Buffalo Wild Wings 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Buffalo Wild Wings annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 29, 2013

or

Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to .

Commission File Number: 000-24743

BUFFALO WILD WINGS, INC.

(Exact name of registrant as specified in its charter)

Minnesota No. 31-1455915

(State or Other Jurisdiction of

Incorporation or Organization) (IRS Employer

Identification No.)

5500 Wayzata Boulevard, Suite 1600, Minneapolis, MN 55416

(Address of Principal Executive Offices)

Registrant’s telephone number (952) 593-9943

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, no par value Nasdaq Global Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. YES NO

Indicate by a checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during

the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and

will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a

smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in

Rule 12b-2 of the Exchange Act.

Large Accelerated Filer Accelerated Filer Non-Accelerated Filer Smaller Reporting Company

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange

Act). YES NO

The aggregate market value of the voting stock held by non-affiliates was $1.8 billion based on the closing sale price of the

Company’s Common Stock as reported on the NASDAQ Stock Market on June 28, 2013.

The number of shares outstanding of the registrant’s common stock as of February 10, 2014: 18,808,822 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2014 Annual Meeting of Shareholders are incorporated by reference into Part III of this

report.

Table of contents

-

Page 1

... sale price of the Company's Common Stock as reported on the NASDAQ Stock Market on June 28, 2013. The number of shares outstanding of the registrant's common stock as of February 10, 2014: 18,808,822 shares. DOCUMENTS INCORPORATED BY REFERENCE Portions of the Proxy Statement for the 2014 Annual... -

Page 2

... chain. To do so, we plan to execute the following strategies Continue to strengthen the Buffalo Wild Wings® brand; Deliver a unique guest experience; Offer boldly-flavored menu items with broad appeal; Create an inviting, neighborhood atmosphere; Focus on operational excellence; Open restaurants... -

Page 3

...®, Caribbean Jerk, Thai Curry™, Hot BBQ, Hot, Mango Habanero™, Wild® and Blazin'® ; or signature seasonings: Buffalo, Desert Heat®, Chipotle BBQ, Lemon Pepper and Salt & Vinegar. Our chicken wings can be ordered by the portion, ranging from Snack-sized to Large, with larger orders available... -

Page 4

...casual dining quality food with minimal wait times. Training. We provide thorough training for our management and hourly Team Members to prepare them for their role in delivering a positive and engaging Buffalo Wild Wings experience for each and every guest. Our managers are trained using a hands-on... -

Page 5

...greater financial and marketing resources than we do. We also compete with other restaurant and retail establishments for site locations and restaurant Team Members. Proprietary Rights We own the rights to the "Buffalo Wild Wings®" service mark and to certain other service marks and trademarks used... -

Page 6

... information related to chicken wing prices is included in Item 7 under "Results of Operations." If we are unable to successfully open new restaurants, our revenue growth rate and profits may be reduced. To successfully expand our business, we must open new Buffalo Wild Wings® restaurants on... -

Page 7

... Our inability to effectively manage supply chain risk could increase our costs and limit the availability of products critical to our restaurant operations. We may experience higher-than-anticipated costs associated with the opening of new restaurants or with the closing, relocating, and remodeling... -

Page 8

... to operate and manage our business. Our success and the success of our individual restaurants and business depends on our ability to attract, motivate, develop and retain a sufficient number of qualified key executives and restaurant employees, including restaurant managers, and hourly Team Members... -

Page 9

...rates, citizenship requirements, union membership, and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees... -

Page 10

... site in the event of default under the lease or franchise agreement. The following table sets forth the states and provinces in which Buffalo Wild Wings restaurants are located and the number of restaurants in each state or province as of December 29, 2013: Number of Restaurants Open Company... -

Page 11

...of our business, including claims arising from personal injuries, contract claims, franchise-related claims, dram shop claims, employment-related claims and claims from guests or employees alleging injury, illness or other food quality, health or operational concerns. To date, none of these types of... -

Page 12

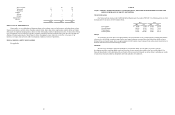

... with the Consolidated Financial Statements and related notes thereto set forth in Item 8 of this Form 10-K. Fiscal Years Ended (1) Dec. 29, 2013 Dec. 30, 2012 Dec. 25, 2011 Dec. 26, 2010 Dec. 27, 2009 COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* Among Buffalo Wild Wings, Inc., the NASDAQ... -

Page 13

...commentary on company-owned and franchised restaurant units, restaurant sales, same-store sales, and average weekly sales volumes. Management believes such sales information is an important measure of our performance, and is useful in assessing consumer acceptance of the Buffalo Wild Wings® concept... -

Page 14

... of restaurant sales. Fiscal Years Ended Dec. 29, 2013 Dec. 30, 2012 Dec. 25, 2011 Revenue: Restaurant sales Franchise royalties and fees Total revenue Costs and expenses: Restaurant operating costs: Cost of sales Labor Operating Occupancy Depreciation and amortization General and administrative... -

Page 15

...compensation, our general and administrative expenses decreased to 7.3% of total revenue in 2012 from 7.8% in 2011. 29 The annual average prices paid per pound for chicken wings for company-owned restaurants are as follows: Fiscal Years Ended Dec. 29, 2013 Dec. 30, 2012 Dec. 25, 2011 Average price... -

Page 16

... our corporate offices. Lease terms are generally 10 to 15 years with renewal options and generally require us to pay a proportionate share of real estate taxes, insurance, common area maintenance and other operating costs. Some restaurant leases provide for contingent rental payments based on sales... -

Page 17

... same-store sales, changes in commodity prices, the timing and number of new restaurant openings and related preopening expenses, asset impairment charges, store closing charges, general economic conditions, stock-based compensation, and seasonal fluctuations. As a result, our results of operations... -

Page 18

... do not create a market risk. The primary food product used by company-owned and franchised restaurants is chicken wings. We work to counteract the effect of the volatility of chicken wing prices, which can significantly change our cost of sales and cash flow, with the introduction of new menu items... -

Page 19

... three-year period ended December 29, 2013, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Buffalo Wild Wings, Inc.'s internal control over financial reporting... -

Page 20

... Fiscal years ended December 29, 2013, December 30, 2012, and December 25, 2011 (Dollar amounts in thousands) Accumulated Other Comprehensive (Loss) Income Common Stock Shares Amount Revenue: Restaurant sales Franchise royalties and fees Total revenue Costs and expenses: Restaurant operating costs... -

Page 21

... for the initial and continuing franchise fees received, we give franchisees the right to use the name Buffalo Wild Wings. We operate as a single segment for reporting purposes. At December 29, 2013, December 30, 2012, and December 25, 2011, we operated 434, 381, and 319 company-owned restaurants... -

Page 22

...that purchase requirements do not create a market risk. The primary food product used by company-owned and franchised restaurants is chicken wings. Current month chicken wing prices are determined based on the average of the previous month's spot rates. For fiscal 2013, 2012, and 2011, chicken wings... -

Page 23

... $530, respectively. The related total tax benefit recognized in 2012 was $2,670. Total stock-based compensation expense recognized in the consolidated statement of earnings for fiscal year 2011 was $11,383 before income taxes and consisted of restricted stock units, stock options, and ESPP expense... -

Page 24

..., 2012 December 25, 2011 The following table summarizes the financial instruments measured at fair value in our consolidated balance sheet as of December 30, 2012: Level 1 Level 2 Level 3 Total Expected dividend yield Expected stock price volatility Risk-free interest rate Expected life of options... -

Page 25

...rents based upon sales levels. Rent expense, excluding our proportionate share of real estate taxes and building operating expenses, was as follows: Fiscal Years Ended December 29, 2013 December 30, 2012 December 25, 2011 Minimum rents Percentage rents Total Equipment and auto leases $ $ $ 53,651... -

Page 26

... taxes (benefits) at the statutory rate of 35% to the actual provision for income taxes: Fiscal Years Ended December 29, 2013 December 30, 2012 December 25, 2011 Expected federal income tax expense State income tax expense, net of federal effect General business credits Other, net Total income tax... -

Page 27

...income taxes, based on our closing stock price of $146.08 as of the last business day of the year ended December 29, 2013, which would have been received by the optionees had all options been exercised on that date. As of December 29, 2013, total unrecognized stock-based compensation expense related... -

Page 28

... us during fiscal 2013, 2012, and 2011, respectively. Under our Management Deferred Compensation Plan, our executive officers and certain other individuals are entitled to receive an amount equal to a percentage of their base salary ranging from 5.0% to 12.5% which is credited on a monthly basis to... -

Page 29

... 18 Buffalo Wild Wings franchised restaurants through three acquisitions. The total purchase price in 2013 and 2012 was $4,297 and $43,580, respectively, and was paid in cash and was funded by cash from operations and the sale of marketable securities. The acquisitions were accounted for as business... -

Page 30

...2012, and the related consolidated statements of earnings, comprehensive income, stockholders' equity, and cash flows for each of the fiscal years in the three-year period ended December 29, 2013, and our report dated February 26, 2014 expressed an unqualified opinion on those consolidated financial... -

Page 31

... Public Accounting Firm dated February 26, 2014 Consolidated Balance Sheets as of December 29, 2013 and December 30, 2012 Consolidated Statements of Earnings for the Fiscal Years Ended December 29, 2013, December 30, 2012, and December 25, 2011 Consolidated Statements of Comprehensive Income... -

Page 32

... duly authorized. Date: February 26, 2014 BUFFALO WILD WINGS, INC. By /s/ SALLY J. SMITH For the Fiscal Year Ended: December 29, 2013 Exhibit Number BUFFALO WILD WINGS, INC. EXHIBIT INDEX TO FORM 10-K Commission File No. 000-24743 Description Sally J. Smith Chief Executive Officer and President... -

Page 33

... Restricted Stock Unit Award under the 2012 Equity Incentive Plan (Officer Level) (1) Form of Notice of Incentive Stock Option Award under the 2012 Equity Incentive Plan (1) Employment Agreement dated May 11, 2012 with Lee R. Patterson (1) Employment Agreement dated May 11, 2012 with Andrew D. Block... -

Page 34

(This page has been left blank intentionally.) -

Page 35