are not employees, at prices based on a

n o n - d i s c re t i o n a ry formula, which may be less than the mark e t

value of the stock at the date of grant. During 1996 and 19 9 5 ,

the Company granted options to purchase 600,000and

500,000 shares, respectively, to two key officers, under sepa-

rate plans, in conjunction with terms of their initial employ-

ment. AtDecember 31, 1997, no shares we re available for

grant underthese plans. Ad d i t i o n a l l y, under the 19 9 0

Amended and Restated Stock Option Plan (“1990 Pl a n” ) ,

4,920,000 share swe re authorized for issuance at December 31,

1997, while noshares were available for future grant at

December 31, 1997.

Under the Company’s stock option plans, outstanding

options vest over periods ranging from ze ro to five years fro m

the grant date and expire up to ten years after the grant date.

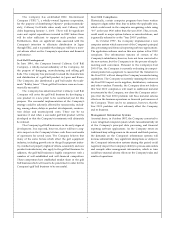

The following summarizes stock option transactions for the years ended December 31, 1997, 1996, and 1995:

(in thousands, except per share data) Year ended December 31,

1 9 9 7 1 9 9 6 1 9 9 5

We i g h t e d - We i g h t e d - We i g h t e d -

Ave r a g e Average Ave r a g e

Exe rc i s e Exe rc i s e Exe rc i s e

Sh a re s Pr i c e Sh a re s Pr i c e Sh a re s Pr i c e

Outstanding at beginning of ye a r 1 0 , 8 0 0 $ 1 5 . 0 3 9 , 8 4 2 $9 . 8 7 1 0 , 6 5 2 $6 . 5 9

Gr a n t e d 3 , 4 0 6 3 3 . 7 9 2 , 7 6 0 2 8 . 4 7 3 , 1 4 5 1 6 . 5 4

Exe rc i s e d ( 2 , 8 7 7 ) 7 . 8 1 ( 1 , 7 7 5 ) 7 . 0 7 ( 2 , 3 2 9 ) 3 . 5 7

C a n c e l e d ( 7 2 ) 2 8 . 8 1 ( 2 7 ) 1 6 . 9 8 ( 1 , 6 2 6 ) 9 . 9 8

Outstanding at end of ye a r 1 1 , 2 5 7 $ 2 2 . 4 1 1 0 , 8 0 0 $ 1 5 . 0 3 9 , 8 4 2 $9 . 8 7

Options exe rcisable at end of ye a r 3 , 4 5 3 $ 1 2 . 1 7 3 , 9 3 9 $8 . 8 3 3 , 3 5 4 $6 . 0 5

Price range of outstanding options $0.44 – $40.00 $0.44 – $34.38 $.019 – $18.06

The following table summarizes additional information about outstanding stock options at December 31, 1997:

We i g h t e d -

Ave r a g e

Nu m b e r Re m a i n i n g We i g h t e d - Nu m b e r We i g h t e d -

Range of Ou t s t a n d i n g C o n t r a c t u a l Ave r a g e Exe rc i s a b l e Ave r a g e

Exe rcise Pr i c e s (in thousands) L i f e - Y e a r s Exe rcise Pr i c e (in thousands) Exe rcise Pr i c e

$0 – $15 3 , 7 3 4 3 . 7 $9 . 6 9 2 , 5 9 4 $8 . 2 0

$15 – $30 3 , 9 9 4 5 . 9 $ 2 3 . 6 3 6 9 3 $ 2 3 . 5 8

$30 – $40 3 , 5 2 9 7 . 3 $ 3 4 . 9 8 1 6 6 $ 3 2 . 3 7

$0 – $40 1 1 , 2 5 7 5 . 6 $ 2 2 . 4 1 3 , 4 5 3 $ 1 2 . 1 7