Berkshire Hathaway 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

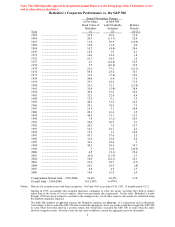

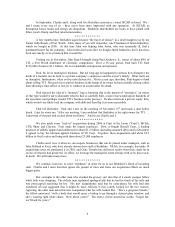

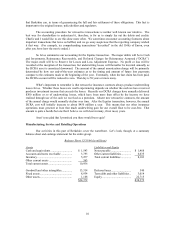

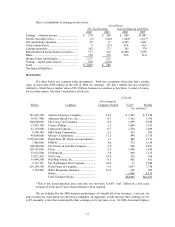

Year Pre-Tax Earnings Per Share*

1965 ..................................................................... $ 4

1975 ..................................................................... 4

1985 ..................................................................... 52

1995 ..................................................................... 175

2006 ..................................................................... $3,625

Compound Growth Rate 1965-2006 .................... 17.9%

Compound Growth Rate 1995-2006 .................... 31.7%

*Excluding purchase-accounting adjustments and net of minority interests

Last year we had a good increase in non-insurance earnings – 38%. Large gains from here on in,

though, will come only if we are able to make major, and sensible, acquisitions. That will not be easy. We

do, however, have one advantage: More and more, Berkshire has become “the buyer of choice” for

business owners and managers. Initially, we were viewed that way only in the U.S. (and more often than

not by private companies). We’ ve long wanted, nonetheless, to extend Berkshire’ s appeal beyond U.S.

borders. And last year, our globe-trotting finally got underway.

Acquisitions

We began 2006 by completing the three acquisitions pending at yearend 2005, spending about $6

billion for PacifiCorp, Business Wire and Applied Underwriters. All are performing very well.

The highlight of the year, however, was our July 5th acquisition of most of ISCAR, an Israeli

company, and our new association with its chairman, Eitan Wertheimer, and CEO, Jacob Harpaz. The

story here began on October 25, 2005, when I received a 1¼-page letter from Eitan, of whom I then knew

nothing. The letter began, “I am writing to introduce you to ISCAR,” and proceeded to describe a cutting-

tool business carried on in 61 countries. Then Eitan wrote, “We have for some time considered the issues

of generational transfer and ownership that are typical for large family enterprises, and have given much

thought to ISCAR’ s future. Our conclusion is that Berkshire Hathaway would be the ideal home for

ISCAR. We believe that ISCAR would continue to thrive as a part of your portfolio of businesses.”

Overall, Eitan’ s letter made the quality of the company and the character of its management leap

off the page. It also made me want to learn more, and in November, Eitan, Jacob and ISCAR’ s CFO,

Danny Goldman, came to Omaha. A few hours with them convinced me that if we were to make a deal, we

would be teaming up with extraordinarily talented managers who could be trusted to run the business after

a sale with all of the energy and dedication that they had exhibited previously. However, having never

bought a business based outside of the U.S. (though I had bought a number of foreign stocks), I needed to

get educated on some tax and jurisdictional matters. With that task completed, Berkshire purchased 80% of

ISCAR for $4 billion. The remaining 20% stays in the hands of the Wertheimer family, making it our

valued partner.

ISCAR’ s products are small, consumable cutting tools that are used in conjunction with large and

expensive machine tools. It’ s a business without magic except for that imparted by the people who run it.

But Eitan, Jacob and their associates are true managerial magicians who constantly develop tools that make

their customers’ machines more productive. The result: ISCAR makes money because it enables its

customers to make more money. There is no better recipe for continued success.

5