Berkshire Hathaway 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

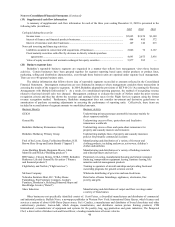

(22) Contingencies and Commitments (Continued)

purchasers through bid-rigging and contingent commission arrangements. Berkshire, General Re and General Reinsurance were not

parties to the original, transferred cases. On August 1, 2005, the named plaintiffs—fourteen businesses, two municipalities, and three

individuals—filed their First Consolidated Amended Commercial Class Action Complaint, and Berkshire, General Re and General

Reinsurance (along with a large number of insurance companies and insurance brokers) were named as defendants in the Amended

Complaint. The plaintiffs claim that all defendants engaged in a pattern of racketeering activity, in violation of RICO, and that they

conspired to restrain trade. They further allege that the broker defendants breached fiduciary duties to the plaintiffs, that the insurer

defendants aided and abetted that breach, and that all defendants were unjustly enriched in the process. Plaintiffs seek treble damages

in an unspecified amount, together with interest and attorneys fees and expenses. They also seek a declaratory judgment of

wrongdoing as well as an injunction against future anticompetitive practices. On November 29, 2005, General Re, General

Reinsurance and Berkshire, together with the other defendants, filed motions to dismiss the complaint. On February 1, 2006,

plaintiffs filed a motion for leave to file a Second Consolidated Amended Complaint. Among other things, plaintiffs seek leave to

add numerous new defendants, including several additional Berkshire subsidiaries including, among others, NICO. Berkshire

opposed the motion for leave to amend, and the Court has denied the motion without prejudice to plaintiffs’ renewing it following a

ruling on defendants’ motion to dismiss the First Consolidated Amended Complaint.

Berkshire cannot at this time predict the outcome of these matters, is unable to estimate a range of possible loss, if any, and

cannot predict whether or not the outcomes will have a material adverse effect on Berkshire’ s business or results of operations for at

least the quarterly period when these matters are completed or otherwise resolved.

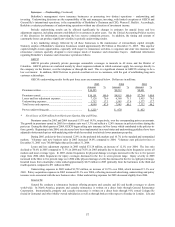

c) Commitments

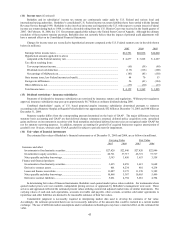

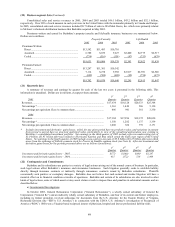

Berkshire subsidiaries lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Total

rent expense for all leases was $432 million, $422 million and $384 million in 2005, 2004 and 2003, respectively. Minimum rental

payments for operating leases having initial or remaining non-cancelable terms in excess of one year are as follows. Amounts are in

millions.

After

2006 2007 2008 2009 2010 2010 Total

$357 $296 $236 $187 $136 $420 $1,632

Several of Berkshire’ s subsidiaries have made long-term commitments to purchase goods and services used in their businesses.

The most significant of these relate to NetJets’ commitments to purchase up to 404 aircraft through 2015. Commitments under all

such subsidiary arrangements are approximately $3.9 billion in 2006, $1.8 billion in 2007, $1.6 billion in 2008, $1.3 billion in 2009,

$1.1 billion in 2010 and $3.0 billion after 2010.