Berkshire Hathaway 2005 Annual Report Download - page 21

Download and view the complete annual report

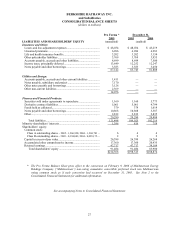

Please find page 21 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2) We borrow money against portfolios of interest-bearing receivables whose risk characteristics we

understand. We did this in 2001 when we guaranteed $5.6 billion of bank debt to take over, in

partnership with Leucadia, a bankrupt Finova (which held a broad range of receivables). All of

that debt has been repaid. More recently, we have borrowed to finance a widely-diversified,

predictably-performing portfolio of manufactured-home receivables managed by Clayton.

Alternatively, we could “securitize” – that is, sell – these receivables, but retain the servicing of

them. If we followed this procedure, which is common in the industry, we would not show the

debt that we do on our balance sheet, and we would also accelerate the earnings we report. In the

end, however, we would earn less money. Were market variables to change so as to favor

securitization (an unlikely event), we could sell part of our portfolio and eliminate the related debt.

Until then, we prefer better profits to better cosmetics.

3) At MidAmerican, we have substantial debt, but it is that company’ s obligation only. Though it

will appear on our consolidated balance sheet, Berkshire does not guarantee it.

Even so, this debt is unquestionably secure because it is serviced by MidAmerican’ s diversified

stream of highly-stable utility earnings. If there were to be some bolt from the blue that hurt one

of MidAmerican’ s utility properties, earnings from the others would still be more than ample to

cover all debt requirements. Moreover, MidAmerican retains all of its earnings, an equity-

building practice that is rare in the utility field.

From a risk standpoint, it is far safer to have earnings from ten diverse and uncorrelated utility

operations that cover interest charges by, say, a 2:1 ratio than it is to have far greater coverage

provided by a single utility. A catastrophic event can render a single utility insolvent – witness

what Katrina did to the local electric utility in New Orleans – no matter how conservative its debt

policy. A geographical disaster – say, an earthquake in a Western state – can’ t have the same

effect on MidAmerican. And even a worrier like Charlie can’ t think of an event that would

systemically decrease utility earnings in any major way. Because of MidAmerican’ s ever-

widening diversity of regulated earnings, it will always utilize major amounts of debt.

And that’ s about it. We are not interested in incurring any significant debt at Berkshire for

acquisitions or operating purposes. Conventional business wisdom, of course, would argue that we are

being too conservative and that there are added profits that could be safely earned if we injected moderate

leverage into our balance sheet.

Maybe so. But many of Berkshire’ s hundreds of thousands of investors have a large portion of

their net worth in our stock (among them, it should be emphasized, a large number of our board and key

managers) and a disaster for the company would be a disaster for them. Moreover, there are people who

have been permanently injured to whom we owe insurance payments that stretch out for fifty years or

more. To these and other constituencies we have promised total security, whatever comes: financial panics,

stock-exchange closures (an extended one occurred in 1914) or even domestic nuclear, chemical or

biological attacks.

We are quite willing to accept huge risks. Indeed, more than any other insurer, we write high-limit

policies that are tied to single catastrophic events. We also own a large investment portfolio whose market

value could fall dramatically and quickly under certain conditions (as happened on October 19, 1987).

Whatever occurs, though, Berkshire will have the net worth, the earnings streams and the liquidity to

handle the problem with ease.

Any other approach is dangerous. Over the years, a number of very smart people have learned the

hard way that a long string of impressive numbers multiplied by a single zero always equals zero. That is

not an equation whose effects I would like to experience personally, and I would like even less to be

responsible for imposing its penalties upon others.

20