Barclays 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Barclays PLC

Annual Report

barclays.com/annualreport07

Table of contents

-

Page 1

barclays.com/annualreport07 Barclays PLC Annual Report -

Page 2

... these markets. To find out more on how our diversified business portfolio creates value for shareholders and benefits customers visit: www.barclays.com/annualreport07 Section 2 Governance Board and Executive Committee Directors' report Corporate governance report Remuneration report Accountability... -

Page 3

Business review 1 Business review 2 6 7 8 10 15 72 75 Financial and operating highlights Board and Executive management Group Chairman's statement Group Chief Executive's review Key performance indicators Financial review Corporate sustainability Risk management Barclays PLC Annual Report 2007 1 -

Page 4

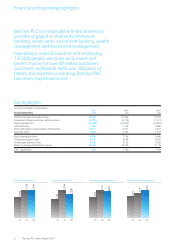

... highlights Barclays PLC is a major global financial services provider engaged in retail and commercial banking, credit cards, investment banking, wealth management and investment management. Operating in over 50 countries and employing 135,000 people, we move, lend, invest and protect money for... -

Page 5

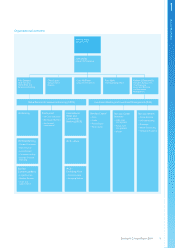

... Business - Asset and Sales Finance - UK Cards and Loans - Barclaycard Business - Barclaycard International - Absa - Western Europe - Emerging Markets 17 % 18 % 7 % 13 % Investment Banking and Investment Management Barclays Capital Proï¬t before tax Barclays Global Investors Barclays... -

Page 6

... and operating highlights UK Banking Delivers banking products and services to 15 million retail customers and 724,000 businesses in the UK. 11.3 Barclaycard m 724,000 Business customers UK Current accounts Is one of the leading credit card businesses in Europe with an extensive international... -

Page 7

...IRCB - Absa - Personal Customers - Home Finance - Local Business - Consumer Lending - Barclays Financial Planning Barclays Commercial Bank IRCB - Excluding Absa - Larger Business - Medium Business - Asset and Sales Finance - Western Europe - Emerging Markets Barclays PLC Annual Report 2007 5 -

Page 8

... Frits Seegers Group Chief Executive President, Barclays PLC and Chief Executive, Investment Banking and Investment Management Chief Operating Officer Group Finance Director Chief Executive, Global Retail and Commercial Banking 1996 1997 2004 2007 2006 Other officers Date appointed Jonathan... -

Page 9

... Holdings of Singapore. The second half of the year saw extremely testing market conditions as rising default rates on sub-prime mortgages in the US severely affected confidence in the global credit and money markets. The Group's diversified portfolio of businesses served shareholders well in 2007... -

Page 10

...2007, increasing the number of employees who serve customers and clients and developing our distribution networks. In IBIM I believe that we handled well the stress test of market turbulence in the second half of 2007. Both Barclays Capital and Barclays Global Investors ended 2007 with profits ahead... -

Page 11

... review We are building significant momentum in GRCB. In particular, we have been growing distribution to create a much broader business base for the years ahead. During 2007, we opened over 600 new branches and sales centres outside the United Kingdom, increasing by over one third the number... -

Page 12

Key performance indicators Barclays strategic priorities are to: Total Shareholder Return Total Shareholder Return (TSR) is defined as the value created for shareholders through share price appreciation, plus reinvested dividend payments. At the end of 2003, Barclays established a set of four year... -

Page 13

... 57% Non UK UK Non UK UK Non UK UK 05 06 07 Profit diversification by business %a 60% 40% 66% 34% 65% 35% UK Banking Other Other UK Banking Other UK Banking 05 Note 06 07 a Head office functions and other operations segment has been excluded. Barclays PLC Annual Report 2007 20.3 11 -

Page 14

... group data has been extracted as at 30th June 2007. c UK Retail Banking peer group includes related credit card businesses. d IRCB Absa excludes Absa Capital, but peers are total Group numbers. e Barclays Capital and Peer group ratios are cost:net income. 12 Barclays PLC Annual Report 2007 76 -

Page 15

... the highest we have achieved. 2007 Employee opinion surveys - response rates % 90 89 Barclays Wealth 82 Global Retail and Commercial Banking Barclays Capital a 72 Barclays Global Investors 74 Head office functions and other operations Note a Barclays Capital runs a survey biennially. The... -

Page 16

14 Barclays PLC Annual Report 2007 -

Page 17

... Capital resources and deposits Deposits and short-term borrowings Commitments and contractual obligations Securities Critical accounting estimates Off-balance sheet arrangements Barclays Capital credit market positions Average balance sheet Corporate sustainability Barclays PLC Annual Report 2007... -

Page 18

...Customer Retail Savings and good performances in Current Accounts, Local Business and Home Finance, partially offset by lower income from loan protection insurance. Enhancements in product offering and continued improvements in processing capacity enabled a strong performance in mortgage origination... -

Page 19

...and higher charges in Larger Business. Barclaycard profit before tax increased to £540m, 18% ahead of the prior year. Steady income relative to 2006 reflected strong growth in Barclaycard International offset by a reduction in UK card extended credit balances as we re-positioned the UK business and... -

Page 20

...per share Dividends per ordinary share Dividend payout ratio Profit attributable to the equity holders of the parent as a percentage of: average shareholders' equity average total assets Cost:income ratio Cost:net income ratio Average United States Dollar exchange rate used in preparing the accounts... -

Page 21

... Dividends per ordinary share Dividend payout ratio Attributable profit as a percentage of: average shareholders' funds average total assets Average United States Dollar exchange rate used in preparing the accounts Average Euro exchange rate used in preparing the accounts The financial information... -

Page 22

... Total liabilities and shareholders' equity Risk weighted assets and capital ratios b Risk weighted assets Tier 1 ratio Risk asset ratio Selected financial statistics Net asset value per ordinary share Year-end United States Dollar exchange rate used in preparing the accounts Year-end Euro exchange... -

Page 23

...and capital ratios Risk weighted assets Tier 1 ratio Risk asset ratio Selected financial statistics Net asset value per ordinary share Year-end United States Dollar exchange rate used in preparing the accounts Year-end Euro exchange rate used in preparing the accounts The financial information shown... -

Page 24

22 Barclays PLC Annual Report 2007 -

Page 25

... 1 Business review International Retail and Commercial Barclaycard Banking £m £m Barclays Global Investors £m Head office functions and other operations £m Analysis of results by business For the year ended 31st December 2007 UK Banking £m Barclays Capital £m Barclays Wealth £m Group... -

Page 26

... products and services and access to the expertise of other Group businesses. Customers are served through a variety of channels comprising the branch network, automated teller machines, telephone banking, online banking and relationship managers. Key facts Number of UK branches 2007 2006... -

Page 27

... joint ventures Profit before tax Balance sheet information Loans and advances to customers Customer accounts Total assets Performance ratios Return on average economic capital Cost:income ratio Cost:net income ratio Other financial measures Risk Tendency Economic profit Risk weighted assets 4,596... -

Page 28

... with customers. Personal Customers and Home Finance provide a wide range of products and services to retail customers, including current accounts, savings and investment products, mortgages branded Woolwich and general insurance. Barclays Financial Planning provides banking, investment products and... -

Page 29

... joint ventures Profit before tax Balance sheet information Loans and advances to customers Customer accounts Total assets Performance ratios Return on average economic capital Cost:income ratio Cost:net income ratio Other financial measures Risk tendency Economic profit Risk weighted assets 2,858... -

Page 30

... leasing and European vendor finance businesses sold in 2006. Average customer accounts grew 4% to £46.4bn (2006: £44.8bn). The asset margin decreased by twelve basis points to 1.80%, reflecting an increased focus on higher quality lending and competitive market conditions. The liabilities margin... -

Page 31

... joint ventures Profit before tax Balance sheet information Loans and advances to customers Customer accounts Total assets Performance ratios Return on average economic capital Cost:income ratio Cost:net income ratio Other financial measures Risk Tendency Economic profit Risk weighted assets 1,738... -

Page 32

.... Key facts Number of Barclaycard UK customers Number of retailer relationships UK credit cards - average outstanding balances UK credit cards - average extended credit balances International average outstanding balance International - average extended credit balances International - cards in issue... -

Page 33

... and joint ventures Profit before tax Balance sheet information Loans and advances to customers Total assets Performance ratios Return on average economic capital Cost:income ratio Cost:net income ratio Other financial measures Risk Tendency Economic profit Risk weighted assets 1,394 1,080 11... -

Page 34

... Banking provides banking services to Barclays personal and corporate customers outside the UK. The products and services offered to customers are tailored to meet customer needs and the regulatory and commercial environments within each country. Key facts Number of distribution points 2007... -

Page 35

... joint ventures Profit before tax Balance sheet information Loans and advances to customers Customer accounts Total assets Performance ratios Return on average economic capital Cost:income ratio Cost:net income ratio Other financial measures Risk Tendency Economic profit Risk weighted assets 1,890... -

Page 36

... accounts, savings, investments, mortgages and loans to our international personal and corporate customers. International Retail and Commercial Banking works closely with all other parts of the group to leverage synergies from product and service propositions. Key facts 2007 2006 2005 Number... -

Page 37

...joint ventures Profit before tax Balance sheet information Loans and advances to customers Customer accounts Total assets Performance ratios Return on average economic capital Cost:income ratio Cost:net income ratio Other financial measures Risk Tendency Economic profit Risk weighted assets 753 425... -

Page 38

... deposit accounts, mortgages, instalment finance, credit cards, bancassurance products and wealth management services. It also offers customised business solutions for commercial and large corporate customers. Key facts Number of branches Number of sales centres Number of distribution points Number... -

Page 39

...asset sales. As expected the impairment charge on loans and advances increased from the very low levels of the prior year, particularly in Absa Home Loans, Absa Card and Retail Banking Services. Operating expenses increased 14% resulting from increased investment in the business in order to support... -

Page 40

..., asset based finance, mortgage backed securities, credit derivatives, structured capital markets and large asset leasing; and Private Equity. Barclays Capital includes Absa Capital, the investment banking business of Absa. Barclays Capital works closely with all other parts of the Group to leverage... -

Page 41

...Balance sheet information Total assets Performance ratios Return on average economic capital Cost:income ratio Cost:net income ratio Compensation:net income ratio Other financial measures Risk Tendency Economic profit Risk weighted assets Average DVaR Average net income generated per member of staff... -

Page 42

...offers structured investment strategies such as indexing, global asset allocation and risk controlled active products including hedge funds and provides related investment services such as securities lending, cash management and portfolio transition services. BGI collaborates with the other Barclays... -

Page 43

... assets Amortisation of intangible assets Operating expenses Profit before tax Balance sheet information Total assets Performance ratios Return on average economic capital Cost:income ratio Other financial measures Economic profit Risk weighted assets Average net income generated per member of staff... -

Page 44

.... We work closely with all other parts of the Group to leverage synergies from client relationships and product capabilities, for example, offering world-class investment solutions with institutional quality products and services from Barclays Capital and Barclays Global Investors. Key facts Total... -

Page 45

... tax Balance sheet information Loans and advances to customers Customer accounts Total assets Performance ratios Return on average economic capital Cost:income ratio Other financial measures Risk Tendency Economic profit Risk weighted assets Average net income generated per member of staff ('000... -

Page 46

... review Analysis of results by business Head office functions and other operations Who we are Head office functions and other operations comprises: Performance 2007/06 Head office functions and other operations loss before tax increased £169m to £428m (2006: £259m). Group segmental reporting... -

Page 47

...cost of hedging the foreign exchange risk on the Group's equity investment in Absa, which amounted to £71m (2005: £37m). The impact of such inter-segment adjustments reduced £72m to £147m (2005: £219m). These adjustments related to internal fees for structured capital market activities of £87m... -

Page 48

... balance sheet growth across a number of businesses. Group net interest income reflects structural hedges which function to reduce the impact of the volatility of short-term interest rate movements on equity and customer balances that do not re-price with market rates. The contribution of structural... -

Page 49

... amount captured as Other. This relates to the benefit of capital excluded from the business margin calculation, Head office functions and other operations and net funding on non-customer assets and liabilities. 2006/05 UK Retail Banking assets margin decreased 11 basis points to 1.32% (2005: 1.43... -

Page 50

... generated from lending fees in Barclays Commercial Bank. Fee income in Barclays Capital increased primarily due to the acquisition of HomEq. Net gain from disposal of available for sale assets Dividend income Net gain from financial instruments designated at fair value Other investment income Net... -

Page 51

... to customers under investment contracts Increase in liabilities to customers under investment contracts Property rentals Loss on part disposal of Monument credit card portfolio Other Other income Certain asset management products offered to institutional clients by Barclays Global Investors are... -

Page 52

... benign wholesale credit environment. This was partially offset by an increase in Barclays Commercial Bank, reflecting higher charges in Medium Business and growth in lending balances. The wholesale and corporate impairment charge was 0.15% (2005 b: 0.19%) as a percentage of year-end total loans and... -

Page 53

... £282m). This was mainly due to lower service costs. UK Banking UK Retail Banking Barclays Commercial Bank Barclaycard IRCB IRCB - ex Absa IRCB - Absa Barclays Capital Barclays Global Investors Barclays Wealth Head office functions and other operations Total Group permanent staff worldwide 41,200... -

Page 54

... front office, systems development and control functions to support continued business expansion. Barclays Global Investors increased staff numbers 400 to 2,700 (2005: 2,300) spread across regions, product groups and support functions, reflecting continued investment to support strategic initiatives... -

Page 55

... and intangible assets arising on acquisition, but excludes preference shares. d Averages for the period will not correspond exactly to period end balances disclosed in the balance sheet. Numbers are rounded to the nearest £50m for presentation purposes only. Barclays PLC Annual Report 2007 53 -

Page 56

... in the balance sheet and the mix of securities lending activity. UK Banking UK Retail Banking Barclays Commercial Bank Barclaycard IRCB IRCB - ex Absa IRCB - Absa Barclays Capital Barclays Global Investors Barclays Wealth Head office functions and other operations Total assets Risk weighted assets... -

Page 57

... the rate of balance sheet growth driven by changes in the mix of lending and growth in guarantees. Head office functions and other operations total assets decreased 24% to £7.1bn (2005: £9.3bn). Risk weighted assets decreased 53% to £1.9bn (2005: £4.0bn). Barclays PLC Annual Report 2007 55 -

Page 58

...) staff shares of £1 each. Called up share capital increased by £17m representing the nominal value of shares issued to Temasek Holdings, China Development Bank (CDB) and employees under share option plans largely offset by a reduction in nominal value arising from share buy-backs. Share premium... -

Page 59

... equivalent risk weighted assets of £28.4bn attributable to operational risk. The reduced risk weighted assets attributable to credit risk were mainly driven by recognition of the low risk profile of first charge residential mortgages in UK Retail Banking and Absa and the use of internal models to... -

Page 60

Financial review Capital resources and deposits Total net capital resources Basel II 2007 £m Barclays PLC Group Barclays PLC Group Basel I 2007 £m Barclays Bank PLC Group Barclays PLC Group Basel I 2006 £m Barclays Bank PLC Group Barclays PLC Group Basel I 2005 £m Barclays Bank PLC Group ... -

Page 61

... bearing Savings accounts Other time deposits Total repayable in offices outside the United Kingdom 294,987 256,754 238,684 Negotiable certificates of deposit Negotiable certificates of deposits are issued mainly in the UK and US, generally in denominations of not less than US$100,000. 2007... -

Page 62

... 283 191,834 Payments due by period Less than one year £m Between one to three years £m Between three to five years £m After five years £m Total £m Long-term debt Operating lease obligations Purchase obligations Total The long-term debt does not include undated loan capital of £6,631m. 90... -

Page 63

...Other public bodies Mortgage and asset backed securities Corporate issuers Other issuers Equity securities Investment securities - available for sale Other securities - held for trading Debt securities: United Kingdom government Other government Mortgage and asset backed securities Bank and building... -

Page 64

... transaction prices where available. Assets stated at fair value Trading portfolio assets Financial assets designated at fair value: - held on own account - held in respect of linked liabilities to customers under investment contracts Derivative financial instruments Available for sale financial... -

Page 65

... losses incurred in the loan portfolios as at the balance sheet date. Changes to the allowances for loan impairment and changes to the provisions for undrawn contractually committed facilities and guarantees provided are reported in the consolidated income statement as part of the impairment charge... -

Page 66

... reflects long-term expectations of both earnings and retail price inflation. The difference between the fair value of the plan assets and the present value of the defined benefit obligation at the balance sheet date, adjusted for any historic unrecognised actuarial gains or losses and past service... -

Page 67

... 79% of the capital structure. The initial WAL of the notes in issue averaged 7.1 years. The full contractual maturity is 37.8 years. In the ordinary course of business and primarily to facilitate client transactions, the Group enters into transactions which may involve the use of off-balance sheet... -

Page 68

...fair value within trading portfolio assets. The credit risk on this note has been transferred to a third party investment bank. For the remaining facilities, the amount drawn totalled £152m and is included on the balance sheet within loans and advances to customers and included in the credit market... -

Page 69

... review Other credit market exposures Barclays Capital held other exposures impacted by the turbulence in credit markets, including: whole loans and other direct and indirect exposures to US sub-prime and Alt-A borrowers; exposures to monoline insurers; and commercial mortgage backed securities... -

Page 70

Financial review Average balance sheet Average balance sheet and net interest income (year ended 31st December) 2007 Average balance a £m Interest £m Average rate % Average balance a £m 2006 Interest £m Average rate % Average balance a £m 2005 Interest £m Average rate % Assets Loans and ... -

Page 71

...in offices outside the United Kingdom Customer accounts: other time deposits - wholesale: - in offices in the United Kingdom - in offices outside the United Kingdom Debt securities in issue: - in offices in the United Kingdom - in offices outside the United Kingdom Dated and undated loan capital and... -

Page 72

... outside the UK 1,760 881 2,641 Total interest receivable: - in offices in the UK - in offices outside the UK 7,561 3,106 10,667 Note a 2004 figures do not reflect the applications of IAS 32 and IAS 39 and IFRS 4 which became effective from 1st January 2005. 70 Barclays PLC Annual Report 2007 -

Page 73

... - other time deposits - retail: - in offices in the UK - in offices outside the UK Customer accounts - other time deposits - wholesale: - in offices in the UK - in offices outside the UK Debt securities in issue: - in offices in the UK - in offices outside the UK Dated and undated loan capital and... -

Page 74

... back on track. We are also testing a new product, Barclaycard Freedom, which combines a credit card and the features of a structured loan, making it easier for people to manage their borrowing and keep their interest payments down. Customer service We have a strategic priority to be the best bank... -

Page 75

... into the consumer market with new lower-carbon products and services. An example is Barclaycard Breathe, a new card that gives consumers incentives when they buy green products, and donates half its profits to environmental projects. In the wholesale market we have Barclays Capital's commitment to... -

Page 76

... to new areas of commodities business and the fee structure for Barclaycard. The Community Partnerships Committee, chaired by Gary Hoffman, sets the policy and provides governance for our global community investment programmes, and the Environmental Steering Group gives direction and governance to... -

Page 77

... Operational risk management Organisation and structure Measurement and capital modelling Operational risk events 107 109 109 109 110 Financial crime risk management Anti-money laundering and sanctions Fraud Security 111 111 112 112 Statistical information 113 Barclays PLC Annual Report 2007... -

Page 78

76 Barclays PLC Annual Report 2007 -

Page 79

... and Advances to Customers Analysis of LTV Ratios of Mortgages in UK Home Loan Portfolio (at most recent sanction) Loans and Advances, Balances and Limits to Wholesale Customers by Internal Risk Rating (%) Credit Exposure to Sub-Investment Grade Countries Maturity Analysis of Loans and Advances to... -

Page 80

... rates, credit spreads, commodity prices, equity prices and foreign exchange rates. The main market risk arises from trading activities. The Group is also exposed to interest rate risk in the banking book and market risk in the pension fund. Operational risk Operational risk is the risk of direct... -

Page 81

... as part of the Group's formal governance processes and are reviewed by the Executive Committee, Group Finance Director and the Board Risk Committee; - the tax charge is also reviewed by the Board Audit Committee; - the tax risks of proposed transactions or new areas of business are fully considered... -

Page 82

... charge. After many years of positive economic conditions in South Africa, the wholsesale portfolios will be under more stress in current market conditions. Loan loss rates across the Western Europe and Emerging Markets wholesale businesses were stable in 2007. The Group continued to invest in risk... -

Page 83

... product mix. Higher market volatilities in the fourth quarter led to an increase in DVaR at year end, and will contribute to higher average DVaRs in 2008. Liquidity risk Bank funding markets and general liquidity in credit markets came under pressure in 2007. In the second half, some money market... -

Page 84

... process of aggregation and broad review by businesses and risk across the Group (page 83). Barclays Risk methodologies include systems that enable the Group to measure, aggregate and report risk for internal and regulatory purposes. As an example, our credit grading models produce Internal Ratings... -

Page 85

... Heads Business Risk Directors Retail Credit risk Corporate/ Wholesale Credit risk Market risk Operational risk All other risks UK Banking Barclays Capital Barclaycard International Retail and Commercial Bank Barclays Wealth Barclays Global Investors x Barclays PLC Annual Report... -

Page 86

... with Group risk appetite. - Debates and agrees actions on the risk profile and risk strategy across the Group. - Considers issues escalated by Risk Type Heads and Business Risk Directors. Treasury Committee - Sets policy/controls for liquidity, maturity transformation and structural interest rate... -

Page 87

... securitisation plans Principal Risks Retail Credit Wholesale Credit Market Capital Liquidity Financial Crime Operations Technology People Regulatory Financial Reporting Legal Taxation Other Level 1 Risks Strategic Change Corporate Responsibility Brand Management Barclays PLC Annual Report 2007... -

Page 88

..., the Group sets limits for business capital demand to ensure the capital management objectives including meeting internal targets will continue to be met over the medium-term period. Treasury Committee reviews the limits on a monthly basis. Risk Appetite concepts (diagram not to scale) Mean Loss... -

Page 89

... of the business to direct, assess, control, report, and manage and challenge the risks in the business accurately. Group Risk supports the planning process by providing robust review and challenge of the business plans to ensure that: - The figures relating to risk are internally consistent and... -

Page 90

...07 06 1,450 Barclays Capital Barclays Global Investors Barclays Wealth Head office functions and other operations d 07 UK Retail Banking Barclays Commercial Bank Barclaycard International Retail and Commercial Banking - Absa International Retail and Commercial Banking - ex Absa Group Centre... -

Page 91

1 Business review Model governance Barclays has a large number of models in place across the Group, covering all risk types. To minimise the risk of loss through model failure, a Group Policy for the Control of Model Risk has been developed. The Policy helps reduce the potential for model failure by... -

Page 92

..., the Group Retail Credit Risk Management Committee, the Risk Oversight Committee and the Board Risk Committee (see page 84 for more details of this Committee). The Board Audit Committee also reviews the impairment allowance as part of financial reporting. 90 Barclays PLC Annual Report 2007 -

Page 93

...Business review Measurement, reporting and internal ratings The principal objective of credit risk measurement is to produce the most accurate possible quantitative assessment of the credit risk to which the Group is exposed, from the level of individual facilities up to the total portfolio. The key... -

Page 94

... economic conditions that may determine, for example, the prices that can be realised for assets, whether a businesses can readily be refinanced or the availability of a repayment source for personal customers. The ratings process The term 'internal ratings' usually refers to internally calculated... -

Page 95

...final trigger of default. Our retail banking operations have long and extensive experience of using credit models in assessing and managing risk in their businesses and as a result models play an integral role in retail approval and customer management (e.g. limit setting, cross-sell etc.) processes... -

Page 96

...Risk Tendency increased £90m, reflecting a weakening of retail credit conditions in South Africa after a series of interest rate rises in 2006 and 2007 and balance sheet growth. Risk Tendency in Barclays Capital increased £45m to £140m (2006: £95m) primarily due to drawn leveraged loan positions... -

Page 97

... taken to address performance are appropriate and timely. Metrics reviewed will consider portfolio composition at both an overall stock and new flow level. The Wholesale Credit Risk Management Committee (WCRMC) oversees wholesale exposures, comprising lending to businesses, banks and other financial... -

Page 98

... % Home loans Financial services Other personal Business and other services Wholesale and retail trade, distribution and leisure Property Manufacturing Finance lease receivables Energy and water Transport Construction Postal and Communication Agriculture, forestry and fishing Government 0 5 10... -

Page 99

... in the limit or, if there has been no increase, at inception of the loan. Business flows (new business versus loans redeemed) have not materially changed the risk profile of the portfolio. The impact of house price inflation will result in a reduction in LTV ratios within the mortgage book on... -

Page 100

... in parts of UK Retail Banking, Barclays Wealth, International Retail and Commercial Banking and Barclaycard. The approach is consistent with the Group's policy of raising a collective impairment allowance as soon as objective evidence of impairment is identified. Potential credit risk loans If the... -

Page 101

.... The decrease in these ratios reflected a change in the mix of CRLs and PCRLs. Unsecured retail exposures, where the recovery outlook is low, decreased as a proportion of the total as the collections and underwriting processes were improved. Secured retail and wholesale and corporate exposures... -

Page 102

... Fig. 17: Impairment/provisions charges over five years £m 2,795 1,347 1,093 03 UK GAAP 04 a UK Banking Barclaycard International Retail and Commercial Banking Barclays Capital Barclays Global Investors Barclays Wealth Head office functions and other operations Total impairment charges 252 846... -

Page 103

.... Arrears in some of International Retail and Commercial Banking - Absa's key retail portfolios deteriorated in 2007, driven by interest rate increases in 2006 and 2007 resulting in pressure on collections. Wholesale and corporate impairment charges on loans and advances increased £436m to £701m... -

Page 104

..., credit spreads, commodity prices, equity prices and foreign exchange rates. The main market risk arises from trading activities. Barclays is also exposed to interest rate risk in the banking book and the pension fund. Barclays market risk objectives are to: - Understand and control market risk by... -

Page 105

... Risk Director for review. Risk type Traded ...managed by Barclays Capital and reviewed by market risk and...- Traded Products Risk Review Meeting Non-traded - Banking book interest rate risk - FX risk Global Retail and Commercial Banking - Asset and Liability Committees - New product process... -

Page 106

... operations in Global Retail and Commercial Banking to support and facilitate client activity. This is minimised in accordance with modest risk limits and was not material as at end 2007. Other non-Barclays Capital foreign exchange exposure is covered in Note 46. Asset management structural market... -

Page 107

...the credit risk of an asset (the reference asset) is transferred from the buyer to the seller of protection. A credit default swap is a contract where the protection seller receives premium or interest-related payments in return for contracting to make payments to the protection buyer upon a defined... -

Page 108

... a combination of recognised market observable prices, exchange prices, and established inter-commodity relationships. Further information on fair value measurement of financial instruments can be found in Note 49. Credit risk Credit risk exposures are actively managed by the Group. Refer to Note 47... -

Page 109

... by short term mismatch limits for the next day, week and month which control expected cash flows to ensure that requirements can be met. These requirements include replenishment of funds as they mature or are borrowed by customers. The Group maintains an active presence in global money markets and... -

Page 110

... accounts form a stable funding base for the Group's operations and liquidity needs. The Group policy is to fund the balance sheet of the retail and commercial bank on a global basis with customer deposits without recourse to the wholesale markets. This provides protection from the liquidity risk... -

Page 111

...and is a member of the Operational Risk Data Exchange (ORX), an association of international banks that share anonymised loss data information to assist in risk identification, assessment and modelling. By combining internal data, including internal loss experience, risk and control assessments, key... -

Page 112

...for the majority of losses by value (figure 4), with Execution, Delivery and Process Management accounting for 52% of total operational risk losses and External Fraud accounting for 24%. This again was consistent with 2006 internal risk events and, from our analysis of external data, is in line with... -

Page 113

... Committee and the Policy Review Forum) review business performance, share intelligence, develop and agree controls, and discuss emerging themes and the implementation status of policies and procedures. All businesses contribute towards the Group Money Laundering Reporting Officers Annual Report... -

Page 114

... screening process to protect the bank from those people who want to harm the organisation, by either joining as staff members or becoming involved with its operations. Security Risk is regularly reported by the businesses and reviewed via the Security Risk Management Committee, whose objectives are... -

Page 115

... UK Retail Banking Barclays Commercial Bank Barclaycard International Retail and Commercial Banking International Retail and Commercial Banking - excluding Absa International Retail and Commercial Banking - Absa Barclays Capital Barclays Wealth Head office functions and other operations a Risk... -

Page 116

... Property Government Energy and water Wholesale and retail, distribution and leisure Transport Postal and communication Business and other services Home loans b Other personal Overseas customers c Finance lease receivables Loans and advances to customers excluding reverse repurchase agreements... -

Page 117

... December Financial services Agriculture, forestry and fishing Manufacturing Construction Property Government Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans b Other personal Overseas customers c Finance lease... -

Page 118

... Manufacturing Construction Property Government Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans b Other personal Finance lease receivables Loans and advances to customers in the United States See note under... -

Page 119

...2006 and 2005, there were no countries where Barclays had cross-currency loans to borrowers between 0.75% and 1% of total Group assets. Note a In the UK, finance lease receivables are included in 'Other lending', although some leases are to corporate customers. Barclays PLC Annual Report 2007 117 -

Page 120

Risk management Statistical information Table 13: Off-balance sheet and other credit exposures as at 31st December 2007 £m 2006 £m 2005 £m Off-balance sheet exposures Contingent liabilities Commitments On-balance sheet exposures Trading portfolio assets Financial assets designated at fair value... -

Page 121

1 Business review Table 16: Credit risk loans IFRS UK GAAP 2005 £m 2004 a £m 2003 £m 2007 £m 2006 £m At 31st December Impaired loans: b United Kingdom Other European Union United States Africa Rest of the World Total Non-accrual loans: United Kingdom Other European Union United States Africa ... -

Page 122

... under the original contractual terms United Kingdom Rest of the World Total 340 91 431 357 70 427 304 52 356 Interest income of approximately £48m (2006: £72m, 2005: £29m) from such loans was included in profit, of which £26m (2006: £49m, 2005: £20m) related to domestic lending and the... -

Page 123

1 Business review Table 20: Impairment/provisions charges ratios ('Loan loss ratios') IFRS 2007 % 2006 % 2005 % 2004 a % UK GAAP 2003 % Impairment/provisions charges as a percentage of average loans and advances for the year: Specific provisions charge General provisions charge Impairment charge ... -

Page 124

... 15 16 18 222 217 9 14 4 11 255 95 7 10 1 - 113 Notes a Does not reflect the application of IAS 32, IAS 39 and IFRS 4 which became effective from 1st January 2005. b Does not reflect the impairment of available for sale assets or other credit risk provisions. 122 Barclays PLC Annual Report 2007 -

Page 125

... £m United Kingdom: Financial services Agriculture, forestry and fishing Manufacturing Construction Property Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans Other personal Overseas customers c Finance lease... -

Page 126

... % United Kingdom: Financial services Agriculture, forestry and fishing Manufacturing Construction Property Energy and water Wholesale and retail distribution and leisure Transport Postal and communication Business and other services Home loans Other personal b Overseas customers c Finance lease... -

Page 127

...a change in the mix of credit risk loans and potential credit risk loans: unsecured retail exposures, where the recovery outlook is relatively low, decreased as a proportion of the total as the collections and underwriting processes were improved. Secured retail and wholesale and corporate exposures... -

Page 128

... the non-banking financial services industry and focuses on enhancing consumer protection and regulating market conduct. In the United States, Barclays PLC, Barclays Bank PLC, and certain US subsidiaries and branches of the Bank are subject to a comprehensive regulatory structure, involving numerous... -

Page 129

Governance Board and Executive committee Directors' report Corporate governance report Remuneration report Accountability and audit 128 130 133 144 159 2 Governance Barclays PLC Annual Report 2007 127 -

Page 130

.... Daniël retired as Chairman of Absa on 1st July 2007 and from the Absa Board on 31st July 2007. He is currently a Director of TSB Sugar RSA Limited and Sappi Limited. He is a member of the Board Risk Committee. Daniël does not intend to seek re-election at the 2008 Annual General Meeting and will... -

Page 131

... Group Finance Director Executive Director and member of Executive Committee (Age 47) Chris joined the Board on 1st April 2007. Chris came from PricewaterhouseCoopers LLP, where he was UK Head of Financial Services and Global Head of Banking and Capital Markets. He was Global Relationship Partner... -

Page 132

... report by reference. Profit Attributable The profit attributable to equity shareholders of Barclays PLC for the year amounted to £4,417m, compared with £4,571m in 2006. Dividends The final dividends for the year ended 31st December 2007 of 22.5p per ordinary share of 25p each and 10p per staff... -

Page 133

... Group is a major global financial services provider engaged in retail and commercial banking, credit cards, investment banking, wealth management and investment management services. The Group operates through branches, offices and subsidiaries in the UK and overseas. Community Involvement Barclays... -

Page 134

... grown rapidly and comprises a blend of retail and commercial banking, operating 32 branches and dealing with a range of corporate and wholesale clients. As at 31st December 2007, Expobank had net assets of $186m (£93m). The Auditors The Board Audit Committee reviews the appointment of the external... -

Page 135

... US companies listed on the NYSE. As our main listing is on the London Stock Exchange, we follow the UK's Combined Code. Key differences between the NYSE Rules and the Code are set out later in this report. 2 Governance Marcus Agius Group Chairman 7th March 2008 Barclays PLC Annual Report 2007... -

Page 136

.... The Group Chairman works closely with the Company Secretary to ensure that accurate, timely and clear information flows to the Board. Supporting papers for scheduled meetings are distributed the week before each meeting. Directors may also access electronic copies of meeting papers and other key... -

Page 137

... and Implementation Monitoring 39% 2 Operational and Financial Performance 27% 3 Governance and Risk 9% 4 M&A 16% 5 Other 9% Geographical mix (main experience) of non-executive Directors 1 2 3 4 UK 8 Continental Europe 1 US 1 Other 2 5 4 3 2 1 4 3 2 1 Barclays PLC Annual Report 2007 135 -

Page 138

... Directors. At the date of this report, the Board is comprised of the Group Chairman, five executive Directors and 12 non-executive Directors. The balance of the Board is illustrated by the chart below left. The Board Corporate Governance and Nominations Committee is responsible for reviewing... -

Page 139

...Directors at scheduled Board and Committee meetings in 2007. Board Board HR & Corporate Remuner- Governance & ation Nominations Committee Committee 4 2 Independent Number of scheduled meetings Board 8 Board Audit Committee 8 Board Risk Committee 4 Group Chairman Marcus Agius Executive Directors... -

Page 140

....com There are a number of regular attendees at each meeting, including the Group Chief Executive, Group Finance Director, Barclays Internal Audit Director, Barclays Risk Director, Barclays General Counsel and the lead external audit partner. The Board Audit Committee members meet with the external... -

Page 141

... of financial statements Barclays has in place a strong governance process to support its framework of disclosure controls and procedures. That process, in which the Board Audit Committee plays a key role, is illustrated below. Legal and Technical Review Committee - Reviews the annual results... -

Page 142

... - reviewed succession plans for the Executive Committee and the position of Group Chief Executive. Board Risk Committee allocation of time 1 2 3 4 5 Risk profile/Risk appetite 40% Key Risk issues 40% Internal control/Risk policies 3% Regulatory frameworks 12% Other 5% Board Corporate Governance... -

Page 143

...Group Finance Director. Members include the Company Secretary, Barclays General Counsel, Head of Investor Relations, Barclays Risk Director, Head of Corporate Affairs, Financial Controller and Treasurer. The Committee: - considers and reviews the preliminary and interim results, Annual Report/Annual... -

Page 144

... and Board Risk Committees during the year to observe at first hand how these Committees operate and the key issues they examine. Marcus Agius Barclays businesses and operations During 2007, two off-site Board meetings were held. In March, the Board met at the New York offices of Barclays Capital... -

Page 145

...number of 'values based' business conduct and ethics policies, which apply to all employees. In addition, we have adopted a Code of Ethics for the Group Chief Executive and senior financial officers as required by the US Securities and Exchange Commission. Shareholder approval of equity-compensation... -

Page 146

... development. The Committee's terms of reference are available in the Corporate Governance section of the Barclays Investor Relations website (www.aboutbarclays.com). The Committee meets a minimum of four times a year. Marcus Agius became a member of the Committee on 1st January 2007. Marcus Agius... -

Page 147

... Directors comprises: - base salary; - annual bonus including mandatory deferral into Barclays shares through the Executive Share Award Scheme (ESAS); - long-term incentives through the Performance Share Plan (PSP); and - pension and other benefits. 2 Governance Total Shareholder Return £ Year... -

Page 148

... leading international banks and financial services organisations, and other companies of similar size to Barclays in the FTSE 100 Index. The component parts for each executive Director are detailed in the tables accompanying this report. The Committee guideline that executive Directors should hold... -

Page 149

... value creation for shareholders. ESAS is a deferred share award plan which operates in conjunction with the annual Barclays Group cash bonus plans (and various other cash long-term incentive plans operated by Barclays Group companies). Currently, for executive Directors, typically 75% of the annual... -

Page 150

Corporate governance Remuneration report EP comprises profit after tax and minority interests less a capital charge. Independent confirmation is provided to the Committee as to whether a performance condition has been met. Each year a review of the Group's share-based long-term incentives (... -

Page 151

... Barclays Global Investors UK Holdings Limited (BGI Holdings) within an overall cap of 20% of the issued ordinary share capital of BGI Holdings. All grants of options are approved by the Committee. The Committee is also advised of option exercises and share sales by employees. Directors of Barclays... -

Page 152

... to the accounts respectively. Replacement of the BGI EOP The Group will introduce a new BGI employee share plan in 2008, under which awards will be made using Barclays PLC shares purchased in the market. The quantum of awards will be linked to BGI business performance. Executive Directors will not... -

Page 153

... of Barclays Group, Barclays Capital, Barclays Global Investors and Barclays Wealth, both on an absolute and industry relative basis. The composition of this package continues to be heavily weighted towards elements that are 'at risk' and reflects practice in the investment banking and investment... -

Page 154

...of the applicable pension fund are reviewed annually. Pensions increase by a minimum of the increase in the retail prices index (up to a maximum of 5%), subject to the scheme rules. b The transfer values have been calculated in a manner consistent with the Retirement Benefit Scheme - Transfer Values... -

Page 155

...as at 2nd April 2007, the first working day after he was appointed executive Director. g The notional value is based on the share price as at 31st December 2007. The highest and lowest market prices per share during the year were £7.90 and £4.775 respectively. Barclays PLC Annual Report 2007 153 -

Page 156

Corporate governance Remuneration report Executive Directors: shares provisionally allocated and shares under option under ESAS a, h, i, j During 2007 Number at 1st January 2007 Awarded in respect of the results for 2006 Market price on Release date £ Market price on Exercise date £ Bonus shares ... -

Page 157

...respect of Chris Lucas, the price used to convert the present fair value of the award to a number of shares was £7.23, which was the price at which shares were purchased in the market to fund the award. c The price shown is the mid-market closing price on the date of the award. d The details of the... -

Page 158

Corporate governance Remuneration report Executive Directors: shares under option under Sharesave a During 2007 Information as at 31st December 2007 Weighted average exercise price of outstanding options £ Number held at 1st January 2007 Granted Exercised Exercise price per share £ Market ... -

Page 159

... a Director of Barclays PLC at that time. The BGI EOP is an option plan, approved by shareholders in 2000 and offered predominantly to participants in the US. Under the BGI EOP, participants receive an option to purchase shares in Barclays Global Investors UK Holdings Limited. The exercise price is... -

Page 160

...As at 1st January 2007 and 31st December 2007, Robert E Diamond Jr held 200,000 'A' ordinary shares in Barclays Global Investors UK Holdings Limited. f Appointed as an executive Director on 1st April 2007. g Appointed as a non-executive Director on 1st May 2007. 158 Barclays PLC Annual Report 2007 -

Page 161

... to internal control and details Group policies and processes. The GICAF is reviewed and approved on behalf of the Group Chief Executive by the Group Governance and Control Committee. Quarterly risk reports are made to the Board covering risks of Group significance including credit risk, market risk... -

Page 162

... and reported within the time periods specified in the US Securities and Exchange Commission's rules and forms. As of the date of the evaluation, the Group Chief Executive and Group Finance Director concluded that the design and operation of these disclosure controls and procedures were effective... -

Page 163

... statement Consolidated balance sheet Statement of recognised income and expense Consolidated cash flow statement Parent company accounts Notes to the accounts Barclays Bank PLC accounts 162 163 164 165 165 174 176 177 178 179 180 182 266 3 Financial statements Barclays PLC Annual Report 2007... -

Page 164

... public limited company and its name was changed from Barclays Bank International Limited to Barclays Bank PLC. All of the issued ordinary share capital of Barclays Bank PLC is owned by Barclays PLC. The Annual Report for Barclays PLC also contains the consolidated accounts of, and other information... -

Page 165

... whether the board's statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the Company's or Group's corporate governance procedures or its risk and control procedures. We read other information contained in the Annual Report and consider whether... -

Page 166

... Registered Public Accounting Firm's report Report of Independent Registered Public Accounting Firm to the Board of Directors and Shareholders of Barclays PLC In our opinion, the accompanying Consolidated income statements and the related Consolidated balance sheets, Consolidated statements of... -

Page 167

... held at fair value through profit or loss, are reported as part of the fair value gain or loss. Translation differences on equities classified as available for sale financial assets and non-monetary items are included directly in equity. 3 Financial statements Barclays PLC Annual Report 2007 165 -

Page 168

... the date on which the Group commits to purchase or sell the asset. The fair value option is used in the following circumstances: (i) financial assets backing insurance contracts and financial assets backing investment contracts are designated at fair value through profit or loss because the related... -

Page 169

... best information available, for example by reference to similar assets, similar maturities or other analytical techniques. 8. Impairment of financial assets The Group assesses at each balance sheet date whether there is objective evidence that loans and receivables or available for sale financial... -

Page 170

... income. 10. Securitisation transactions Certain Group undertakings have issued debt securities or have entered into funding arrangements with lenders in order to finance specific loans and advances to customers. All financial assets continue to be held on the Group balance sheet, and a liability... -

Page 171

... the balance sheet. 12. Hedge accounting Derivatives are used to hedge interest rate, exchange rate, commodity, and equity exposures and exposures to certain indices such as house price indices and retail price indices related to non-trading positions. Where derivatives are held for risk management... -

Page 172

Consolidated accounts Barclays PLC Accounting policies The Group uses the following annual rates in calculating depreciation: Freehold buildings and long-leasehold property (more than 50 years to run) Leasehold property (less than 50 years to run) Costs of adaptation of freehold and leasehold ... -

Page 173

... is included in shareholders' equity. 19. Insurance contracts and investment contracts The Group offers wealth management, term assurance, annuity, property and payment protection insurance products to customers that take the form of long- and short-term insurance contracts. The Group classifies its... -

Page 174

... statement on a straight-line basis over the lease term unless another systematic basis is more appropriate. 21. Employee benefits The Group provides employees worldwide with post-retirement benefits mainly in the form of pensions. The Group operates a number of pension schemes which may be funded... -

Page 175

...the holding or placing of assets on behalf of individuals, trusts, retirement benefit plans and other institutions. These assets and income arising thereon are excluded from these financial statements, as they are not assets of the Group. 3 Financial statements Barclays PLC Annual Report 2007 173 -

Page 176

...in loss of control will no longer be recognised in the income statement but directly in equity. In 2007, gains of £23m and losses of £6m were recognised in income relating to such transactions. - IFRIC 13 - Customer Loyalty Programs addresses accounting by entities that grant loyalty award credits... -

Page 177

... in 1994 it has grown rapidly and comprises a blend of retail and commercial banking, operating 32 branches and dealing with a range of corporate and wholesale clients. As at 31st December 2007, Expobank had net assets of $186m (£93m). 3 Financial statements Barclays PLC Annual Report 2007 175 -

Page 178

...17.40 £m 1 Interim dividend paid Proposed final dividend The Board of Directors approved the accounts set out on pages 165 to 265 on 7th March 2008. The accompanying notes form an integral part of the Consolidated accounts. 1 768 1,485 666 1,307 582 1,105 176 Barclays PLC Annual Report 2007 -

Page 179

Consolidated accounts Barclays PLC Consolidated balance sheet Consolidated balance sheet As at 31st December Notes 2007 £m 2006 £m Assets Cash and balances at central banks Items in the course of collection from other banks Trading portfolio assets Financial assets designated at fair value: - ... -

Page 180

... accounts Barclays PLC Consolidated statement of recognised income and expense Consolidated statement of recognised income and expense For the year ended 31st December 2007 £m 2006 £m 2005 £m Available for sale reserve: - Net gains/(losses) from changes in fair value - Losses transferred... -

Page 181

...-cash movements Changes in operating assets and liabilities: Net increase in loans and advances to banks and customers Net increase in deposits and debt securities in issue Net (increase)/decrease in derivative financial instruments Net increase in trading portfolio assets Net (decrease)/increase in... -

Page 182

...of Barclays PLC Parent company accounts Income statement For the year ended 31st December 2007 £m 2006 £m 2005 £m Dividends received from subsidiary Interest income Trading loss Other income Management charge from subsidiary Profit before tax Tax Profit after tax The Company had no staff during... -

Page 183

... December 2007 or 2006 to significant risks arising from the financial instruments it holds; which mainly comprised cash and balances with central banks. Dividends received are treated as operating income. The accompanying notes form an integral part of the accounts. Barclays PLC Annual Report 2007... -

Page 184

... 22.5p per ordinary share of 25p each and 10p per staff share of £1 each, amounting to a total of £1,485m, which will be paid on 25th April 2008. The financial statements for the year ended 31st December 2007 do not reflect these dividends, which will be accounted for in shareholders' equity as an... -

Page 185

4 Principal transactions 2007 £m 2006 £m 2005 £m Rates related business Credit related business Net trading income Net gain from disposal of available for sale assets Dividend income Net gain from financial instruments designated at fair value Other investment income Net investment income ... -

Page 186

... relating to corporate finance transactions entered into or proposed to be entered into by or on behalf of the Company or any of its associates Other Total auditors' remuneration 7 12 6 - - - 25 - - 2 - - 2 4 - - - 8 - - 8 - - - - 5 2 7 7 12 8 8 5 4 44 184 Barclays PLC Annual Report 2007 -

Page 187

...advice relating to transactions and other tax planning and advice. Services relating to corporate finance transactions comprise due diligence related to transactions and accounting consultations and audits in connection with such transactions. 3 Financial statements Barclays PLC Annual Report 2007... -

Page 188

... within Absa Group Limited and Barclays Global Investors UK Holdings Limited. The weighted average number of ordinary shares excluding own shares held in employee benefit trusts and shares held for trading, is adjusted for the effects of all dilutive potential ordinary shares, totalling 177 million... -

Page 189

...changes in credit risk for loans and advances designated at fair value was £401m in 2007 (2006: £nil; 2005; £nil). The gains or losses on related credit derivatives was £4m for the year (2006: £nil; 2005; £nil). 3 Financial statements The cumulative net loss attributable to changes in credit... -

Page 190

...fair values of derivative financial assets and liabilities can fluctuate significantly. The fair value of a derivative contract represents the amount at which that contract could be exchanged in an arms-length transaction, calculated at market rates current at the balance sheet date. The fair values... -

Page 191

... in issue, fixed rate loans to banks and customers and investments in fixed rate debt securities held. Currency derivatives are primarily designated as hedges of the foreign currency risk of net investments in foreign operations. The Group's total derivative asset and liability position as reported... -

Page 192

...Loans and advances to banks Less: Allowance for impairment Loans and advances to banks Loans and advances to customers Less: Allowance for impairment Loans and advances to customers 40,123 (3) 40,120 349,167 (3,769) 345,398 30,930 (4) 30,926 285,631 (3,331) 282,300 190 Barclays PLC Annual Report... -

Page 193

... 12 months after the balance sheet date; and balances of £1,291m (2006: £785m) expected to be recovered more than 12 months after the balance sheet date. Other assets comprise £3,966m (2006: £4,097m) of receivables which meet the definition of financial assets. Barclays PLC Annual Report 2007... -

Page 194

... tax account is as follows: 2007 £m 2006 £m At beginning of year Income statement credit/(charge) Equity Available for sale investments Cash flow hedges Share-based payments Other equity movements Acquisitions and disposals Exchange and other adjustments At end of year Deferred tax assets and... -

Page 195

... adjustments to prior year tax provisions. The forthcoming change in the UK rate of corporation tax from 30% to 28% on 1st April 2008 led to an additional tax charge in 2007 as a result of its effect on the Group's net deferred tax asset. 3 Financial statements Barclays PLC Annual Report 2007 193 -

Page 196

... £m Property, plant and equipment Financial investments Trading portfolio assets Loans to banks and customers Other assets Total assets Deposits from banks and customers Trading portfolio liabilities Other liabilities Shareholders' equity Total liabilities Net income Operating expenses Profit... -

Page 197

...£m UK Banking Barclaycard International Retail and Commercial Banking Barclays Capital Barclays Global Investors Barclays Wealth Goodwill 3,131 400 1,682 147 1,261 393 7,014 3,132 403 1,481 86 673 317 6,092 The Barclays Financial Planning business previously managed and reported within Barclays... -

Page 198

... (261) 1,506 (172) (136) (7) 24 (291) 1,215 Impairment charges reflect the impairment of certain IT assets where the future economic benefit did not exceed the carrying value. Impairment charges detailed above have been included within other operating expenses. 196 Barclays PLC Annual Report 2007 -

Page 199

... finance leases. See Note 37. In 2007 the value of an existing office building in the UK property portfolio was impaired by £2m reflecting local market conditions that had prevented its disposal in the year. In 2008 the freehold of the building will be disposed of by a short- or long-term leaseback... -

Page 200

... is the insured risk, advances in medical care and social conditions are the key factors that increase longevity. The Group manages its exposure to risk by operating in part as a unit-linked business, prudent product design, applying strict underwriting criteria, transferring risk to reinsurers... -

Page 201

... programmes are in place to restrict the amount of cover to any single life. The reinsurance cover is spread across highly rated companies to diversify the risk of reinsurer solvency. Net insurance reserves include a margin to reflect reinsurer credit risk. Barclays PLC Annual Report 2007... -

Page 202

... for a further period of five years. i These Notes bear a fixed rate of interest until 2015. After that date, in the event that the Notes are not redeemed, the coupon will be reset to a fixed margin over a reference gilt rate for a further period of five years. 200 Barclays PLC Annual Report 2007 -

Page 203

... or mandatory interest. Any repayments require the prior notification to the FSA. All issues of undated loan capital have been made in the eurocurrency market and/or under Rule 144A, and no issues have been registered under the US Securities Act of 1933. Barclays PLC Annual Report 2007 201 -

Page 204

...the accounts For the year ended 31st December 2007 27 Subordinated liabilities (continued) (b) Dated loan capital Dated loan capital, issued by the Bank for the development and expansion of the Group's business and to strengthen its capital base, by Barclays Bank Spain SA (Barclays Spain), Barclays... -

Page 205

... time of conversion, should Barclays Zambia experience pre-tax losses in excess of its retained earnings and other capital surplus accounts. q The dividends are compounded and payable semi-annually in arrears on 30th September and 31st March of each year. The shares were issued by Absa Group Limited... -

Page 206

... to the accounts For the year ended 31st December 2007 27 Subordinated liabilities (continued) The 7.4% Subordinated Notes 2009 (the '7.4% Notes') issued by the Bank have been registered under the US Securities Act of 1933. All other issues of dated loan capital by the Bank, Barclays Spain, BBG... -

Page 207

... The Group was party to securitisation transactions involving Barclays residential mortgage loans, business loans and credit card balances. In addition, the Group acts as a conduit for commercial paper, whereby it acquires static pools of residential mortgage loans from other lending institutions... -

Page 208

... For the year ended 31st December 2007 30 Retirement benefit obligations Pension schemes The UK Retirement Fund (UKRF), which is the main scheme of the Group, amounting to 94% of all the Group's schemes in terms of benefit obligations, comprises ten sections. The 1964 Pension Scheme Most employees... -

Page 209

...£m £m Total £m Total £m Total £m Staff cost charge Current service cost Interest cost Expected return on scheme assets Recognised actuarial loss Past service cost Curtailment or settlements Total included in staff costs Staff costs are included in other operating expenses. Change in benefit... -

Page 210

... on the balance sheet are as follows: 2007 Pensions UK £m Overseas £m Post-retirement benefits UK £m Overseas £m Total £m UK £m Pensions Overseas £m 2006 Post-retirement benefits UK £m Overseas £m Total £m Benefit obligation at end of period Fair value of plan assets at end of period... -

Page 211

... credit method. Under this method, where a defined benefit scheme is closed to new members, such as in the case of the 1964 Pension Scheme, the current service cost expressed as a percentage of salary is expected to increase in the future, although this higher rate will be applied to a decreasing... -

Page 212

... risk and return profile of the holdings. The value of the assets of the schemes, their percentage in relation to total scheme assets, and their expected rate of return at 31st December 2007 and 31st December 2006 were as follows: 2007 UK schemes % of total fair value of scheme assets Expected rate... -

Page 213

30 Retirement benefit obligations (continued) Assets (continued) 2006 UK schemes % of total fair value of scheme assets Expected rate of return % Overseas schemes % of total fair value of scheme assets Expected rate of return % Total % of total fair value of scheme assets Expected rate of return % ... -

Page 214

... issued shares are fully paid. Called up share capital, allotted and fully paid Ordinary shares: At beginning of year Issued to staff under the Sharesave Share Option Scheme Issued under Incentive Share Option Plan Issue of new ordinary shares Repurchase of shares At end of year Staff shares Total... -

Page 215

... of Companies. This created £7,223m of additional distributable reserves in Barclays PLC. The purpose of the cancellation of the share premium account was to create distributable profits in order to allow the payment of dividends following the completion of the share buy-back programme, the... -

Page 216

... - Barclays PLC Group Capital redemption reserve £m Other capital reserve £m Available for sale reserve £m Cash flow hedging reserve £m Currency translation reserve £m Total £m At 1st January 2007 Net gains from changes in fair value Net (gains)/losses transferred to net profit Currency... -

Page 217

.... Retained earnings - Barclays PLC (Parent company) Retained earnings £m Capital redemption reserve £m Total £m 3 Financial statements At 1st January 2007 Profit after tax Dividends paid Transfer from share premium account Arising on share issue Repurchase of shares At 31st December 2007 At 1st... -

Page 218

...the accounts For the year ended 31st December 2007 33 Minority interests 2007 £m 2006 £m At beginning of year Share of profit after tax Dividend and other payments Equity issued by subsidiaries Available for sale reserve: net gain/(loss) from changes in fair value Cash flow hedges: net loss from... -

Page 219

...collateral Of which fair value of securities repledged / transferred to others 343,986 269,157 279,591 210,182 3 Financial statements 35 Legal proceedings Barclays has for some time been party to proceedings, including a class action, in the United States against a number of defendants following... -

Page 220

... secure better value for money, in particular to help customers make more informed current account choices and drive competition. The study will focus on PCAs but will include an examination of other retail banking products, in particular savings accounts, credit cards, personal loans and mortgages... -

Page 221

... on the Group balance sheet and income statement is as follows: (a) As Lessor Finance lease receivables The Group specialises in asset-based lending and works with a broad range of international technology, industrial equipment and commercial companies to provide customised finance programmes to... -

Page 222

...of the ordinary shares of Indexchange Investment AG, based in Munich offering exchange traded fund products. (b) Equifirst Corporation On 30th March 2007, the Group acquired 100% of the ordinary shares of Equifirst Corporation, a sub-prime mortgage origination business. (c) Walbrook Group Limited On... -

Page 223

... in Barclays Global Investors UK Holdings Limited Cash paid in respect of acquisition of shares in Absa Bank Limited Increase in investment in subsidiaries 297 (51) 246 488 180 668 39 Investment in subsidiaries The investment in Barclays Bank PLC is stated in the balance sheet of Barclays PLC at... -

Page 224

... Barclays Capital Inc. Barclays Financial Corporation Barclays Global Investors, National Association Barclays Bank of Zimbabwe Limited Banking Banking Banking, holding company Loans and advances including leases to customers Holding company Investment management Life assurance Banking, securities... -

Page 225

...the purpose of inclusion in the consolidated financial statements of Barclays PLC, entities with different reporting dates are made up until 31st December. Entities may have restrictions placed on their ability to transfer funds, including payment of dividends and repayment of loans, to their parent... -

Page 226

... the Group pension funds (principally the UK Retirement Fund), providing loans, overdrafts, interest and non-interest bearing deposits and current accounts to these entities as well as other services. Group companies, principally within Barclays Global Investors, also provide investment management... -

Page 227

42 Related party transactions and Directors' remuneration (continued) For the year ended and as at 31st December 2006 Entities under Joint common ventures directorships £m £m Pension funds unit trusts and investment funds £m Associates £m Total £m Income statement: Interest received Interest... -

Page 228

... and comprise the Directors of Barclays PLC and the Officers of the Group, certain direct reports of the Group Chief Executive and the heads of major business units. In the ordinary course of business, the Bank makes loans to companies where a Director or other member of Key Management Personnel (or... -

Page 229

..., as defined in the Companies Act 2006, and for Managers, within the meaning of the Financial Services and Markets Act 2000, of Barclays Bank PLC were: Number of Directors or Managers Number of connected persons Amount £m 3 Financial statements Directors Loans Quasi-loans and credit card accounts... -

Page 230

...retail and commercial banking, operating 32 branches and dealing with a range of corporate and wholesale clients. As at 31st December 2007, Expobank had net assets of $186m (£93m). 44 Share-based payments The Group operates share schemes for employees throughout the world. The main current schemes... -

Page 231

... Group Limited. The performance of Absa over a threeyear period determines the final number of notional shares that any cash payment would be based on. Awards vest after three years to the extent that the performance conditions are satisfied. 3 Financial statements Barclays PLC Annual Report 2007... -

Page 232

... holding period of options between grant and exercise dates. The risk-free rate on the AGLSIT scheme represents the yield, recorded on date of option grant, on South African government zero coupon bond of a term commensurate to the expected life of the option. 230 Barclays PLC Annual Report 2007 -

Page 233

...3.50-5.03 - - - - (512) 3.40-3.89 - - 4,847 3.40-3.89 - 3.40-3.89 4.41-6.35 - - 3.85-5.53 - 3.50-5.03 - b Options/award granted over Barclays Global Investors UK Holdings Limited shares. c Options/award granted over Absa Group Limited shares. d Nil cost award. Barclays PLC Annual Report 2007 231 -

Page 234

... price range, the weighted average contractual remaining life and number of options outstanding (including those exercisable) at the balance sheet date are as follows: Notes a Options/award granted over Barclays PLC shares. b Options/award granted over Barclays Global Investors UK Holdings Limited... -

Page 235

....1% interest in Absa Group Limited if exercised. Notes a Options/award granted over Barclays PLC shares. b Options/award granted over Barclays Global Investors UK Holdings Limited shares. c Options/award granted over Absa Group Limited shares. d Nil cost award. Barclays PLC Annual Report 2007 233 -

Page 236

... to the accounts For the year ended 31st December 2007 45 Financial risks Financial risk management Barclays PLC is a major global financial services provider engaged in retail and commercial banking, credit cards, investment banking, wealth management and investment management services. Financial... -

Page 237

... the increased market volatility in the second half of the year. Barclays Capital DVaR: Summary table for 2007 and 2006 12 months to 31st December 2007 Average £m High £m Low £m 3 Financial statements Interest rate risk Credit spread risk Commodities risk Equities risk Foreign exchange risk... -

Page 238

... risk Asset and liability market risk Interest rate risk arises from the provision of retail and wholesale (non-trading) banking products and services, as well as foreign currency translational exposures within the Group's balance sheet. The Group's approach is to transfer risk from the businesses... -

Page 239

... designated at fair value held in respect of linked liabilities to customers under investment contracts, and the related liabilities, have been omitted from the above analysis as the Group is not exposed to the interest rate risk inherent in these assets or liabilities. Barclays PLC Annual Report... -

Page 240

... at fair value held in respect of linked liabilities to customers under investment contracts, and the related liabilities, have been omitted from the above analysis as the Group is not exposed to the interest rate risk inherent in these assets or liabilities. 238 Barclays PLC Annual Report 2007 -

Page 241

... Assets Cash and balances at central banks Loans and advances to banks Loans and advances to customers Available for sale financial instruments Reverse repurchase agreements and cash collateral on securities borrowed Liabilities Deposits from other banks Customer accounts Debt securities in issue... -

Page 242

... for sale reserve. The impact of foreign exchange rate changes on derivatives and borrowings designated as IFRS net investment hedges would be fully offset by the impact on the hedged net investments, resulting in no impact on the Group profit or equity. 240 Barclays PLC Annual Report 2007 -

Page 243

...credit risks. They are chaired by the Group Wholesale and Retail Credit Risk Directors. Corporate and commercial lending Corporate accounts which are deemed to contain heightened levels of risk are recorded on graded problem loan lists known as early-warning or watch lists. These are updated monthly... -

Page 244

...' or Moody's. Barclays wholesale credit rating contains 21 grades, representing the Group's best estimate of credit risk for a counterparty based on current economic conditions. Retail customers are not assigned internal risk ratings in this way for account management purposes, although a mapping... -

Page 245

... in the relevant portfolio or to the flow of new exposures into that portfolio. Typical limits include the proportion of lending with maturity in excess of seven years and the proportion of new mortgage business that is buy-to-let. 3 Financial statements Barclays PLC Annual Report 2007 243 -

Page 246

... and security types are as follows: - Personal lending - mortgages over residential properties; - Commercial and industrial sector - charges over business assets such as premises, stock and debtors, and third party credit protection (i.e. guarantees); - Commercial real estate sector - charges over... -

Page 247

... securities Other financial assets Total financial assets designated at fair value held on own account Derivative financial instruments Loans and advances to banks Loans and advances to customers: Residential mortgage loans Credit card receivables Other personal lending Wholesale and corporate loans... -

Page 248

... and/or nature of the transaction. Loans and advances to customers - Residential mortgage loans - Credit card receivables - Other personal lending - Wholesale and corporate loans and advances These are secured by a fixed charge over the property. In addition, portfolios may be securitised. This... -

Page 249