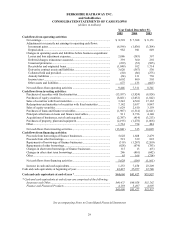

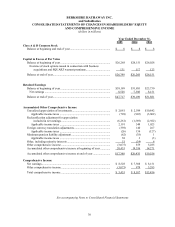

Berkshire Hathaway 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

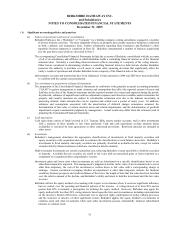

(2) Investments in MidAmerican Energy Holdings Company (Continued)

MidAmerican owns a combined electric and natural gas utility company in the United States, two interstate natural gas pipeline

companies in the United States, two electricity distribution companies in the United Kingdom, a diversified portfolio of domestic and

international electric power projects and the second largest residential real estate brokerage firm in the United States.

Through its investments in MidAmerican common and convertible preferred stock, at December 31, 2005, Berkshire possessed

9.7% of the voting rights and 83.4% (80.5% diluted) of the economic rights in MidAmerican. Each share of convertible preferred

stock was convertible into a share of common stock only upon the occurrence of specified events, including the elimination of the

Public Utility Holding Company Act of 1935 (“PUHCA”). Walter Scott, Jr., a member of Berkshire’ s Board of Directors, controlled

approximately 86% of the voting interest in MidAmerican at December 31, 2005.

During the three year period ending December 31, 2005, Berkshire possessed the ability to exercise significant influence on the

operations of MidAmerican through its investments in common and convertible preferred stock of MidAmerican. The convertible

preferred stock, although generally non-voting, was substantially an identical subordinate interest to a share of common stock and

economically equivalent to common stock. Therefore, during this period, Berkshire accounted for its investments in MidAmerican

pursuant to the equity method.

The Energy Policy Act of 2005 was enacted on August 8, 2005 and included the repeal of PUHCA, which became effective on

February 8, 2006. On February 9, 2006, Berkshire Hathaway converted its preferred stock to common stock and upon conversion,

owned approximately 83.4% (80.5% diluted) of the voting common stock interests. As of that date, Berkshire is deemed to control

MidAmerican for financial reporting purposes. The accounts of MidAmerican will be consolidated in Berkshire’ s Consolidated

Financial Statements beginning February 2006. However, there will be no changes in MidAmerican’ s operations, management or

capital structure as a result of the consolidation of MidAmerican. Specifically, MidAmerican’ s debt is currently not guaranteed by

Berkshire. However, Berkshire has made a commitment until February 28, 2011 that would allow MidAmerican to request up to $3.5

billion of capital to pay its debt obligations or to provide funding to its regulated subsidiaries.

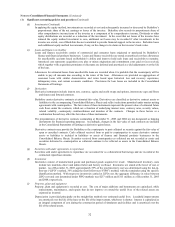

Beginning in 2006, Berkshire’ s Consolidated Financial Statements will consolidate the accounts of MidAmerican. Although the

consolidation of MidAmerican will have a significant impact on consolidated revenues and expenses, the only difference in

consolidated net earnings or shareholders’ equity from the equity method amounts will pertain to deferred income taxes. Berkshire

will cease accruing deferred income taxes with respect to its investments in MidAmerican in accordance with SFAS No. 109. Due to

the significance of this change in accounting on future Consolidated Financial Statement presentations, an unaudited pro forma

balance sheet has been included on the face of Berkshire’ s Consolidated Balance Sheets which reflects the consolidation of

MidAmerican as of December 31, 2005. Berkshire management believes that such unaudited pro forma information is meaningful

and relevant to investors, creditors and other financial statement users.

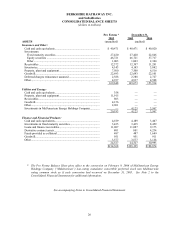

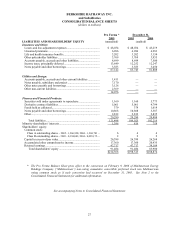

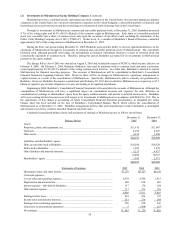

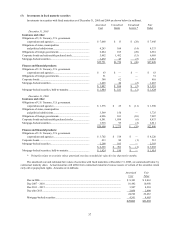

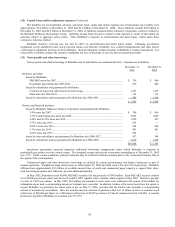

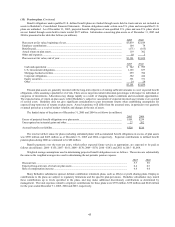

Condensed consolidated balance sheets and statements of earnings of MidAmerican are as follows (in millions).

December 31, December 31,

Balance Sheets 2005 2004

Assets:

Properties, plants, and equipment, net........................................................................................... $11,915 $11,607

Goodwill ....................................................................................................................................... 4,156 4,307

Other assets................................................................................................................................... 4,122 3,990

$20,193 $19,904

Liabilities and shareholders’ equity:

Debt, except debt owed to Berkshire............................................................................................. $10,296 $10,528

Debt owed to Berkshire................................................................................................................. 1,289 1,478

Other liabilities and minority interests .......................................................................................... 5,223 4,927

16,808 16,933

Shareholders’ equity ..................................................................................................................... 3,385 2,971

$20,193 $19,904

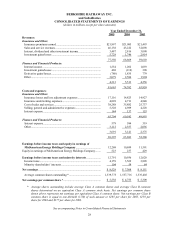

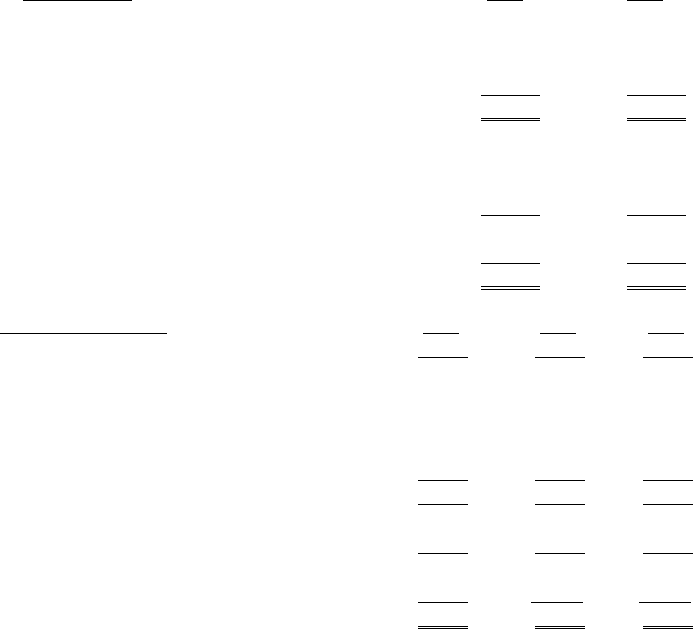

Statements of Earnings 2005 2004 2003

Operating revenue and other income............................................................................... $7,279 $6,727 $6,143

Costs and expenses:

Cost of sales and operating expenses .............................................................................. 4,978 4,390 3,913

Depreciation and amortization ........................................................................................ 608 638 603

Interest expense – debt held by Berkshire....................................................................... 157 170 184

Other interest expense..................................................................................................... 717 713 716

6,460 5,911 5,416

Earnings before taxes...................................................................................................... 819 816 727

Income taxes and minority interests................................................................................ 261 278 284

Earnings from continuing operations .............................................................................. 558 538 443

Gain (loss) on discontinued operations ........................................................................... 5 (368) (27)

Net earnings .................................................................................................................... $ 563 $ 170 $ 416