Berkshire Hathaway 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

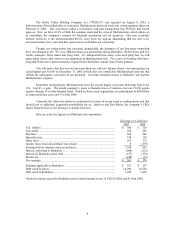

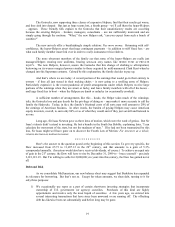

Manufacturing, Service and Retailing Operations

Our activities in this part of Berkshire cover the waterfront. Let’ s look, though, at a summary

balance sheet and earnings statement for the entire group.

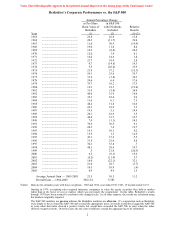

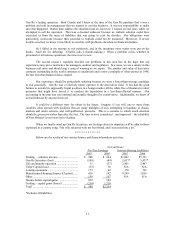

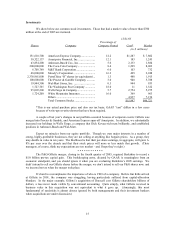

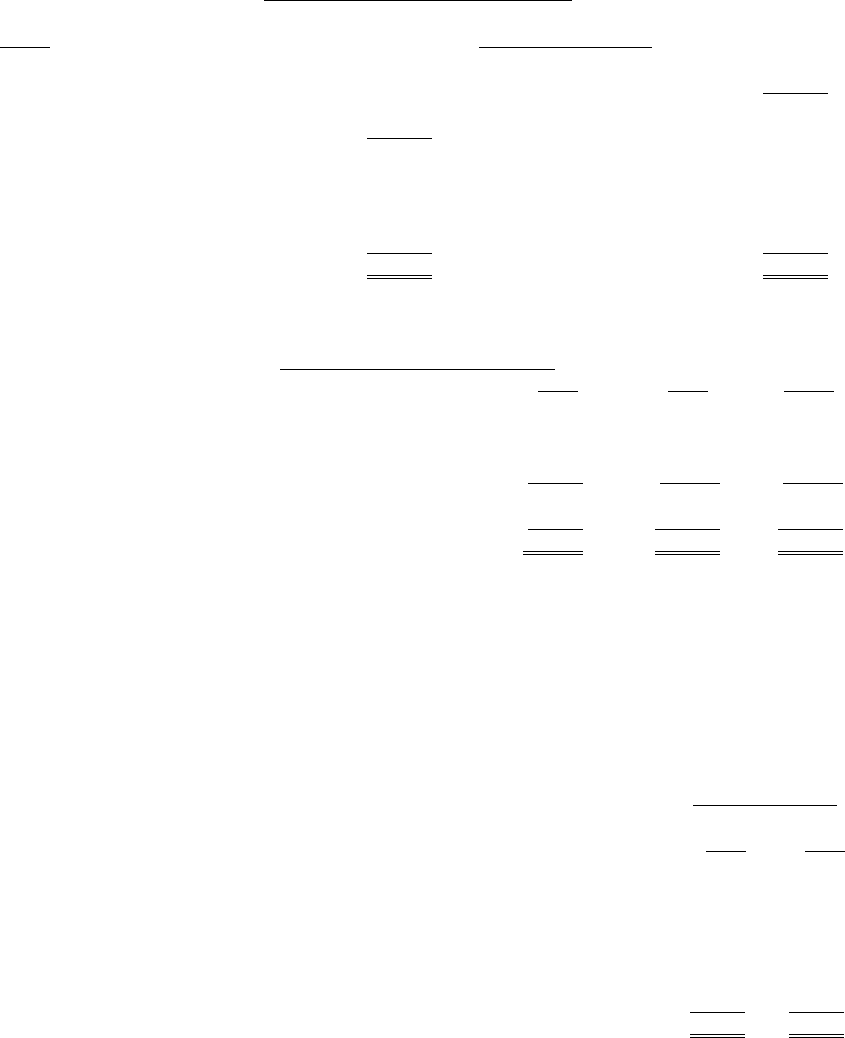

Balance Sheet 12/31/05 (in $ millions)

Assets Liabilities and Equity

Cash and equivalents .............................. $ 1,004 Notes payable ............................ $ 1,469

Accounts and notes receivable ............... 3,287 Other current liabilities.............. 5,371

Inventory ................................................ 4,143 Total current liabilities .............. 6,840

Other current assets ................................ 342

Total current assets................................. 8,776

Goodwill and other intangibles............... 9,260 Deferred taxes............................ 338

Fixed assets............................................. 7,148 Term debt and other liabilities... 2,188

Other assets............................................. 1,021 Equity ........................................ 16,839

$26,205 $26,205

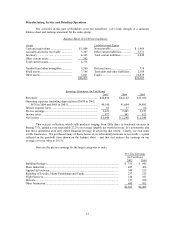

Earnings Statement (in $ millions)

2005 2004 2003

Revenues .................................................................................... $46,896 $44,142 $32,106

Operating expenses (including depreciation of $699 in 2005,

$676 in 2004 and $605 in 2003).......................................... 44,190 41,604 29,885

Interest expense (net).................................................................. 83 57 64

Pre-tax earnings.......................................................................... 2,623 2,481 2,157

Income taxes............................................................................... 977 941 813

Net income ................................................................................. $ 1,646 $ 1,540 $ 1,344

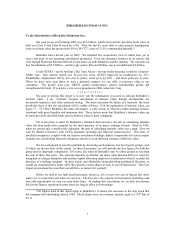

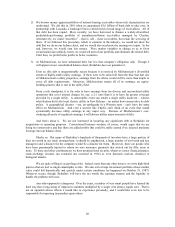

This eclectic collection, which sells products ranging from Dilly Bars to fractional interests in

Boeing 737s, earned a very respectable 22.2% on average tangible net worth last year. It’ s noteworthy also

that these operations used only minor financial leverage in achieving that return. Clearly, we own some

terrific businesses. We purchased many of them, however, at substantial premiums to net worth – a point

reflected in the goodwill item shown on the balance sheet – and that fact reduces the earnings on our

average carrying value to 10.1%.

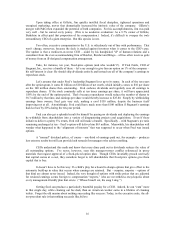

Here are the pre-tax earnings for the larger categories or units.

Pre-Tax Earnings

(in $ millions)

2005 2004

Building Products .................................................................................................... $ 751 $ 643

Shaw Industries ....................................................................................................... 485 466

Apparel & Footwear................................................................................................ 348 325

Retailing of Jewelry, Home Furnishings and Candy ............................................... 257 215

Flight Services......................................................................................................... 120 191

McLane.................................................................................................................... 217 228

Other businesses ...................................................................................................... 445 413

$2,623 $2,481

12