Cabela's 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 Cabela's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

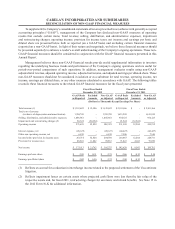

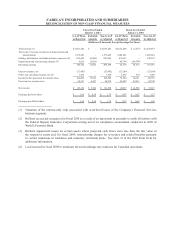

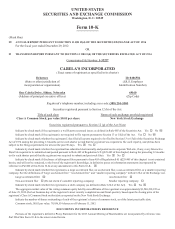

CABELA’S INCORPORATED AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Fiscal Year Ended

January 1, 2011

Fiscal Year Ended

January 2, 2010

GAAP Basis

as Reported

Excluded

Amounts

Non-GAAP

as Adjusted

GAAP Basis

as Reported

Excluded

Amounts

Non-GAAP

as Adjusted

(Dollars in Thousands Except Earnings Per Share)

Total revenue (1) $2,663,242 $ - $2,663,242 $2,632,240 $ (2,557) $ 2,629,683

Total cost of revenue (exclusive of depreciation and

amortization) 1,575,449 - 1,575,449 1,602,621 - 1,602,621

Selling, distribution, and administrative expenses (2) 895,405 (8,000) 887,405 870,147 - 870,147

Impairment and restructuring charges (3) 5,626 (5,626) - 66,794 (66,794) -

Operating income 186,762 13,626 200,388 92,678 64,237 156,915

Interest expense, net (27,442) - (27,442) (23,109) - (23,109)

Other non-operating income, net (4) 7,360 - 7,360 6,955 574 7,529

Income before provision for income taxes 166,680 13,626 180,306 76,524 64,811 141,335

Provision for income taxes 54,521 4,457 58,978 26,907 22,813 49,720

Net income $ 112,159 $ 9,169 $ 121,328 $ 49,617 $ 41,998 $ 91,615

Earnings per basic share $ 1.65 $ 0.14 $ 1.79 $ 0.74 $ 0.63 $ 1.37

Earnings per diluted share $ 1.62 $ 0.14 $ 1.76 $ 0.74 $ 0.62 $ 1.36

(1) Valuation of the interest-only strip associated with securitized loans of the Company’s Financial Services

business segment.

(2) Reflects an accrual recognized in fiscal 2010 as a result of an agreement in principle to settle all matters with

the Federal Deposit Insurance Corporation arising out of its compliance examination conducted in 2009 of

World’s Foremost Bank.

(3) Reflects impairment losses on certain assets where projected cash flows were less than the fair value of

the respective assets and, for fiscal 2009, restructuring charges for severance and related benefits pursuant

to certain reductions in workforce and voluntary retirement plans. See Note 15 in the 2010 Form 10-K for

additional information.

(4) Loss incurred in fiscal 2009 to terminate forward exchange rate contracts for Canadian operations.