Cabela's 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Cabela's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABOUT US

Cabela’s® is a leading specialty

retailer, and the world’s

largest direct marketer, of

hunting, fi shing, camping and

related outdoor merchandise.

Since our founding in 1961,

Cabela’s has grown to become

one of the most well-known

outdoor recreation brands in

the world, and has long been

recognized as the World’s

Foremost Outfi tter.

® Through

our growing number of retail

stores and our

well-established direct

business, we offer a wide

and distinctive selection of

high-quality outdoor products

at competitive prices while

providing superior customer

service. We also issue the

Cabela’s CLUB® Visa credit

card, which serves as our

primary customer loyalty

rewards program.

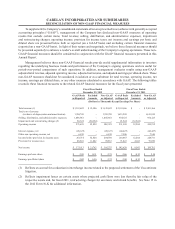

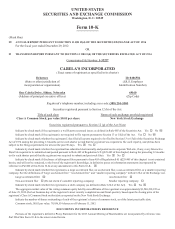

Fiscal Year

(Dollars in thousands, except per share data) 2010(1) 2011(1) 2012

(1)

Total Revenue $2,663,242 $2,811,166 $3,125,182

Gross Profi t $1,087,793 $1,197,917 $1,355,384

Gross Profi t Margin 40.8% 42.6% 43.4%

Operating Income $200,388 $243,792 $308,523

Operating Income Margin 7.5% 8.7% 9.9%

Net Income $121,328 $150,762 $195,275

Earnings Per Diluted Share $1.76 $2.12 $2.72

Diluted Weighted Average Shares Outstanding 69,086,533 71,274,242 71,709,873

Total Cash and Cash Equivalents $136,419 $304,679 $288,750

Inventories $509,097 $494,828 $552,575

Total Debt

(2) $345,152 $344,922 $336,535

Total Stockholders’ Equity $1,024,548 $1,181,316 $1,375,979

Lease Adjusted Debt-To-Capitalization Ratio(2)(3) 28.1% 26.7% 23.9%

Return on Invested Capital(4) 13.1% 14.3% 15.9%

FINANCIAL HIGHLIGHTS

(1) Fiscal year 2009, 2010, 2011 and 2012 results exclude the impact of impairment and restructuring charges, other special charges,

and valuations of interest-only strips associated with securitized loans. Fiscal year 2012 results also exclude the reduction in revenue

related to the proposed settlement of the Visa antitrust litigation. A reconciliation to GAAP is provided after the Letter to

(2) Excludes all borrowings of fi nancial services subsidiary.

(3) Both the numerator and the denominator are adjusted to include operating lease obligations capitalized at eight times next year’s

annual minimum lease payments and deferred compensation.

(4) A calculation of ROIC is provided after the Letter to Shareholders.

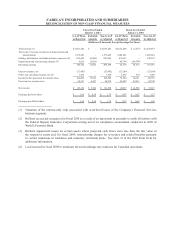

Operating Income(1)

Total Revenue(1)

($ millions)

($ millions)

2009

2009

$157

$2,630

$200

$2,663

$244

$2,811

$309

$3,125

2010

2010

2011

2011

2012

2012

($ millions)

Net Income(1)

2009

$92 $121

$151

$195

2010 2011 2012

ROIC(4)

2009

11.0%

13.1%

14.3% 15.9%

2010 2011 2012

Shareholders.