Berkshire Hathaway 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(11) Derivatives (Continued)

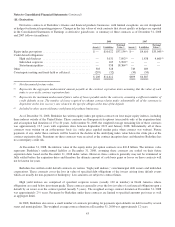

Premiums on the high yield index and state/municipality contracts were received at the inception dates of the contracts and

as a result Berkshire has no counterparty credit risk. Berkshire’s payment obligations under certain of these contracts are on a

first loss basis. Several other contracts are subject to an aggregate loss deductible that must be satisfied before Berkshire has any

payment obligations or contain provisions that otherwise delay payment obligations arising from defaults.

During 2008, Berkshire also wrote credit default contracts on individual issuers in North America whose obligations are

primarily rated as investment grade and where installment premiums are due from counterparties over the terms of the contracts.

In most instances, premiums are due from counterparties on a quarterly basis. Most individual issuer contracts had a five year

term when written.

The equity index put option contracts and credit default contracts were entered into with the expectation that amounts

ultimately paid to counterparties will be less than the premiums received. Berkshire views these contracts as economically

similar to insurance contracts, notwithstanding the “fair value” accounting requirements for derivatives contracts.

Most of Berkshire’s equity index put option and credit default contracts contain no collateral posting requirements with

respect to changes in either the fair value or intrinsic value of the contracts and/or a downgrade of Berkshire’s credit rating.

Under certain conditions, a few contracts require that Berkshire post collateral. At December 31, 2008, Berkshire had posted

collateral of approximately $550 million with counterparties, related to these contracts.

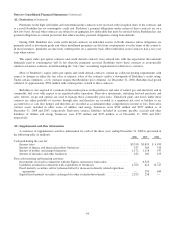

Berkshire is also exposed to variations in the market prices in the purchases and sales of natural gas and electricity and in

commodity fuel costs with respect to its regulated utility operations. Derivative instruments, including forward purchases and

sales, futures, swaps and options are used to manage these commodity price risks. Unrealized gains and losses under these

contracts are either probable of recovery through rates and therefore are recorded as a regulatory net asset or liability or are

accounted for as cash flow hedges and therefore are recorded as accumulated other comprehensive income or loss. Derivative

contract assets included in other assets of utilities and energy businesses were $324 million and $397 million as of

December 31, 2008 and 2007, respectively. Derivative contract liabilities included in accounts payable, accruals and other

liabilities of utilities and energy businesses were $729 million and $765 million as of December 31, 2008 and 2007,

respectively.

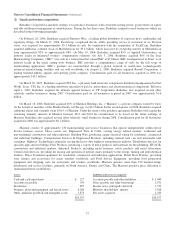

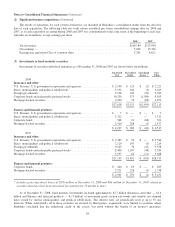

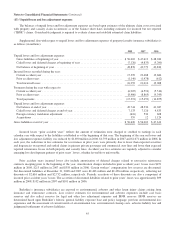

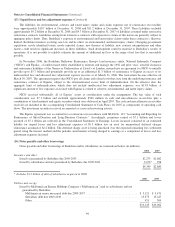

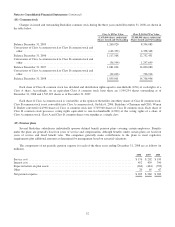

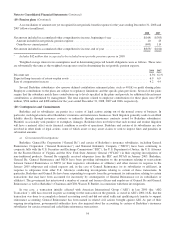

(12) Supplemental cash flow information

A summary of supplemental cash flow information for each of the three years ending December 31, 2008 is presented in

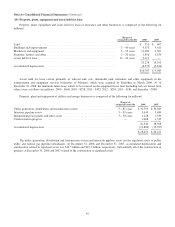

the following table (in millions). 2008 2007 2006

Cash paid during the year for:

Income taxes ................................................................. $3,530 $5,895 $ 4,959

Interest of finance and financial products businesses ................................. 537 569 514

Interest of utilities and energy businesses .......................................... 1,172 1,118 937

Interest of insurance and other businesses .......................................... 182 182 195

Non-cash investing and financing activities:

Investments received in connection with the Equitas reinsurance transaction .............. — 6,529 —

Liabilities assumed in connection with acquisitions of businesses ....................... 4,763 612 12,727

Fixed maturity securities sold or redeemed offset by decrease in directly related repurchase

agreements ................................................................ — 599 460

Equity/fixed maturity securities exchanged for other securities/investments ............... 2,329 258 —

44