Berkshire Hathaway 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (Continued)

Manufacturing, Service and Retailing (Continued)

McLane Company (Continued)

Revenues in 2014 increased $710 million (1.5%) compared to 2013, primarily due to revenue increases in the foodservice

unit (7%) and beverage unit (11%). Pre-tax earnings in 2014 declined $51 million (10.5%) from 2013. Earnings in 2013

included a pre-tax gain of $24 million from the sale of a logistics business. Before the impact of this gain, earnings decreased

6% compared to 2013. The decline reflected slightly higher earnings from the grocery unit and beverage unit, which were more

than offset by lower earnings from the foodservice unit. In 2014, our foodservice unit experienced higher processing costs and

higher other operating costs which more than offset the increase in revenues.

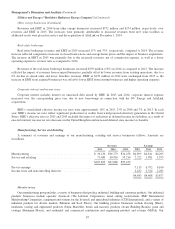

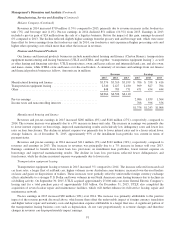

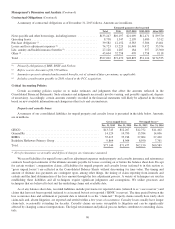

Finance and Financial Products

Our finance and financial products businesses include manufactured housing and finance (Clayton Homes), transportation

equipment manufacturing and leasing businesses (UTLX and XTRA, and together, “transportation equipment leasing”), as well

as other leasing and financing activities. UTLX manufactures, owns and leases railcars and intermodal tank cars, and also owns

and leases cranes, while XTRA owns and leases over-the-road trailers. A summary of revenues and earnings from our finance

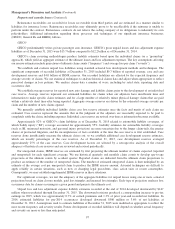

and financial products businesses follows. Amounts are in millions.

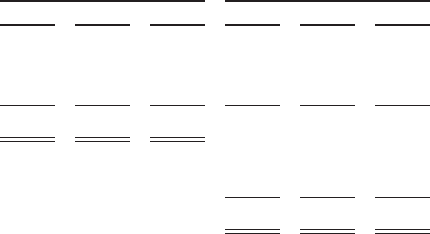

Revenues Earnings

2015 2014 2013 2015 2014 2013

Manufactured housing and finance .............................. $3,576 $3,310 $3,199 $ 706 $ 558 $ 416

Transportation equipment leasing ............................... 2,540 2,427 2,180 909 827 704

Other ..................................................... 848 789 731 471 454 444

$6,964 $6,526 $6,110

Pre-tax earnings ............................................. 2,086 1,839 1,564

Income taxes and noncontrolling interests ........................ 708 596 556

$1,378 $1,243 $1,008

Manufactured housing and finance

Revenues and pre-tax earnings in 2015 increased $266 million (8%) and $148 million (27%), respectively, compared to

2014. The revenue increase was primarily due to a 9% increase in home unit sales. The increase in earnings was primarily due

to lower interest expense on borrowings, improved manufacturing results and relatively low delinquency rates and lower loss

rates on loan foreclosures. The decline in interest expense was primarily due to lower interest rates and to a lesser extent lower

average balances. As of December 31, 2015, approximately 95% of the installment loan portfolio was current in terms of

payment status.

Revenues and pre-tax earnings in 2014 increased $111 million (3%) and $142 million (34%), respectively, compared to

revenues and earnings in 2013. The increase in revenues was principally due to a 7% increase in homes sold over 2013.

Earnings continued to benefit from lower loan loss provisions on installment loan portfolios, lower interest expense on

borrowings and improved manufacturing results. The decline in loan loss provisions reflected fewer delinquencies and

foreclosures, while the decline in interest expense was primarily due to lower rates.

Transportation equipment leasing

Transportation equipment leasing revenues in 2015 increased 5% compared to 2014. The increase reflected increased rail

car lease rates, a larger fleet of rail/tank cars, higher volumes in our Australian crane business, increased over-the-road trailers

on lease and gains on dispositions of trailers. These increases were partially offset by unfavorable foreign currency exchange

effects attributable to a stronger U.S. Dollar and lower volumes in our North American crane leasing business due to declines in

oil drilling activity. On September 30, 2015, UTLX acquired approximately 25,000 tank cars from General Electric Company’s

leasing unit for a total purchase price of approximately $1.0 billion. On December 31, 2015, UTLX also completed the

acquisition of several railcar repair and maintenance facilities, which will further enhance its full-service leasing, repair and

maintenance network.

Pre-tax earnings in 2015 increased $82 million (10%) over 2014. The increase was primarily attributable to the positive

impact of the revenue growth discussed above, which more than offset the unfavorable impact of foreign currency translation

and higher railcar repair and warranty costs and depreciation expense attributable to a larger fleet size. A significant portion of

the transportation leasing business costs such as depreciation, do not vary proportionately to revenue changes and therefore

changes in revenues can disproportionately impact earnings.

91