BP 2014 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• BP and Pantera Acquisition Group, LLC (Pantera) signed an

agreement under which Pantera agreed to acquire BP’s interests in

the Panhandle West and Texas Hugoton gas fields for a purchase

price of $390 million in June. See page 26 for more information.

• Following on from the decision to create a separate BP business

around our US Lower 48 onshore oil and gas activities, and as a

consequence of disappointing appraisal results, we decided not to

proceed with development plans in the Utica shale, incurring a

$544-million write-off relating to this acreage.

For further information on the use of hydraulic fracturing in our shale gas

assets see page 43. BP’s onshore US crude oil and product pipelines and

related transportation assets are included in the Downstream segment.

In Alaska, at the end of 2014, BP operated nine North Slope oilfields in

the Greater Prudhoe Bay area and owned significant interests in six

producing fields operated by others. BP also owns significant non-

operating interests in the Point Thomson development project and the

Liberty prospect.

• In April BP announced the agreement to sell interests in four BP-

operated oilfields on the North Slope of Alaska to Hilcorp. The sale

agreement included all of BP’s interests in the Endicott and

Northstar oilfields and a 50% interest in each of the Milne Point

field and the Liberty prospect, together with BP’s interests in the

oil and gas pipelines associated with these fields. The sales price

was $1.25 billion plus an additional carry of up to $250 million if the

Liberty field is developed. The sale completed in November. See

page 26 for more information.

• Development of the Point Thomson initial production facility continued

throughout 2014. Engineering design is complete and construction of

field infrastructure and fabrication of the four main process modules is

in progress. Overall, the project is on track to commence production in

2016. BP holds a 32% working interest in the field, and ExxonMobil is

the operator.

• BP continued to work jointly with ExxonMobil, ConocoPhillips,

TransCanada, the Alaska Gasline Development Corporation and the

State of Alaska throughout 2014 to advance the Alaska LNG project. In

February 2013 a lead concept for the project was announced,

consisting of a North Slope gas treatment plant, an 800-mile

(approximately) pipeline to tidewater and a three-train liquefaction

facility, with an estimated capacity of 3bcf/d (up to 20 million tonnes

per annum). In October 2013 selection of the lead site for the

liquefaction facility was announced as Nikiski, Alaska, located on the

south-central Alaskan coast. In January BP, ExxonMobil, ConocoPhillips

and TransCanada, and the Alaska Gasline Development Corporation

signed a heads of agreement (HOA) with the State of Alaska enabling

state participation in the $45-$65 billion Alaska LNG project. The HOA

sets out guiding principles for the parties to negotiate project-enabling

contracts, and provided a roadmap for State of Alaska participation in

the project. In April the Alaska Legislature passed legislation (SB-138)

which approved State participation in the project as a 25% co-investor,

and allowed payment of gas production tax in the form of gas volumes.

On 30 June 2014 the Alaska LNG co-venturers, including the State of

Alaska, executed commercial agreements and launched the pre-front

end engineering and design (pre-FEED) phase of the project, which is

expected to extend into 2016 with gross spend more than $500

million. A decision point for progressing to front end engineering and

design (FEED) phase of the project will be considered at the

completion of the pre-FEED phase. In July the Alaska LNG project

submitted an export application with the US Department of Energy,

and in September submitted a pre-file notice of application with the

Federal Energy Regulatory Commission (FERC), which was approved

by the FERC later that month. The US Department of Energy issued a

Free Trade Agreement Export Authorization to the project in

November. First commercial gas is planned between 2023 and 2025.

BP owns a 49% interest in the Trans-Alaska Pipeline System (TAPS). The

TAPS transports crude oil from Prudhoe Bay on the Alaska North Slope to

the port of Valdez in south-east Alaska. In April 2012 the two non-

controlling owners of TAPS, Koch (3.08%) and Unocal (1.37%) gave

notice to BP, ExxonMobil (21.1%) and ConocoPhillips (29.1%) of their

intention to withdraw as an owner of TAPS. The transfer of Koch’s

interest to the remaining owners (BP, ExxonMobil and ConocoPhillips)

was agreed and approved by regulatory authorities and closed in July

with an effective date of August 2012. The remaining owners and Unocal

have not yet reached agreement regarding the terms for the transfer of

Unocal’s interest in TAPS and related litigation will continue in 2015.

In Canada, BP is currently focused on oil sands development and intends

to use in situ steam-assisted gravity drainage (SAGD) technology, which

uses the injection of steam into the reservoir to warm the bitumen so

that it can flow to the surface through producing wells. We hold interests

in three oil sands leases through the Sunrise Oil Sands and Terre de

Grace partnerships and the Pike Oil Sands joint operation. In addition, we

have significant offshore exploration interests in the Canadian Beaufort

Sea and in Nova Scotia.

• Phase 1 of the Sunrise Oil Sands SAGD development, in which BP has

a 50% non-operated interest, achieved first steam in the reservoir in

December 2014. The production capacity of Sunrise Phase 1 is

expected to be 60mb/d of bitumen.

• A major seismic programme on the Nova Scotia exploration licenses was

conducted over the summer of 2014 with 7,090km2of wide azimuth 3D

seismic data acquired. The processing of this seismic data will be

completed by the end of 2015 to identify possible exploration well

locations. During the fourth quarter of 2014 BP expanded the Nova

Scotia licence participation to include Hess Canada Oil and Gas ULC and

Woodside Energy International (Canada). The new participating interests

are BP 40% (operator), Hess 40% and Woodside 20%.

South America

BP has upstream activities in Brazil, Argentina, Bolivia, Chile, Uruguay

and Trinidad & Tobago.

In Brazil, BP has interests in 22 exploration and production concessions

across six basins, five of which are operated by BP. BP’s entry into five of

these concessions is subject to government and regulatory approvals.

• BP completed the sale of interest in the Polvo oil field (BP 60%) in

Brazil to HRT Oil & Gas Ltda for $135 million in January.

• During the year BP continued appraisal of the Itaipu discovery, located

in the deepwater sector of the Campos basin offshore Brazil, in line

with the appraisal plan approved by the Brazilian National Petroleum

Agency (ANP).

• In October the ANP approved the appraisal plan submitted by the

operator, Petróleo Brasileiro S.A. (Petrobras) for BM-POT-16 and BM-

POT-17 (two blocks in the deepwater Potiguar basin located in the

Brazilian equatorial margin), covering activities to 2018. BP’s farm-in to

a 40% interest in the blocks announced in July 2013 is subject to final

regulatory approvals.

• In July BP had a discovery at Xerelete (BP 18%) in Brazil’s Campos

basin, operated by Total.

In Argentina, Bolivia and Chile, BP conducts activity through Pan

American Energy LLC (PAE), an equity-accounted joint venture*with

Bridas Corporation, in which BP has a 60% interest.

In Uruguay, BP has interests in three offshore deepwater exploration

blocks: blocks 11 and 12 in the Pelotas basin and block 6 in the Punta del

Este basin, together covering an area of almost 26,000km2. BP holds a

100% interest in the blocks and the Uruguayan state oil company,

ANCAP, has a right to participate in up to 30% of any discoveries. BP has

already completed its commitment to acquire over 13,000km2of 3D

seismic data and 3,000km of 2D seismic data by December 2015.

In Trinidad & Tobago, BP holds licences and production-sharing contracts

covering 1.8 million acres offshore of the east and north-east coast. Facilities

include 13 offshore platforms and two onshore processing facilities.

Production is comprised of gas and associated liquids. In August, the Juniper

project was sanctioned and subsequently a key contract for the

development of the project was awarded. Fabrication began in November.

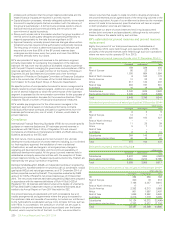

BP also has a shareholding in Atlantic LNG (ALNG), an LNG liquefication

plant that averages 39% across four LNG trainsawith a combined

capacity of 15 million tonnes per annum. BP sells gas to each of the LNG

trains, supplying 100% of the gas for train 1, 50% for train 2, 75% for

train 3 and around 67% of the gas for train 4. All the LNG from Atlantic

train 1 and most of the LNG from trains 2 and 3 is sold to third parties in

the US and Europe under long-term contracts. BP’s equity LNG

entitlement from trains 2, 3 and 4 is marketed via BP’s LNG marketing

and trading function to markets in the US, UK, Spain and South America.

aAn LNG train is a processing facility used to liquefy and purify natural gas in the formation of LNG.

214 BP Annual Report and Form 20-F 2014