BT 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BT Group Annual Report and Form 20-F 2002 3

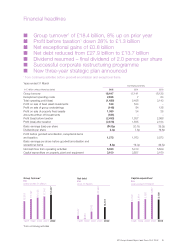

Financial headlines

■Group turnover1of £18.4 billion, 8% up on prior year

■Profit before taxation1down 28% to £1.3 billion

■Net exceptional gains of £0.8 billion

■Net debt reduced from £27.9 billion to £13.7 billion

■Dividend resumed – final dividend of 2.0 pence per share

■Successful corporate restructuring programme

■New three-year strategic plan announced

1from continuing activities before goodwill amortisation and exceptional items

Years ended 31 March Continuing activities

In £ million unless otherwise stated 2002 2001 2000

Group turnover 18,447 17,141 16,125

Exceptional operating costs 2,696 764

Total operating profit (loss) (1,489) 2,456 3,143

Profit on sale of fixed asset investments 169 534 –

Profit on sale of group undertakings (148) 84 126

Profit on sale of property fixed assets 1,089 34 26

Amounts written off investments (535) ––

Profit (loss) before taxation (2,493) 1,937 2,968

Profit (loss) after taxation (2,878) 1,505 2,104

Basic earnings (loss) per share (34.8)p 20.7p 29.2p

Dividends per share 2.0p 7.8p 19.6p

Profit before goodwill amortisation, exceptional items

and taxation 1,273 1,763 2,973

Basic earnings per share before goodwill amortisation and

exceptional items 8.8p 19.3p 29.5p

Net cash flow from operating activities 5,023 5,410 5,609

Capital expenditure on property, plant and equipment 3,100 3,857 3,160

N

e

t

debt

£

m

as

a

t

3

1 M

a

r

c

h

2

from continuin

g

activitie

s

1

998

1

999

2

000

2

001

2

002

953

3,

977

8

,

700

2

7

,

942

1

3

,

701

Grou

p

turnove

r

2

£

m

y

ears ended 31 March

1

998

1

999

2

000

2

001

2

002

1

3

,

651

1

5

,

197

1

6

,

125

1

7

,

141

1

8

,

447

Ca

p

ital ex

p

enditur

e

2

£

m

y

ears ended 31 March

1

998

1

999

2

000

2

001

2

002

2,

720

2,

811

3,

160

3,

857

3,

100