Berkshire Hathaway 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

Management’s Discussion (Continued)

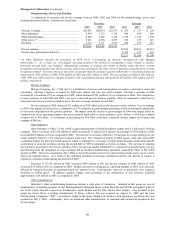

Property and casualty losses (Continued)

BHRG (Continued)

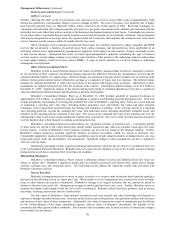

Partially offsetting the effect of the loss payments were increases in loss reserves on pre-2006 events of approximately $200

million that produced a corresponding charge to pre-tax earnings in 2006. The reserve increases were primarily due to higher

than expected reported losses on Hurricane Wilma which occurred in the fourth quarter of 2005. Reserving techniques for

catastrophe and individual risk contracts generally rely more on a per-policy assessment of the ultimate cost associated with the

individual loss event rather than with an analysis of the historical development patterns of past losses. Catastrophe loss reserves

are provided when it is probable that an insured loss has occurred and the amount can be reasonably estimated. Absent litigation

affecting the interpretation of coverage terms, the expected claim-tail is relatively short and thus the estimation error in the initial

reserve estimates usually emerges within 24 months after the loss event.

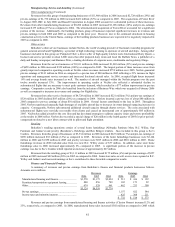

Other reinsurance reserve amounts are generally based upon loss estimates reported by ceding companies and IBNR

reserves that are primarily a function of reported losses from ceding companies and anticipated loss ratios established on an

individual contract basis, supplemented by management’s judgment of the impact on each contract of major catastrophe events

as they become known. Anticipated loss ratios are based upon management’s judgment considering the type of business

covered, analysis of each ceding company’s loss history and evaluation of that portion of the underlying contracts underwritten

by each ceding company, which are in turn ceded to BHRG. A range of reserve amounts as a result of changes in underlying

assumptions is not prepared.

Other Critical Accounting Policies

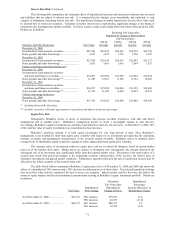

Berkshire records as assets deferred charges with respect to liabilities assumed under retroactive reinsurance contracts.

At the inception of these contracts, the deferred charges represent the difference between the consideration received and the

estimated ultimate liability for unpaid losses. Deferred charges are amortized using the interest method over an estimate of the

ultimate claim payment period and are reflected in earnings as a component of losses and loss expenses. The deferred charge

balances are adjusted periodically to reflect new projections of the amount and timing of loss payments. Adjustments to these

assumptions are applied retrospectively from the inception of the contract. Unamortized deferred charges were $2.0 billion at

December 31, 2006. Significant changes in the amount and payment timing of estimated unpaid losses may have a significant

effect on unamortized deferred charges and the amount of periodic amortization.

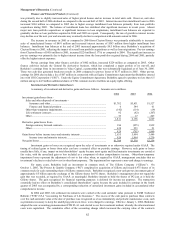

Berkshire’s Consolidated Balance Sheet as of December 31, 2006 includes goodwill of acquired businesses of

approximately $32.2 billion. A significant amount of judgment is required in performing goodwill impairment tests. Such tests

include periodically determining or reviewing the estimated fair value of Berkshire’s reporting units. There are several methods

of estimating a reporting unit’s fair value, including market quotations, asset and liability fair values and other valuation

techniques, such as discounted projected future net earnings and multiples of earnings. If the carrying amount of a reporting

unit, including goodwill, exceeds the estimated fair value, then individual assets, including identifiable intangible assets, and

liabilities of the reporting unit are estimated at fair value. The excess of the estimated fair value of the reporting unit over the

estimated fair value of net assets would establish the implied value of goodwill. The excess of the recorded amount of goodwill

over the implied value is then charged to earnings as an impairment loss.

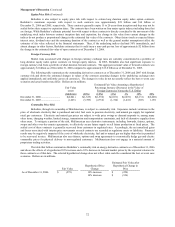

Berkshire’s consolidated financial position reflects very significant amounts of invested assets. A substantial portion

of these assets are carried at fair values based upon current market quotations and, when not available, based upon fair value

pricing models. Certain of Berkshire’s fixed maturity securities are not actively traded in the financial markets. Further,

Berkshire’s finance businesses maintain significant balances of finance receivables, which are carried at amortized cost.

Considerable judgment is required in determining the assumptions used in certain valuation models, including interest rate, loan

prepayment speed, credit risk and liquidity risk assumptions. Significant changes in these assumptions can have a significant

effect on carrying values.

Information concerning recently issued accounting pronouncements which are not yet effective is included in Note 1(r)

to the Consolidated Financial Statements. Berkshire does not expect that the adoption of any of the recently issued accounting

pronouncements will have a material effect on its financial condition.

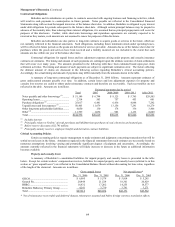

Market Risk Disclosures

Berkshire’s Consolidated Balance Sheets include a substantial amount of assets and liabilities whose fair values are

subject to market risks. Berkshire’s significant market risks are primarily associated with interest rates, equity prices, foreign

currency exchange rates and commodity prices. The following sections address the significant market risks associated with

Berkshire’s business activities.

Interest Rate Risk

Berkshire’s management prefers to invest in equity securities or to acquire entire businesses based upon the principles

discussed in the following section on equity price risk. When unable to do so, management may alternatively invest in bonds,

loans or other interest rate sensitive instruments. Berkshire’s strategy is to acquire securities that are attractively priced in

relation to the perceived credit risk. Management recognizes and accepts that losses may occur. Further, Berkshire strives to

maintain the highest credit ratings so that the cost of debt is minimized. Berkshire utilizes derivative products, such as interest

rate swaps, to manage interest rate risks on a limited basis.

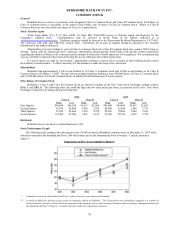

The fair values of Berkshire’s fixed maturity investments and notes payable and other borrowings will fluctuate in

response to changes in market interest rates. Increases and decreases in prevailing interest rates generally translate into decreases

and increases in fair values of those instruments. Additionally, fair values of interest rate sensitive instruments may be affected

by the creditworthiness of the issuer, prepayment options, relative values of alternative investments, the liquidity of the

instrument and other general market conditions. Fixed interest rate investments may be more sensitive to interest rate changes

than variable rate investments.