BP 2014 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Changes in internal control over financial reporting

There were no changes in the group’s internal controls over financial

reporting that occurred during the period covered by the Form 20-F that

have materially affected or are reasonably likely to materially affect our

internal controls over financial reporting.

Principal accountants’ fees and services

The audit committee has established policies and procedures for the

engagement of the independent registered public accounting firm,

Ernst & Young LLP, to render audit and certain assurance and tax

services. The policies provide for pre-approval by the audit committee of

specifically defined audit, audit-related, tax and other services that are not

prohibited by regulatory or other professional requirements. Ernst &

Young are engaged for these services when its expertise and experience

of BP are important. Most of this work is of an audit nature. Tax services

were awarded either through a full competitive tender process or

following an assessment of the expertise of Ernst & Young relative to

that of other potential service providers. These services are for a fixed

term.

Under the policy, pre-approval is given for specific services within the

following categories: advice on accounting, auditing and financial

reporting matters; internal accounting and risk management control

reviews (excluding any services relating to information systems design

and implementation); non-statutory audit; project assurance and advice

on business and accounting process improvement (excluding any

services relating to information systems design and implementation

relating to BP’s financial statements or accounting records); due diligence

in connection with acquisitions, disposals and joint arrangements

(excluding valuation or involvement in prospective financial information);

income tax and indirect tax compliance and advisory services; employee

tax services (excluding tax services that could impair independence);

provision of, or access to, Ernst & Young publications, workshops,

seminars and other training materials; provision of reports from data

gathered on non-financial policies and information; and assistance with

understanding non-financial regulatory requirements. BP operates a two-

tier system for audit and non-audit services. For audit related services,

the audit committee has a pre-approved aggregate level, within which

specific work may be approved by management. Non-audit services,

including tax services, are pre-approved for management to authorize per

individual engagement, but above a defined level must be approved by

the chairman of the audit committee or the full committee. The audit

committee has delegated to the chairman of the audit committee

authority to approve permitted services provided that the chairman

reports any decisions to the committee at its next scheduled meeting.

Any proposed service not included in the approved service list must be

approved in advance by the audit committee chairman and reported to

the committee, or approved by the full audit committee in advance of

commencement of the engagement.

The audit committee evaluates the performance of the auditors each

year. The audit fees payable to Ernst & Young are reviewed by the

committee in the context of other global companies for cost

effectiveness. The committee keeps under review the scope and results

of audit work and the independence and objectivity of the auditors.

External regulation and BP policy requires the auditors to rotate their lead

audit partner every five years. (See Financial statements – Note 34 and

Audit committee report on page 64 for details of fees for services

provided by auditors.)

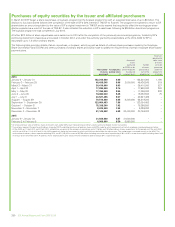

Directors’ report information

This section of BP Annual Report and Form 20-F 2014 forms part of, and

includes certain disclosures which are required by law to be included in,

the Directors’ report.

Indemnity provisions

In accordance with BP’s Articles of Association, on appointment each

director is granted an indemnity from the company in respect of liabilities

incurred as a result of their office, to the extent permitted by law. These

indemnities were in force throughout the financial year and at the date of

this report. In respect of those liabilities for which directors may not be

indemnified, the company maintained a directors’ and officers’ liability

insurance policy throughout 2014. During the year, a review of the terms

and scope of the policy was undertaken. The 2013 policy was extended

into 2014 and subsequently renewed during 2014 into 2015. Although

their defence costs may be met, neither the company’s indemnity nor

insurance provides cover in the event that the director is proved to have

acted fraudulently or dishonestly. In addition, each director of the

company’s subsidiaries which subsidiaries are trustees of the group’s

pension schemes, is granted an indemnity from the company in respect

of liabilities incurred as a result of such a subsidiary’s activities as a

trustee of the pension scheme, to the extent permitted by law. These

indemnities were in force throughout the financial year and at the date of

this report.

Financial risk management objectives and policies

The disclosures in relation to financial risk management objectives and

policies, including the policy for hedging, are included in Our

management of risk on page 46, Liquidity and capital resources on page

211 and Financial statements – Notes 27 and 28.

Exposure to price risk, credit risk, liquidity risk and cash flow risk

The disclosures in relation to exposure to price risk, credit risk, liquidity

risk and cash flow risk are included in Financial statements – Note 27.

Important events since the end of the financial year

Disclosures of the particulars of the important events affecting BP which

have occurred since the end of the financial year are included in the

Strategic report as well as in other places in the Directors’ report.

Likely future developments in the business

An indication of the likely future developments of the business is

included in the Strategic report.

Research and development

An indication of the activities of the company in the field of research and

development is included in Our strategy on page 13.

Branches

As a global group our interests and activities are held or operated through

subsidiaries*, branches, joint arrangements*or associates*

established in – and subject to the laws and regulations of – many

different jurisdictions.

Employees

The disclosures concerning policies in relation to the employment of

disabled persons and employee involvement are included in Corporate

responsibility – Employees on page 44.

Employee share schemes

Certain shares held by the Employee Share Ownership Plan trusts

(ESOPs) carry voting rights. Voting rights in respect of such shares are

exercisable via a nominee.

Greenhouse gas emissions

The disclosures in relation to greenhouse gas emissions are included in

Corporate responsibility – Environment and society on page 42.

Disclosures required under Listing Rule 9.8.4R

The information required to be disclosed by Listing Rule 9.8.4R can be

located as set out below:

Information required Page

(1) Amount of interest capitalized 123

(2) – (14) Not applicable

Cautionary statement

This document contains certain forecasts, projections and forward-

looking statements – that is, statements related to future, not past

events – with respect to the financial condition, results of operations and

businesses of BP and certain of the plans and objectives of BP with

respect to these items. These statements may generally, but not always,

be identified by the use of words such as ‘will’, ‘expects’, ‘is expected

to’, ‘aims’, ‘should’, ‘may’, ‘objective’, ‘is likely to’, ‘intends’, ‘believes’,

‘anticipates’, ‘plans’, ‘we see’ or similar expressions. In particular, among

other statements, (1) certain statements in the Chairman’s letter (pages

6-7), the Group chief executive’s letter (pages 8-9), the Strategic report

Additional disclosures

*Defined on page 252. BP Annual Report and Form 20-F 2014 241