BT 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

and Form 20-F

2002

Table of contents

-

Page 1

Annual Report and Form 20-F 2002 -

Page 2

... 159 BT Group plc is a public limited company registered in England and Wales, with listings on the London and New York stock exchanges. This is the annual report for the year ended 31 March 2002. It complies with UK regulations and is the annual report on Form 20-F for the Securities and Exchange... -

Page 3

... shareholders through being the best provider of communications services and solutions for everybody in the UK, and for corporate customers in Europe, achieving global reach through partnership. The fundamentals of our strategy are: â- customer satisfaction; â- financial discipline; â- broadband... -

Page 4

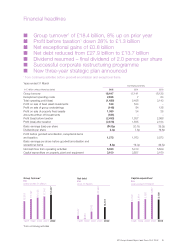

... strategic plan announced Continuing activities from continuing activities before goodwill amortisation and exceptional items Years ended 31 March In £ million unless otherwise stated 2002 2001 2000 Group turnover Exceptional operating costs Total operating profit (loss) Profit on sale of fixed... -

Page 5

...one for BT Group. Our operating results were satisfactory and we are pleased to propose a final dividend of 2.0 pence per share. In May 2001, your Board developed an action plan to reduce debt, manage costs and enhance BT's ability to serve its customers even more effectively. In the year since then... -

Page 6

... profitable ways to meet what our customers need, particularly in the "new wave" services arena, in order to enhance shareholder value. The last couple of years have been tough for our shareholders. I would like to thank you all for your continued support. They've also been tough for BT employees... -

Page 7

Chief Executive's statement Ben Verwaayen, Chief Executive, says that outstanding customer service, profitable growth and the development of new broadband services are key to the creation of shareholder value... 6 BT Group Annual Report and Form 20-F 2002 -

Page 8

..., skilled employees, focused on their customers, are at the heart of what BT has to offer. We want to be the best communications services and solutions company for everyone in the UK and business customers in Europe. We deliver global connectivity and solutions where that meets customers' needs... -

Page 9

... 11 Lines of business 11 BT Retail Voice services New-wave business Brand extension Net-centricity Customer satisfaction 14 BT Wholesale Changing market conditions Strategic objectives Broadband 15 BT Ignite Meeting customers' needs Business realignment Cash management Customers 16 BTopenworld... -

Page 10

...We also transferred assets and businesses to Concert, which was subsequently unwound (see ``Concert'' below). 2002 £m 2001 a £m 2000 a £m Turnover summary Years ended 31 March Fixed-network calls Exchange lines Receipts from other operators Private services Solutions Customer premises equipment... -

Page 11

...employees from BT to Land Securities Trillium (Telecom) during the ®rst quarter of 2002. Under these new arrangements, Telereal is responsible for providing accommodation and estates management services to BT. In return, we pay Telereal around £190 million of annual rental, increasing at 3% a year... -

Page 12

... in the joint venture, nor any obligations in relation to AT&T Canada. Lines of business The following table sets out the group turnover for each of our lines of business in the 2002 and 2001 ®nancial years. Group turnover Years ended 31 March 2002 £m 2001 £m BT Retail Years ended, or as... -

Page 13

... in the ACT NOW programme in Exchange line turnover, comprising rental and connection charges, accounted for approximately 30% of our revenues in the 2002 ®nancial year. The number of BT Group's business lines grew by 1.3% over the year, with high-speed ISDN services being the main driver... -

Page 14

....bt.com) provides residential and business customers with an e-commerce channel through which they can access information and services. The site is a key part of BT Retail's drive to become more net-centric, by giving its customers increased opportunities to deal with the company over the internet... -

Page 15

... advanced services, and providing a BT Wholesale ``one-stop shop''; and Years ended, or as at, 31 March 2002 2001 & become the number one provider in the high-growth Group turnover £12,256m £11,728m UK broadband market. Group operating pro®t £2,242m £2,538m BT Wholesale has continued to invest... -

Page 16

... global account management and BT Ignite offers a single point of contact for sales and service for all its major and solutions to corporate customers with substantial customers. European operations. Meeting customers' needs BT Ignite provides customers with: Business realignment During the year, BT... -

Page 17

..., or acquiring new customer bases. It will, however, continue to participate in existing SME and consumer businesses, as long as they are pro®table. Cash management In 2002, BT Ignite reduced its capital expenditure by 35%, compared with the previous ®nancial year. Operating free cash ¯ow... -

Page 18

... by the UK Government of the new tax-advantaged Share Incentive Plan, during the year we launched the BT Group Employee Share Investment Plan (the ESIP). From December 2001, we have operated the partnership shares section of the plan, which gives BT Group Annual Report and Form 20-F 2002 17 -

Page 19

... years. For 2003, the number of free shares allocated to employees will be linked to performance measures set by the Board. In addition, employees have the opportunity, from time to time, to buy shares at a discount under the BT Group Employee Sharesave Scheme, a savings-related share option scheme... -

Page 20

... adhere to standard prices and other terms for providing certain services and, in general, to apply uniformly a published scale of charges for installing residential exchange lines on premises to be served by a single line. As a result of our international interests, a Licence condition prohibits us... -

Page 21

...Vodafone mobile phones. Our retention is de®ned by our retail price net of termination payments to the mobile operator. Under this control, applying from 1 April 1999 to 31 March 2002, our retention for calls to O2 UK and Vodafone cannot increase by more than RPI minus 7 each year. In February 2001... -

Page 22

...a noti®cation to the Director General and other licensed operators if we intend to amend existing charges or to offer new services. Non-UK regulation We must take account of the regulatory regimes in the countries in which we operate or wish to operate. European Union The European Union is pursuing... -

Page 23

...committed to universal service. 22 BT Group Annual Report and Form 20-F 2002 Flat rate internet interconnection On 26 May 2000, Oftel issued a Direction stating that we should provide an interconnection product under our licence for ¯at rate internet access call origination (FRIACO). The Direction... -

Page 24

... security, international relations and the detection of crime. Legal proceedings The company does not believe there are any pending legal proceedings which would have a material adverse effect on the ®nancial position or results of operations of the group. BT Group Annual Report and Form 20-F 2002... -

Page 25

... panels, an annual employee survey and a supplier relationship management programme. We also employ a number of professional CSR experts who investigate long-term societal trends, identify potential issues that might affect the business and, when appropriate, support BT's commercial activities... -

Page 26

... new customers for BT Answer 1571, our network-based answering service. Increasingly, we are having to address social and environmental matters when bidding for business ± especially for public sector contracts, which alone represent £1 billion of our business, growing at 10% a year. Our internal... -

Page 27

...-year financial summary Pro®t and loss account Years ended 31 March 1998 £m 1999 £m 2000 £m 2001 £m 2002 £m Total turnover Continuing activities Discontinued activities Group's share of associates' and joint ventures' turnover Trading between group and principal joint venture Group turnover... -

Page 28

Five-year financial summary Cash ¯ow statement Years ended 31 March 1998 £m 1999 £m 2000 £m 2001 £m 2002 £m Net cash ¯ow from operating activities Dividends from associates and joint ventures Returns on investments and servicing of ®nance Taxation paid Capital expenditure and ®nancial ... -

Page 29

... pages. The operating results by line of business are discussed ®rst, followed by the overall group results. Demerger and capital reduction The demerger of mmO2, the group's former mobile phone business, was successfully completed on 19 November 28 BT Group Annual Report and Form 20-F 2002 -

Page 30

... £m 2002 Total £m Continuing activities £m 2001 Total £m Continuing activities £m 2000 Total £m Total turnover Group's share of associates' and joint ventures' turnover Trading between group and principal joint venture Group turnover Other operating income Operating costs Group operating... -

Page 31

... page 34. BT Retail provides an end to end service to its customers over 28.3 million lines in the UK. BT Retail's turnover is mainly derived from calls, lines, private services and total business solutions to the consumer, SME and major business markets. BT Retail has undertaken a number of pricing... -

Page 32

... (12%) in the 2002 ®nancial year, bene®ting from the growing revenues from data and solutions products provided by BT Ignite Solutions to major business customers. BT Wholesale Group turnover EBITDA Operating pro®t Capital expenditure Operating free cash ¯ow 2002 £m 2001 £m 12,256 4,156... -

Page 33

...control. BTopenworld Group turnover EBITDA Group operating loss Share of losses of associates and joint ventures Capital expenditure Operating free cash ¯ow 2002 £m 2001 £m BTopenworld's group turnover is derived principally from its UK broadband and narrowband internet access services. Turnover... -

Page 34

... pension costs and the annual pay awards were the main reasons for the increase in staff costs. The allocation for employee share ownership, included within staff costs, was £25 million in the 2002 ®nancial year. The allocation for the 2001 ®nancial year was £32 million. BT Group Annual Report... -

Page 35

... operating costs in the 2002 ®nancial year also include: & costs of £172 million associated with the unwind of the Concert global venture, discussed further on page 36; & charges of £68 million in relation to the BT Retail call centre rationalisation programme, reducing the number of call centres... -

Page 36

Financial review resulted in an impairment in goodwill of £3,000 million, of which £200 million related to BT's continuing activities. Other exceptional items within operating costs in the 2001 ®nancial year included a credit of £193 million for the refund of rates on BT's infrastructure ... -

Page 37

... its share of redundancy and other unwind costs in Concert and BT's own unwind costs of £172 million have been charged against group operating costs in the 2002 ®nancial year. The value of BT's investments has been reviewed in the light of the rapidly changing global telecoms market conditions. In... -

Page 38

... values for the property and compensation to Telereal covering funding costs and equity return. BT can also re-acquire the reversion of the general estate (non-operational buildings such as of®ces and warehousing) at the end of the headlease term of 999 years. BT has the right to renew the lease... -

Page 39

...194 million increase in BT's share of its ventures' interest charges principally through the Japanese investments and Viag Interkom which was partly offset by an exceptional interest receipt of £25 million relating to the rates refund from the UK Government, noted above. The 2002 ®nancial year did... -

Page 40

... results for both the 2002 and 2001 ®nancial years re¯ect the higher interest charges, losses incurred by newly acquired businesses and the adverse effect which competitive pressures have continued to have on our operating margins in the UK ®xed-voice telephony market. Diluted earnings per share... -

Page 41

... at the end of the 2000 ®nancial year, to 40 BT Group Annual Report and Form 20-F 2002 re®nance a signi®cant part of our commercial paper borrowings with medium or longer-term debt when market conditions allowed and also to raise further signi®cant ®nance in the 2001 ®nancial year to meet the... -

Page 42

... between the value of outgoing and incoming international calls. To date, these imbalances have not been material. As a result, the group's pro®t has not been materially affected by movements in exchange rates in the three years under review. The majority of the group's long-term borrowings has... -

Page 43

... mobile phone 42 BT Group Annual Report and Form 20-F 2002 operator. BT has reviewed the carrying value of its investment and provision has been made for the associated impairment and exit costs. During the 2001 ®nancial year, BT completed a number of acquisitions of businesses, mainly located... -

Page 44

... 1996 valuation. The increase in the pension charge in the 2002 and 2001 ®nancial years was due, in part, to the smaller amortisation of the combined pension fund position and pension provision held in the BT group balance sheet. The amortisation credit netted in pension costs amounted to £nil... -

Page 45

...new de®ned contribution pension scheme for people joining BT after that date which is to 44 BT Group Annual Report and Form 20-F 2002 provide bene®ts based on the employees' and the employing company's contributions. This change is in line with the practice increasingly adopted by major UK groups... -

Page 46

...our current employees, the return that the pension fund assets will generate in the time before they are used to fund the pension payments and the discount rate at which the future pension payments are discounted. We use estimates for all these factors in BT Group Annual Report and Form 20-F 2002 45 -

Page 47

... BT is considering the impact of EMU on the UK business and the associated costs. US GAAP The group's net income (loss) and earnings (loss) per share for the three ®nancial years ended 31 March 2002 and shareholders' equity at 31 March 2002 and 2001 under US Generally Accepted Accounting Principles... -

Page 48

Financial review of SFAS No. 141 will not have a material impact on BT's results of operations, ®nancial position or cash ¯ows. SFAS No. 142 ``Goodwill and Other Intangible Assets'' was also issued in July 2001. SFAS No. 142 is applicable to ®nancial years commencing after 15 December 2001. SFAS... -

Page 49

...was appointed to the Board on 19 November 2001. He joined BT as Chief Executive of BT Retail in October 2000 and was a member of the former Executive Committee. From 1981 to 2000, he worked for Rank Xerox 48 BT Group Annual Report and Form 20-F 2002 (which became Xerox Limited in 1997), latterly as... -

Page 50

... of principal Board committees: a Operating b Audit c Remuneration d Nominating e Community Support f Pension Scheme Performance Review Group All of the non-executive directors are considered independent of the management of the company Operating Committee Ben Verwaayen Chief Executive Ian... -

Page 51

...on directors' remuneration on pages 60 and 69 and the discussion on Corporate governance on page 52. Substantial shareholdings At 21 May 2002, the company had received a noti®cation from Legal & General Investment Management Limited under Part VI of the Companies Act 1985 in respect of a holding of... -

Page 52

... at an extraordinary general meeting of the company held on 10 September 2001 for the company to purchase in the market 870 million of its shares, representing 10% of the issued share capital, expires on 9 September 2002. This authority was not used during the year and shareholders will be asked... -

Page 53

... the group. On appointment, directors take part in an induction programme when they receive information about BT, the 52 BT Group Annual Report and Form 20-F 2002 formal statement of the Board's role, the terms of reference and memberships of the principal Board and management committees, including... -

Page 54

... ventures and associates, which BT does not control, outside the UK have not been dealt with as part of the group for the purposes of this internal control assessment. Relations with shareholders Senior executives, led by the Chief Executive and Group Finance Director, hold meetings with the company... -

Page 55

...Annual Report and the Notice of AGM are being sent to shareholders more than 20 working days before the AGM. Established procedures ensure the timely release of share price sensitive information and the publication of ®nancial results and regulatory ®nancial statements. Non audit services provided... -

Page 56

... ability to transfer substantial volumes of data speedily and without interruption. Any signi®cant failure or interruption of such data transfer due to factors outside their control could have a material adverse effect on the businesses and their results BT Group Annual Report and Form 20-F 2002 55 -

Page 57

... share in respect of the year ended 31 March 2002 and expects to resume regular dividend payments thereafter. However, the level of dividend which BT expects to pay in the future will be dependent on the future performance of the business. Declining investment returns may result in the funding cost... -

Page 58

...company's Operating Committee (OC) and senior executives reporting to the Chief Executive. Speci®cally, the Remuneration Committee agrees their service contracts, salaries, other bene®ts, including bonuses and participation in the company's long-term incentive plans, and other terms and conditions... -

Page 59

... employees of BT's internet business and/or new recruits. The price at which shares may be acquired is the market price at the date of grant. For options granted in the 2002 ®nancial year, the exercise of the option is generally phased over three years. Other 58 BT Group Annual Report and Form 20... -

Page 60

... directors at the end of the 2002 ®nancial year are shown on page 65. BT Executive Share Plan/BT Performance Share Plan The last awards under these plans were granted in 1999. Awards of shares under the BT Executive Share Plan (ESP) normally vest at the end of ®ve years but only if BT's TSR meets... -

Page 61

... and long-term incentives are excluded. BT closed its ®nal salary pension arrangements to new recruits with effect from 31 March 2001 and this has also 60 BT Group Annual Report and Form 20-F 2002 been re¯ected in the retirement provision granted to executive directors and other senior executives... -

Page 62

... those of shareholders, the company's policy is to encourage these directors to purchase, on a voluntary basis, £5,000 of BT shares each year. The directors are asked to hold these shares until they retire from the Board. This policy is not mandatory. BT Group Annual Report and Form 20-F 2002 61 -

Page 63

... bonus for the 2002 ®nancial year of £122,000. This was increased by the Remuneration Committee to £152,000 to re¯ect corporate performance. Directors' remuneration payable in respect of their services as directors of BT (excluding pension arrangements and deferred bonus awards) was as follows... -

Page 64

... of that current year's on target bonus or the previous year's bonus, the market value of shares awarded under an employee share ownership plan or deferred bonus plan that have not vested together with a year's salary and the value of any bene®ts. BT Group Annual Report and Form 20-F 2002 63 -

Page 65

... to above, to which each director has become entitled during the year and the transfer value of the increase in accrued bene®t: Increase in accrued pension during year or to date of a retirement in year 2002 £000 2001 £000 Total accrued pension at year end or at date of b retirement, if earlier... -

Page 66

... Plan. The value of the replacement options was determined by averaging the combined share price of the BT Group plc and the mmO2 plc shares over the 20 dealing days following the demerger on 19 November 2001 (see note 34 to the ®nancial statements). b Options under the BT Employee Sharesave Scheme... -

Page 67

...by an option granted under the BT Group Legacy Option Plan (see note 34 to the ®nancial statements). The market price of the shares on the date of exercise was 255p per share. His remaining options lapsed on 31 December 2001. d Bill Cockburn's option under the BT Employee Sharesave Scheme lapsed on... -

Page 68

.... The value of the awards was based on the average combined share price of BT Group plc and mmO2 plc shares over the 20 dealing days following the demerger on 19 November 2001 (see note 34 to the ®nancial statements). d Excluding shares purchased by each director and held under the ESP (see page 65... -

Page 69

... awarded to the directors under the DBP. These shares will normally be transferred to participants at the end of the three-year deferred period if those participants are still employed by the group. Market value 1 April a 2001 Rights Issue Awarded Vested Demerger b 31 March 2002 2002 £000 2001... -

Page 70

... former Executive Committee, other than directors, for services in all capacities during the 2002 ®nancial year was as follows: 2002 £000 2001 £000 Salaries and bene®ts Annual bonuses Termination and retention payments Provision for long-term incentive awards Company pension contributions Total... -

Page 71

...of the pro®t or loss and cash ¯ows of the group for that period. The directors consider that, in preparing the ®nancial statements for the year ended 31 March 2002 on pages 72 to 135 the company has used appropriate accounting policies, consistently applied and supported by reasonable and prudent... -

Page 72

... speci®ed for our review by the Listing Rules, and we report if it does not. We are not required to consider whether the board's statements on internal control cover all risks and controls, or to form an opinion on the effectiveness of the company's or group's corporate governance procedures or its... -

Page 73

... used principally when accounting for interconnect income, provision for doubtful debts, payments to telecommunication operators, depreciation, goodwill amortisation and impairment, employee pension schemes and taxes. II Turnover Group turnover, which excludes value added tax and other sales taxes... -

Page 74

... contribution rates. The cost of providing pensions is charged against pro®ts over employees' working lives with the group using the projected unit method. Variations from this regular cost are allocated on a straight-line basis over the average remaining service lives of current employees to the... -

Page 75

... within staff costs. The group also operates de®ned contribution pension schemes and the pro®t and loss account is charged with the contributions payable. XV Taxation The group has adopted Financial Reporting Standard 19 ``Deferred Taxation'' (FRS 19) during the 2002 ®nancial year. Full provision... -

Page 76

..., representing the net assets of mmO2 (including purchased goodwill) as at the date of demerger. Of the demerger distribution, £9 million represents a cash dividend paid by British Telecommunications plc to mmO2 plc as part of the demerger process. BT Group Annual Report and Form 20-F 2002 75 -

Page 77

... principal joint venture Group turnover Other operating income Operating costs Group operating pro®t (loss) Group's share of operating loss of joint ventures Group's share of operating pro®t (loss) of associates Total operating pro®t (loss) Pro®t on sale of ®xed asset investments Pro®t on sale... -

Page 78

... Operating costs Group operating pro®t (loss) Group's share of operating loss of joint ventures Group's share of operating pro®t (loss) of associates Total operating pro®t (loss) Pro®t on sale of group undertakings Pro®t on sale of property ®xed assets Interest receivable Interest payable... -

Page 79

... the year ended 31 March 2002 As restated 2001 £m As restated 2000 £m 2002 £m Pro®t (loss) for the ®nancial year: Group Joint ventures Associates Total pro®t (loss) for the ®nancial year Currency movements arising on consolidation of non-UK: Subsidiaries Joint ventures Associates Unrealised... -

Page 80

Group cash flow statement for the year ended 31 March 2002 2002 £m 2001 £m 2000 £m Notes Net cash in¯ow from operating activities Dividends from associates and joint ventures Returns on investments and servicing of ®nance Interest received Interest paid, including ®nance costs Net cash out¯... -

Page 81

... 28, 37 28 28 28 28 The ®nancial statements on pages 72 to 135 were approved by the board of directors on 21 May 2002 and were signed on its behalf by Sir Christopher Bland Chairman Ben Verwaayen Chief Executive Ian Livingston Group Finance Director 80 BT Group Annual Report and Form 20-F 2002 -

Page 82

... the UK and the USA. These activities, together with mmO2, are shown as discontinued operations in the pro®t and loss accounts. The eliminations are intra-group eliminations. The interest charge allocated to mmO2 for all periods presented up to the date of BT Group Annual Report and Form 20-F 2002... -

Page 83

...fees charged to its contract customers and from handset equipment sales. & Yell derived its turnover from selling advertising in its classi®ed directories in the UK and in the US. Prior to the restructuring implemented during the year ended 31 March 2001, the group was managed as a unitary business... -

Page 84

...UK mobile communication services, principally via O2 UK (formerly BT Cellnet). Products and Solutions managed the group's outsourcing services. Operating pro®t (loss) of associates Depreciation and joint Group and ventures total amortisation £m £m £m 2. Turnover External £m Internal £m Year... -

Page 85

... analysis continued Turnover External £m Internal £m Operating pro®t (loss) of associates Depreciation and joint Group and ventures total amortisation £m £m £m Total operating pro®t (loss) £m Year ended 31 March 2000 Markets Enterprises Networks & Systems Mobility Products and Solutions... -

Page 86

...the financial statements 2. Segmental analysis continued The following tables show the capital expenditure on plant, equipment and property, the net operating assets or liabilities and the net book value of associates and joint ventures by line of business for the years ended 31 March 2002 and 2001... -

Page 87

...UK and turnover with non-UK joint ventures and associates. The group turnover from continuing activities as disclosed in the group pro®t and loss account includes intra-group trading with discontinued activities. 2002 £m 2001 £m Group ®xed assets are located UK Europe, excluding the UK Americas... -

Page 88

... transit international calls by country of origin and turnover with non-UK joint ventures and associates would be treated differently but would not lead to a materially different geographical analysis. See the ``information about geographic areas'' above. 2002 £m 2001 £m 2000 £m Group operating... -

Page 89

... to the financial statements 2. Segmental analysis continued 2002 £m 2001 £m 2000 £m Share of operating results of associates and joint ventures, including goodwill amortisation ± pro®ts (losses) UK Europe, excluding the UK Americas Asia and Paci®c Total continuing activities UK Europe... -

Page 90

... the financial statements 3. Turnover 2002 £m 2001 £m a 2000 £m a Fixed network calls Exchange lines Receipts from other operators Private services Solutions Customer premises equipment supply Other sales and services Total continuing activitiesb Wireless products Yellow Pages Other sales... -

Page 91

Notes to the financial statements 5. Operating costs 2002 £m 2001 £m 2000 £m Total Group Staff costs: Wages and salaries Social security costs Pension costs (note 31) Employee share ownershipa Total staff costs Own work capitalised Depreciation (note 21) Amortisation and impairment of goodwill... -

Page 92

Notes to the financial statements 5. Operating costs continued 2002 £m 2001 £m 2000 £m Continuing activities Staff costs: Wages and salaries Social security costs Pension costs (note 31) Employee share ownershipa Total staff costs Own work capitalised Depreciation (note 21) Amortisation and ... -

Page 93

... and 1996, and the amount provided for pension costs within provisions for liabilities and charges. b The accounting of all the mmO2 operating units was aligned; this resulted in a write off of previously capitalised costs in certain non-UK operations. 92 BT Group Annual Report and Form 20-F 2002 -

Page 94

... of £2,380 million. Of the total pro®t in the year from the sale of property, £1,019 million relates to this transaction. BT has rented the majority of these properties from Telereal for a thirty-year term. Telereal will also be providing facilities BT Group Annual Report and Form 20-F 2002 93 -

Page 95

... of interest on rates refunds received in the year ended 31 March 2001, relating to prior years 11. Interest payable Interest payable and similar charges in respect of: Bank loans and overdrafts Other borrowingsa Group Joint ventures Associates Total interest payable a 2002 £m 2001 £m 2000... -

Page 96

... pro®t on sale of property ®xed assets. A tax charge on recognised gains and losses not included in the pro®t and loss account of £11 million (2001 ± £29 million charge, 2000 ± £3 million credit) related to exchange movements offset in reserves. In the year ended 31 March 2001, the loss on... -

Page 97

...restated for the British Telecommunications plc rights issue which closed on 15 June 2001. Options over 16 million shares were excluded from the calculation of the total diluted number of shares in the year ended 31 March 2002 as they were antidilutive. 96 BT Group Annual Report and Form 20-F 2002 -

Page 98

... ®gures have been restated for the British Telecommunications plc rights issue which closed on 15 June 2001. Earnings per share before goodwill amortisation and exceptional items are provided to help readers evaluate the performance of the group. BT Group Annual Report and Form 20-F 2002 97 -

Page 99

... companies Year ended 31 March 2002 Esat Digifone £m a Other £m b Total £m Consideration: Cash Deferred Total Viag c Interkom £m 869 ± 869 Telfort £m d 27 8 35 Other £m d 896 8 904 Total £m Year ended 31 March 2001 Consideration: Cash Carrying value of joint venture wholly acquired... -

Page 100

...fair values £m Fixed assets Current assets Current liabilities Long-term liabilities Group's share of original book value of net assets Goodwill Total cost 6,728 619 (585) (2,505) 4,257 4,992 9,249 Since the acquisition was made towards the end of the year ended 31 March 2001, the fair values of... -

Page 101

... and the consideration given comprised: e Year ended 31 March 2001 Telfort £m Other £m Total £m Minority Interest Fixed assets Current assets Current liabilities Group share of original book value of net assets and fair value to group Goodwill Total cost e ± 496 221 (261) 456 986 1,442... -

Page 102

...its international products for business customers, as well as Concert Communications. AT&T contributed a similar set of assets and businesses. The book value of the assets contributed by the group to the joint venture comprised: £m Intangible assets Tangible ®xed assets Total ®xed assets Current... -

Page 103

...of associates and joint ventures Year ended 31 March 2002 Blu £m l Group share of original book value of net assets and fair value to the group Goodwill Total cost Telenordia £m m 16 50 66 J-Phone £m n Year ended 31 March 2001 Group share of original book value of net assets and fair value to... -

Page 104

... 1999, the group acquired jointly with AT&T an approximate 33% interest in Rogers Wireless Inc. (formerly Rogers Cantel Mobile Communications Inc.), a cellular mobile phone company operating in Canada. The resulting economic interest of approximately 17% cost £299 million. On 31 March 2001, the 17... -

Page 105

..., the group's former mobile phone business in Europe. mmO2 consists of O2 UK Limited (formerly BT Cellnet Limited), O2 Communications (Ireland) Limited (formerly Esat Digifone Limited), Telfort Mobiel BV, Viag Interkom GmbH & Co, Manx Telecom and Genie. r On 22 June 2001, BT completed the sale of... -

Page 106

... long term values. After 31 March 2015 the projections use a long-term growth rate compatible with projections for the countries concerned. The average discount rate used to arrive at this calculation was 15.1% on a pre-tax basis. The review has resulted in an exceptional charge to operating costs... -

Page 107

...value of land and buildings comprised: Freehold Long leases (over 50 years unexpired) Short leases Total net book value of land and buildings 343 34 194 571 2002 £m 1,514 170 230 1,914 2001 £m b Expenditure on tangible ®xed assets comprised: Plant and equipment Transmission equipment Exchange... -

Page 108

Notes to the financial statements 22. Fixed asset investments Interests in associates and joint ventures b Shares £m Other Share of post Other acquisition participating c interests investments losses Loans £m £m £m £m Total £m Group Cost 1 April 2001 Additions Disposals Demerged with ... -

Page 109

... to the financial statements 22. Fixed asset investments continued The group's proportionate share of its associates' and joint ventures' assets and liabilities, in aggregate, at 31 March was as follows: 2002 £m 2001 £m Fixed assets Current assets Current liabilities Net current liabilities Non... -

Page 110

...75% notes 2002 Total listed bonds, debentures and notes Lease ®nance Bank loans due 2001-2009 (average effective interest rate 9.8%) Euro ¯oating rate note 2000-2005 Floating rate note 2001-2009 (average effective interest rate 4.1%) Other loans Bank overdrafts and other short-term borrowings Euro... -

Page 111

... Total deferred tax provisions at 31 March 2002 2002 £m 270 2,015 2,285 66 (211) 2,140 As restated 2001 £m Tax effect of timing differences due to: Excess capital allowances Pension prepayment (provisions) Other Total provision for deferred taxation 110 BT Group Annual Report and Form 20-F 2002... -

Page 112

... year (as restated) Dividends (19.6p per ordinary share restated) Unrealised gain on transfer of assets and group undertakings to a joint venture Balances at 1 April 2000 Employee share option schemes ± 78 million shares issued (note 34) Movement relating to BT's employee share ownership trustc... -

Page 113

... disposal of the business to which it related. c During the year ended 31 March 2002 the company issued shares at a market value of £154 million (2001 ± £400 million) in respect of the exercise of options awarded under its principal savings-related share option scheme. Employees paid £84 million... -

Page 114

... adverse effect on the ®nancial position or results of operations of the group. Subsequent events On 1 April 2002, the Concert global joint venture was unwound with the businesses, customer accounts and networks being returned to the two parent companies, with BT and AT&T each taking ownership of... -

Page 115

... is payable. The BTPS assets are invested in UK and overseas equities, UK and overseas properties, ®xed interest and index linked securities, deposits and short-term investments. At 31 March 2002, the UK equities included 55 million (2001 ± 51 million) ordinary shares of the company with a market... -

Page 116

...payment and deferred pensions Rate used to discount scheme liabilities In¯ation ± average increase in retail price index The expected rate of return and fair values of the assets of the BTPS at 31 March 2002 were: Expected long-term rate of return (per annum) % 4.0 2.5 6.0 2.5 Fair value £b UK... -

Page 117

..., share options and other long-term incentive plans is shown in the report on directors' remuneration from pages 62 to 69. 33. People employed Year end '000 2002 Average '000 Year end '000 2001 Average '000 Year end '000 2000 Average '000 Number of employees in the group: UK Non-UK Total continuing... -

Page 118

... the Executive Option Plans were given the opportunity to (i) conditionally on the scheme of arrangement being sanctioned by the Court, release their options over British Telecommunications plc shares in consideration for the grant of options in their employer's new holding company (BT Group plc or... -

Page 119

... fair value of options granted. See United States Generally Accepted Accounting Principles ± IV Accounting for share options for the treatment under US GAAP. BT Group Employee Share Investment Plan From December 2001 the new BT Group Share Investment Plan (ESIP) was in operation. This plan, which... -

Page 120

... Group Legacy Option Plan and the BT Group Global Share Option Plan. All other options are in respect of British Telecommunications plc shares. In addition, as shown on page 118, options over 160 million shares were granted under the BT Group Employee Sharesave Scheme during the year. This resulted... -

Page 121

....8 (1.7) 1.2 68.8 Total £m Value of range of possible future transfers: nil to Provision for the costs of the plans charged (credited) to the pro®t and loss account in year Nominal value of shares held in trust Market value of shares held in trust 120 BT Group Annual Report and Form 20-F 2002 10... -

Page 122

Notes to the financial statements 34. Employee share schemes continued The values of possible future transfers of shares under the plans were based on the BT Group plc's share price at 31 March 2002 of 280p (2001 ± BT plc share price of 510p). The provisions for the costs of the ISP, RSP, ESP and ... -

Page 123

...®xed interest payable rate of 6.2%. During the year ended 31 March 2000, net debt increased from £953 million to £8,700 million primarily as a result of the group making acquisitions of businesses and interests in joint ventures and associates. This increase in debt was primarily funded under the... -

Page 124

... by calculating the present value, using appropriate discount rates in effect at the balance sheet dates, of affected future cash ¯ows translated, where appropriate, into pounds sterling at the market rates in effect at the balance sheet dates. BT Group Annual Report and Form 20-F 2002 123 -

Page 125

... into account the various interest rate swaps and forward foreign currency contracts entered into by the group, the interest rate pro®le of the group's ®nancial assets at 31 March was: 2002 Financial assets on which no interest is paid £m Financial assets on which no interest is paid £m 2001... -

Page 126

... amount £m Average interest receivable rate % Average interest payable rate % Average maturity Pay ®xed interest and receive variable interest Pay variable interest and receive ®xed interest Over 5 years Under 5 years 7,120 750 6.5 5.5 4.2 6.4 BT Group Annual Report and Form 20-F 2002 125 -

Page 127

...and share capital of £2 representing two ordinary shares with a nominal value of £1. During the year ended 31 March 2002, the company acquired BT Group Investments Limited (BTGI) for £9,971 million (see note 1). BTGI is the intermediary holding company of British Telecommunications plc. c Debtors... -

Page 128

...Acquisition of BTGIj Other share option schemes Totals for the year ended 31 March 2002 j 8,670,033,956 659,040 8,670,692,996 434 ± 434 9,971 2 9,973 Re¯ects nominal value of 5 pence per share following capital reduction from 115 pence per share. BT Group Annual Report and Form 20-F 2002 127 -

Page 129

...in trust for share schemes are recorded in ®xed asset investments. Gains and losses on instruments used for hedges are not recognised until the exposure being hedged is recognised. Under US GAAP, trading securities and available-for-sale securities are 128 BT Group Annual Report and Form 20-F 2002 -

Page 130

...'s resulting net assets and the net book value of assets contributed by the group to the joint venture is amortised over the life of the items giving rise to the difference. (i) Employee share plans Certain share options have been granted under BT save-as-you-earn plans at a 20% discount. Under UK... -

Page 131

... March 2002 £m 2001 £m 2000 £m Net income (loss) applicable to shareholders under UK GAAP Restatement for deferred tax under FRS 19 Net income (loss) applicable to shareholders under UK GAAP as previously reported Adjustment for: Sale and leaseback of properties Pension costs Redundancy charges... -

Page 132

... statements continued 2002 £m 2001 £m Shareholders' equity At 31 March Shareholders' equity under UK GAAP Restatement for deferred tax under FRS 19 Shareholders equity under UK GAAP as previously reported Adjustment for: Sale and leaseback of properties Pension costs Redundancy costs... -

Page 133

... bank and in hand reported under UK GAAP. 2002 £m 2001 £m 2000 £m Net cash provided by operating activities Net cash used in investing activities Net cash provided by (used in) ®nancing activities Net increase (decrease) in cash and cash equivalents Effect of exchange rate changes on cash Cash... -

Page 134

... the year Service cost Interest cost Employees' contributions Additional cost of termination bene®ts Actuarial movement Other changes Bene®ts paid or payable Bene®t obligation at the end of the year Changes in scheme assets Fair value of scheme assets at the beginning of the year Actual return on... -

Page 135

... joint ventures and associates at 31 March 2002, all of which were unlisted unless otherwise stated, were as follows: Activity Group interest b in allotted capital Country c of operations Subsidiary undertakings British Telecommunications plcd Communication related services and products provider BT... -

Page 136

...the Securities and Exchange Commission under Form 6-K on 31 May 2002. Share capital b = billions m = millions Activity Issued a Percentage owned Country of b operations Associates Cegetel SA SmarTone Telecommunications Holdings Limited Communications related services and products provider Mobile... -

Page 137

... analysis of turnover and profit Year ended 31 March 2002 Continuing activities Total turnover Group's share of associates' and joint ventures' turnover Trading between group and principal joint venture Group turnover Other operating income Group operating pro®t (loss) Group's share of operating... -

Page 138

... analysis of turnover and profit Year ended 31 March 2001 Continuing activitiesa Total turnover Group's share of associates' and joint ventures' turnover Trading between group and principal joint venture Group turnover Other operating income Group operating pro®t Group's share of operating... -

Page 139

... employed is represented by total assets, excluding goodwill, less current liabilities, excluding corporate taxes and dividends payable, and provisions other than those for deferred taxation. Year-end ®gures are used in the computation of the average, except in the case of short-term investments... -

Page 140

... in absolute call minutes. 5 6 12 18 19 1998 1999 2000 2001 2002 UK exchange line connections Business ('000) % growth over previous year Residential ('000) % growth over previous year Service providers ('000) % growth over previous year Total exchange line connections ('000) % growth... -

Page 141

... Government redeemed at par a special rights redeemable preference share to which certain special rights attached. In 1985, Cellnet was launched as a joint venture between British Telecom and Securicor, which held 40% of the company. BT acquired full control of Cellnet (now O2 UK ± part of mmO2 plc... -

Page 142

...November 2001 adjusted the value for capital gains tax purposes of BT shares. Rights issue An explanatory note on the effects of the rights issue on the CGT position relating to BT shareholdings is available from the Shareholder Helpline (see page 154). BT Group Annual Report and Form 20-F 2002 141 -

Page 143

... of dividends, which changed for dividends paid on or after 6 April 1999, see Taxation of dividends below. Dividends have been translated from pounds sterling into US dollars using exchange rates prevailing on the date the ordinary dividends were paid. 142 BT Group Annual Report and Form 20-F 2002 -

Page 144

...to approval at the annual general meeting. The US dollar amount of the ®nal dividend of 20 pence per ADS to be paid to holders of ADSs will be based on the exchange rate in effect on 9 September 2002, the date of payment to holders of ordinary shares. As dividends paid by the company are in pounds... -

Page 145

..., BT Group's share price rose slightly from 278p to close at 280p on 31 March 2002. In the period, BT Group's TSR was in line with the FTSE 100 index at 0.7%. This was signi®cantly better than the performance of the FTSE 350 UK telco index (negative 27.1%) and the FTSE European 300 telecom services... -

Page 146

... Buying Rates in effect on the last day of each month during the relevant period. On 16 May 2002, the most recent practicable date for this annual report, the Noon Buying Rate was US$1.46 to £1.00. Memorandum and Articles of Association The following is a summary of the principal provisions of BT... -

Page 147

.... Fixed dividends will be paid on any class of shares on the dates stated for the payments of those dividends. The directors can offer ordinary shareholders the right to choose to receive new ordinary shares, which are credited as fully paid, instead of some or all of their cash dividend. Before... -

Page 148

... connection with the business of the company. The Board can award extra fees to a director who holds an executive position; acts as chairman or deputy chairman; serves on a Board committee at the request of the Board; or performs any other services which the Board consider extend beyond the ordinary... -

Page 149

...next following annual general meeting. A retiring director is eligible for re-election. Directors' borrowing powers To the extent that the legislation and the Articles allow, the Board can exercise all the powers of the company to borrow money, to mortgage or charge its business, property and assets... -

Page 150

... transfer BT Group Investments to BT Group plc and, in exchange for that transfer, BT Group agreed to allot and issue BT Group shares to the mmO2 shareholders in satisfaction of the Demerger dividend (being the dividend declared by mmO2 of an amount equal to the book value of its shareholding in BT... -

Page 151

... non-voting shares in Esat Digifone Limited (now called O2 Communications (Ireland) acquired in April 2000. Property Sale and Leaseback On 13 December 2001, BT sold to Telereal Group Limited (``Telereal'') a substantial part of BT's property portfolio together with the BT property division. Around... -

Page 152

...payment and the UK withholding described above will no longer apply to US Holders. The UK does not currently apply a withholding tax on dividends under its internal tax laws. Were such withholding imposed in the UK as permitted under the New Treaty (in the form signed 24 July 2001), the UK generally... -

Page 153

... and except in respect of the government of, or any resident of, Iraq or any person treated as so resident. There are no limitations under the laws of the United Kingdom restricting the right of non-residents to hold or to vote shares in the company. 152 BT Group Annual Report and Form 20-F 2002 -

Page 154

..., can be accessed on the internet at www.btplc.com/investorcentre. Document Publication date Annual Review including summary ®nancial statement Annual Report and Form 20-F Report for Shareholders Quarterly results releases Current Cost Financial Statements for the Businesses and Activities and... -

Page 155

... and the separate BT Group EasyShare and BT Employee Share Ownership Scheme registers. They also provide a Shareholder Helpline service on Freefone 0808 100 4141. Institutional investors and analysts Institutional investors and equity research analysts may contact Investor Relations on: Tel (020... -

Page 156

...after more than one year Employee share schemes Employment costs Finance lease Financial year Fixed asset investments Freehold Inland calls Interests in associates and joint ventures Loans to associates and joint ventures Net asset value Operating pro®t Other debtors Own work capitalised Pro®t Pro... -

Page 157

... forward-looking statements 140 Board of directors and Operating Committee Report on directors' remuneration Notes to the ®nancial statements Pension costs Directors Report of the directors Directors Corporate governance Report on directors' remuneration Business review Lines of business 48-49... -

Page 158

... rate exposure Notes to the ®nancial statements Financial instruments and risk management Not applicable Not applicable Not applicable BT Group Annual Report and Form 20-F 2002 157 9 9A The offer and listing Offer and listing details 141 9B Plan of distribution 9C Markets 9D 9E 9F Selling... -

Page 159

...Financial statements Not applicable Report of the independent auditors Accounting policies Consolidated ®nancial statements United States generally accepted accounting principles Quarterly analysis of turnover and pro®t 71 72-74 75-127 128-133 136-137 158 BT Group Annual Report and Form 20-F 2002 -

Page 160

... Risk factors 55-56 Risk management 121-126 Segmental analysis 82-88 Share and ADS prices 141 Share capital 27, 80, 111-112, 126-127 Share option schemes 111-112, 116-121 Shareholder communication 154 Shareholdings analysis 142 Staff costs 31, 33, 90-92 Statement of total recognised gains and losses...