Berkshire Hathaway 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Many insurers pass the first three tests and flunk the fourth. They simply can’t turn their back on business

that is being eagerly written by their competitors. That old line, “The other guy is doing it, so we must as well,”

spells trouble in any business, but in none more so than insurance.

Tad has observed all four of the insurance commandments, and it shows in his results. General Re’s huge

float has been considerably better than cost-free under his leadership, and we expect that, on average, to continue.

We are particularly enthusiastic about General Re’s international life reinsurance business, which has grown

consistently and profitably since we acquired the company in 1998.

It can be remembered that soon after we purchased General Re, it was beset by problems that caused

commentators – and me as well, briefly – to believe I had made a huge mistake. That day is long gone. General Re

is now a gem.

************

Finally, there is GEICO, the insurer on which I cut my teeth 65 years ago. GEICO is managed by Tony

Nicely, who joined the company at 18 and completed 54 years of service in 2015. Tony became CEO in 1993, and

since then the company has been flying. There is no better manager than Tony. In the 40 years that I’ve known him,

his every action has made great sense.

When I was first introduced to GEICO in January 1951, I was blown away by the huge cost advantage the

company enjoyed compared to the expenses borne by the giants of the industry. It was clear to me that GEICO

would succeed because it deserved to succeed.

No one likes to buy auto insurance. Almost everyone, though, likes to drive. The insurance consequently

needed is a major expenditure for most families. Savings matter to them – and only a low-cost operation can deliver

these. Indeed, at least 40% of the people reading this letter can save money by insuring with GEICO. So stop

reading – right now! – and go to geico.com or call 800-368-2734.

GEICO’s cost advantage is the factor that has enabled the company to gobble up market share year after

year. (We ended 2015 with 11.4% of the market compared to 2.5% in 1995, when Berkshire acquired control of

GEICO.) The company’s low costs create a moat – an enduring one – that competitors are unable to cross.

All the while, our gecko never tires of telling Americans how GEICO can save them important money. I

love hearing the little guy deliver his message: “15 minutes could save you 15% or more on car insurance.” (Of

course, there’s always a grouch in the crowd. One of my friends says he is glad that only a few animals can talk,

since the ones that do speak seem unable to discuss any subject but insurance.)

************

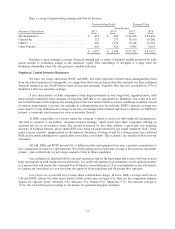

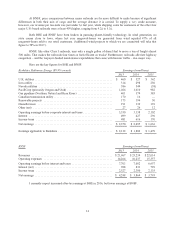

In addition to our three major insurance operations, we own a group of smaller companies that primarily

write commercial coverages. In aggregate, these companies are a large, growing and valuable operation that

consistently delivers an underwriting profit, usually much better than that reported by their competitors. Indeed,

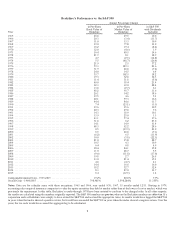

over the past 13 years, this group has earned $4 billion from underwriting – about 13% of its premium volume –

while increasing its float from $943 million to $9.9 billion.

Less than three years ago, we formed Berkshire Hathaway Specialty Insurance (“BHSI”), which we include

in this group. Our first decision was to put Peter Eastwood in charge. That move was a home run: BHSI has already

developed $1 billion of annual premium volume and, under Peter’s direction, is destined to become one of the

world’s leading P/C insurers.

12