Berkshire Hathaway 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tax-Exempt Bond Insurance

Early in 2008, we activated Berkshire Hathaway Assurance Company (“BHAC”) as an insurer of the

tax-exempt bonds issued by states, cities and other local entities. BHAC insures these securities for issuers both

at the time their bonds are sold to the public (primary transactions) and later, when the bonds are already owned

by investors (secondary transactions).

By yearend 2007, the half dozen or so companies that had been the major players in this business had

all fallen into big trouble. The cause of their problems was captured long ago by Mae West: “I was Snow White,

but I drifted.”

The monolines (as the bond insurers are called) initially insured only tax-exempt bonds that were

low-risk. But over the years competition for this business intensified, and rates fell. Faced with the prospect of

stagnating or declining earnings, the monoline managers turned to ever-riskier propositions. Some of these

involved the insuring of residential mortgage obligations. When housing prices plummeted, the monoline

industry quickly became a basket case.

Early in the year, Berkshire offered to assume all of the insurance issued on tax-exempts that was on

the books of the three largest monolines. These companies were all in life-threatening trouble (though they said

otherwise.) We would have charged a 1

1

⁄

2

% rate to take over the guarantees on about $822 billion of bonds. If

our offer had been accepted, we would have been required to pay any losses suffered by investors who owned

these bonds – a guarantee stretching for 40 years in some cases. Ours was not a frivolous proposal: For reasons

we will come to later, it involved substantial risk for Berkshire.

The monolines summarily rejected our offer, in some cases appending an insult or two. In the end,

though, the turndowns proved to be very good news for us, because it became apparent that I had severely

underpriced our offer.

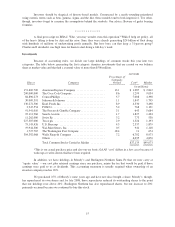

Thereafter, we wrote about $15.6 billion of insurance in the secondary market. And here’s the punch

line: About 77% of this business was on bonds that were already insured, largely by the three aforementioned

monolines. In these agreements, we have to pay for defaults only if the original insurer is financially unable to do

so.

We wrote this “second-to-pay” insurance for rates averaging 3.3%. That’s right; we have been paid far

more for becoming the second to pay than the 1.5% we would have earlier charged to be the first to pay. In one

extreme case, we actually agreed to be fourth to pay, nonetheless receiving about three times the 1% premium

charged by the monoline that remains first to pay. In other words, three other monolines have to first go broke

before we need to write a check.

Two of the three monolines to which we made our initial bulk offer later raised substantial capital.

This, of course, directly helps us, since it makes it less likely that we will have to pay, at least in the near term,

any claims on our second-to-pay insurance because these two monolines fail. In addition to our book of

secondary business, we have also written $3.7 billion of primary business for a premium of $96 million. In

primary business, of course, we are first to pay if the issuer gets in trouble.

We have a great many more multiples of capital behind the insurance we write than does any other

monoline. Consequently, our guarantee is far more valuable than theirs. This explains why many sophisticated

investors have bought second-to-pay insurance from us even though they were already insured by another

monoline. BHAC has become not only the insurer of preference, but in many cases the sole insurer acceptable to

bondholders.

Nevertheless, we remain very cautious about the business we write and regard it as far from a sure

thing that this insurance will ultimately be profitable for us. The reason is simple, though I have never seen even

a passing reference to it by any financial analyst, rating agency or monoline CEO.

13