Callaway 1997 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1997 Callaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Di versification of Credit Risk

The Company’s financial instruments that are subject to

concentrations of credit risk consist primarily of cash

equivalents and trade receivables.

The Company invests its excess cash in money market

accounts and U.S. Government securities and has established

guidelines relative to diversification and maturities in an

effort to maintain safety and liquidity.These guidelines are

periodically reviewed and modified to take advantage of

trends in yields and interest rates.

The Company operates in the golf equipment industry

and primarily sells its products to golf equipment retailers.

The Company performs ongoing credit evaluations of its cus-

t o m e r s’ financial condition and generally re q u i res no collateral

from its customers. The Company maintains reserves for

potential credit losses.

Re c l a s s i f i c a t i o n s

Certain prior period amounts have been reclassified to

conform with the current period presentation.

N

OTE

2

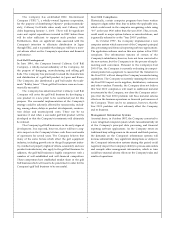

SELECTEDFINANCIALSTATEMENTINFORMATION

(in thousands) December 31,

1 9 9 7 1 9 9 6

Cash and cash equiva l e n t s :

U.S. Tre a s u ry bills $9 6 , 4 0 7

Cash, interest bearing $2 4 , 4 3 8 1 1 , 4 1 5

Cash, non-interest bearing 1 , 7 6 6 6 3 5

$2 6 , 2 0 4 $ 1 0 8 , 4 5 7

Accounts re c e i vable, net:

Trade accounts re c e i va b l e $ 1 3 1 , 5 1 6 $8 0 , 8 1 4

A l l owance for doubtful accounts ( 7 , 0 4 6 ) ( 6 , 3 3 7 )

$ 1 2 4 , 4 7 0 $7 4 , 4 7 7

In ventories, net:

Raw materials $4 7 , 7 8 0 $5 0 , 0 1 2

Wo rk - i n - p ro c e s s 3 , 0 8 3 1 , 6 5 1

Finished goods 5 1 , 9 0 5 5 1 , 9 5 4

1 0 2 , 7 6 8 1 0 3 , 6 1 7

Re s e rve for obsolescence ( 5 , 6 7 4 ) ( 5 , 2 8 4 )

$9 7 , 0 9 4 $9 8 , 3 3 3

(in thousands) December 31,

1 9 9 7 1 9 9 6

Pro p e rt y, plant and equipment, net:

L a n d $1 6 , 3 9 8 $ 9 , 5 8 9

Buildings and improve m e n t s 5 1 , 7 9 7 3 5 , 0 7 6

Ma c h i n e ry and equipment 4 5 , 3 3 2 2 9 , 7 7 8

Fu r n i t u re, computers

and equipment 4 8 , 0 7 1 2 0 , 3 2 9

Production molds 1 3 , 6 9 0 9 , 3 9 9

C o n s t ru c t i o n - i n - p ro c e s s 1 9 , 3 6 1 2 1 , 0 0 3

1 9 4 , 6 4 9 1 2 5 , 1 7 4

Accumulated depre c i a t i o n ( 5 2 , 1 4 6 ) ( 3 3 , 8 2 8 )

$ 1 4 2 , 5 0 3 $9 1 , 3 4 6

Intangible assets:

Trade name $6 9 , 6 2 9

Tr a d e m a rk and trade dre s s 2 9 , 8 4 1

Patents, goodwill and other 1 4 , 6 4 1 $ 4 , 5 0 2

1 1 4 , 1 1 1 4 , 5 0 2

Accumulated amort i z a t i o n ( 1 , 9 7 0 ) ( 2 2 5 )

$ 1 1 2 , 1 4 1 $ 4 , 2 7 7

Accounts payable and

a c c rued expenses:

Accounts payable $1 8 , 3 7 9 $ 2 , 4 4 2

Ac c rued expenses 1 1 , 6 8 4 1 2 , 5 5 4

$3 0 , 0 6 3 $1 4 , 9 9 6

Ac c rued employee compensation

and benefits:

Ac c rued payroll and taxe s $ 9 , 7 2 9 $1 2 , 9 1 4

Ac c rued vacation and sick pay 4 , 0 9 2 3 , 0 1 7

Ac c rued commissions 4 4 1 2 6 4

$1 4 , 2 6 2 $1 6 , 1 9 5

Total rent expense was $1,760,000, $1,363,000, and

$1,181,000 in 1997,1996 and 1995, respectively.

N

OTE

3

BANKLINEOFCREDIT

The Company had a $50,000,000 unsecured line of credit

with an interest rate equal to the bank’s prime rate (8.5%

at December 31, 1997). The line of credit was renewed in

February1998 (Note 14). The line of credit has been pri-

marily utilized to support the issuance of letters of credit, of

which there were $4,046,000 outstanding at December 31,

1997, reducing the amount available under the Company’s

line of credit to $45,954,000.

The line requires the Company to maintain certain

financial ratios, including current and debt-to-equity ratios.

The Company is also subject to other restrictive covenants

under the terms of the credit agreement.