Berkshire Hathaway 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

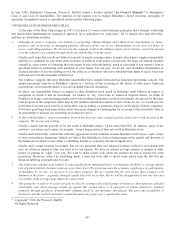

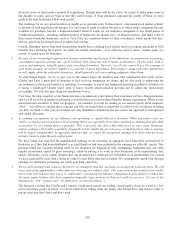

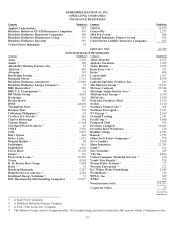

Management’s Discussion and Analysis (Continued)

Interest Rate Risk (Continued)

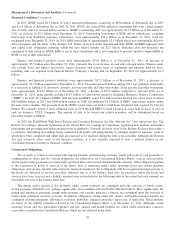

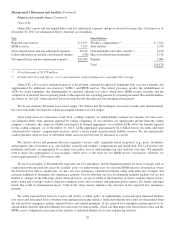

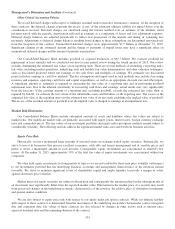

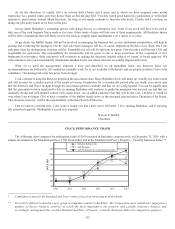

The following table summarizes the estimated effects of hypothetical changes in interest rates on our significant assets and

liabilities that are subject to interest rate risk. It is assumed that the interest rate changes occur immediately and uniformly to

each category of instrument containing interest rate risk, and that there are no significant changes to other factors used to

determine the value of the instrument. The hypothetical changes in interest rates do not reflect what could be deemed best or

worst case scenarios. Variations in interest rates could produce significant changes in the timing of repayments due to

prepayment options available to the issuer. For these reasons, actual results might differ from those reflected in the table.

Dollars are in millions.

Estimated Fair Value after

Hypothetical Change in Interest Rates

(bp=basis points)

Fair Value

100 bp

decrease

100 bp

increase

200 bp

increase

300 bp

increase

December 31, 2015

Assets:

Investments in fixed maturity securities .................... $26,027 $26,618 $25,351 $24,733 $24,164

Other investments (1) ................................... 11,394 11,571 10,664 10,228 9,814

Loans and finance receivables ........................... 13,112 13,594 12,661 12,240 11,844

Liabilities:

Notes payable and other borrowings:

Insurance and other ................................ 14,773 15,589 13,979 13,287 12,679

Railroad, utilities and energy ........................ 62,471 68,625 57,279 52,833 49,006

Finance and financial products ....................... 12,363 12,942 11,860 11,420 11,032

Equity index put option contracts ......................... 3,552 4,110 3,059 2,624 2,242

December 31, 2014

Assets:

Investments in fixed maturity securities .................... $27,636 $28,291 $26,843 $26,127 $25,529

Other investments (1) ................................... 11,239 11,771 10,772 10,317 9,887

Loans and finance receivables ........................... 12,891 13,369 12,444 12,026 11,633

Liabilities:

Notes payable and other borrowings:

Insurance and other ................................ 12,484 13,142 11,914 11,415 10,973

Railroad, utilities and energy ........................ 62,802 69,196 57,412 52,832 48,908

Finance and financial products ....................... 13,417 13,713 12,812 12,281 11,810

Equity index put option contracts ......................... 4,560 5,343 3,874 3,277 2,759

(1) Excludes other investments that are not subject to a significant level of interest rate risk.

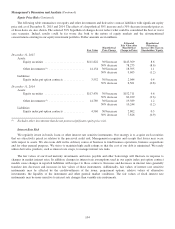

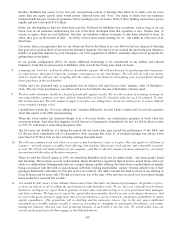

Foreign Currency Risk

Certain of our subsidiaries operate in foreign jurisdictions and we transact business in foreign currencies. We generally do

not use derivative contracts to hedge foreign currency price changes primarily because of the natural hedging that occurs

between assets and liabilities denominated in foreign currencies in our Consolidated Financial Statements. In addition, we hold

investments in common stocks of major multinational companies such as The Coca-Cola Company that have significant foreign

business and foreign currency risk of their own. Our net assets subject to translation are primarily in our insurance, utilities and

energy and certain manufacturing and services subsidiaries, as well as through our investment in Kraft Heinz common stock that

is accounted for under the equity method. The translation impact is somewhat offset by transaction gains or losses on net

reinsurance liabilities of certain U.S. subsidiaries that are denominated in foreign currencies as well as the equity index put

option liabilities of U.S. subsidiaries relating to contracts that would be settled in foreign currencies.

105