Best Buy 2000 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2000 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

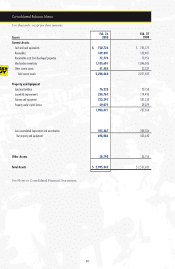

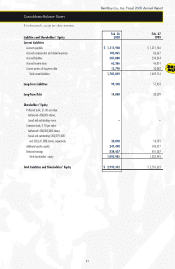

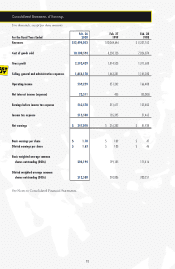

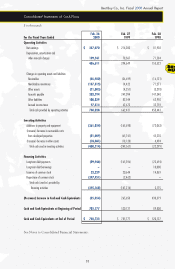

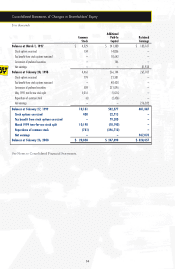

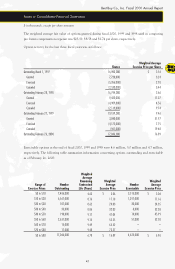

$ in thousands, except per share amounts

1. Summary of Significant Accounting Policies

Description of Business

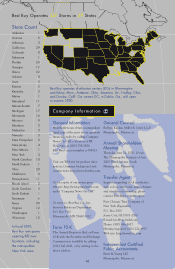

The Company currently operates in a single business segment, selling personal computers and other home

office products, consumer electronics, entertainment software, major appliances and related accessories

principally through its retail stores. Accordingly, additional disclosures under Statement of Financial

Accounting Standards (SFAS) No. 131, Disclosures about Segments of an Enterprise and Related Information,

are not required.

Basis of Presentation

The consolidated financial statements include the accounts of Best Buy Co., Inc. and its subsidiaries.

Significant intercompany accounts and transactions have been eliminated.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with generally accepted accounting principles

requires management to make estimates and assumptions that affect the reported amounts in the

consolidated balance sheets and statements of earnings, as well as the disclosure of contingent

liabilities. Actual results could differ from these estimates and assumptions.

Fiscal Year

The Company’s fiscal year ends on the Saturday nearest the end of February.

Cash and Cash Equivalents

The Company considers short-term investments with a maturity of three months or less when purchased

to be cash equivalents. Cash equivalents are carried at cost, which approximates market value.

Recoverable Costs From Developed Properties

The costs of acquisition and development of properties which the Company intends to sell and lease back

or recover from landlords within one year are included in current assets.

Merchandise Inventories

Merchandise inventories are recorded at the lower of average cost or market.

Property and Equipment

Property and equipment are recorded at cost. Depreciation is computed on the straight-line method over

the estimated useful lives of the assets or, in the case of leasehold improvements, over the shorter of the

estimated useful lives or lease terms. The Company evaluates potential losses on impairment of long-lived

assets used in operations on a location-by-location basis when indicators of impairment are present. A loss

is recorded when an asset’s carrying value exceeds the estimated undiscounted cash flows from the asset.

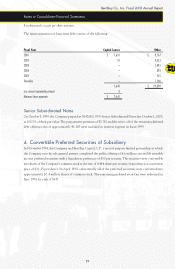

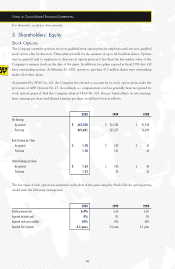

Notes to Consolidated Financial Statements