Cabela's 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Cabela's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

Cabela’s CLUB Marketing. We have a low cost, efficient, and tailored credit card marketing program that

leverages the Cabela’s brand name. We market the Cabela’s CLUB Visa credit card through a number of channels,

including retail stores, inbound telemarketing, catalogs, and the Internet. Our customers can apply for the Cabela’s

CLUB Visa credit card at our retail stores and website through our instant credit process and, if approved, receive

reward points available for use on merchandise purchases the same day. When a customer’s application is approved

through the retail store instant credit process, the customer’s new credit card is produced and given to the customer

immediately thereafter. Maintaining the growth of our credit card program, while continuing to underwrite

high-quality customers, actively manage our credit card delinquencies and charge-offs, and provide exclusive

experiences is key to the successful performance of our Financial Services segment. The growth of Cabela’s CLUB

program is dependent, in part, on the success of our Retail and Direct businesses to generate additional sales and to

attract additional Financial Services customers.

Underwriting and Credit Criteria. We underwrite high-quality credit customers and have historically

maintained attractive credit statistics compared to industry averages. The scores of Fair Isaac Corporation

(“FICO”) are a widely-used tool for assessing a person’s credit rating. During the second quarter of 2012, the

Financial Services segment incorporated a newer version of FICO that utilizes the same factors as the previous

scoring model, but is more sensitive to utilization of available credit, delinquencies considered serious and

frequent, and maintenance of various types of credit. Management of the Financial Services segment believes the

newer version will enable us to improve our risk management decisions. The newer version FICO score resulted

in a slightly higher median score of our credit cardholders, which was 793 at the end of 2012 compared to 788 at

the end of 2011. We believe the median FICO scores of our cardholders are well above the industry average. Our

charge-offs as a percentage of total outstanding balances were 1.87% in 2012, which we believe is well below the

2012 industry average.

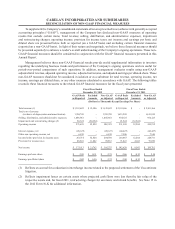

The table below presents data on the performance of our credit card portfolio comparing the last three

years and illustrates the high credit quality of our credit card portfolio. The following table shows delinquencies,

including any delinquent non-accrual and restructured credit card loans, and charge-offs, including any accrued

interest and fees, as a percentage of our average credit card loans:

2012 2011 2010

Delinquencies greater than 30 days 0.72% 0.87% 1.13%

Gross charge-offs 2.46 3.03 4.88

Charge-offs, net of recoveries 1.87 2.35 4.23

Products and Merchandising

We offer our customers a comprehensive selection of high-quality, competitively priced, national and regional

brand products, including our own Cabela’s brand. Our product assortment includes merchandise and equipment

for hunting, fishing, marine use, and camping, along with casual and outdoor apparel and footwear, optics, vehicle

accessories, and gifts and home furnishings with an outdoor theme.

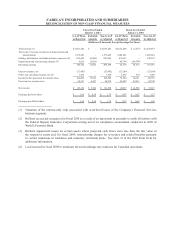

The following table sets forth the percentage of our merchandise revenue contributed by major product

categories for our Retail and Direct segments and in total for the last three years.

Retail Direct Total

Product Category: 2012 2011 2010 2012 2011 2010 2012 2011 2010

Hunting Equipment 49.5% 45.7% 44.5% 37.1% 33.4% 33.7% 45.3% 41.1% 40.2%

General Outdoors 28.7 30.7 31.5 32.0 32.7 32.9 29.8 31.5 32.1

Clothing and Footwear 21.8 23.6 24.0 30.9 33.9 33.4 24.9 27.4 27.7

Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%