BP 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 201388

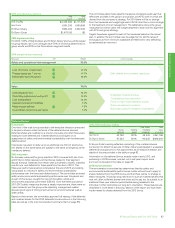

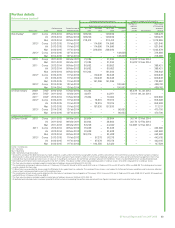

Performance shares

Framework

Performance shares were awarded to each executive director in early 2011

with vesting after three years dependent on performance relative to

measures reflecting the company’s strategic priorities in the period after

the Deepwater Horizon accident. For the 2011-2013 plan, vesting was

based 50% on TSR compared to the peer group, 20% on reserves

replacement ratio, also relative to the peer group, and 30% on a set of

strategic imperatives for rebuilding trust. These centred on S&OR

management, rebuilding BP’s external reputation, and reinforcing staff

alignment and morale.

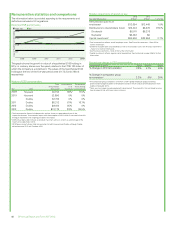

The peer group includes ExxonMobil, Shell, Chevron and Total.

ConocoPhillips was originally included as part of the peer group but was

removed following its demerger (with no impact on outcome in any case).

Vesting was set at 100%, 70% and 35% for performance equivalent to

first, second and third rank respectively and none for fourth or fifth place of

the peer group.

2013 outcomes

Overall, 39.5% of the shares awarded in the 2011-2013 plan are expected

to vest, based on results as shown in the table above.

Relative TSR was weighted heaviest, reflecting the high strategic priority

on restoring value. Outcomes failed to meet the threshold required and so

no shares vested for this measure.

Reserves replacement has been very positive and we expect that BP will

be in second place amongst the oil majors. Since the actual results of the

other majors are not publicly available until their respective annual reports

are published, the committee will review the outcomes when all

information is confirmed and decide then on the final vesting. For the

purposes of this report, and in accordance with UK regulations, second

place has been assumed. Any adjustment to this will be reported in next

year’s annual report on remuneration.

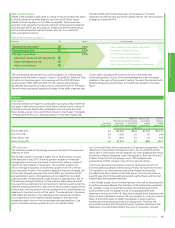

The committee’s review also concluded that progress against the three

strategic imperatives has been positive. S&OR management culture has

shown steady improvement and its high importance increasingly

embedded in the minds of employees, as demonstrated by our internal

surveys. Moreover the S&OR performance metrics have consistently

improved including against those of our peers. BP’s external reputation has

similarly shown steady improvement as measured by external surveys

assessing reputation amongst different groups in key countries. Finally,

staff alignment and morale has been reassuringly positive in the aftermath

of the Deepwater Horizon accident, with internal surveys demonstrating

improvements and a high scoring of measures related to group priorities

including safety and trust.

As in past years, the committee also considers the overall performance of

the company during the period and whether any other relevant factors

should be taken into account. Following this review, the committee

concluded that a 39.5% vesting was a fair reflection of overall performance

pending confirmation of the reserves replacement result. This will result in

the vesting as shown in the table below.

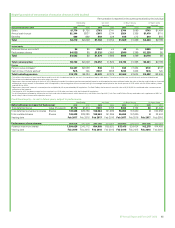

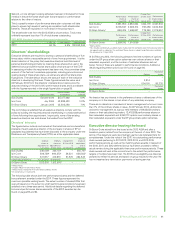

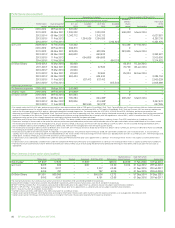

2011-2013 performance shares outcome

Shares

awarded

Shares vested

inc dividends

Value of

vested shares

Bob Dudley 1,330,332 596,028 $4,521,866

Iain Conn 623,025 283,920 £1,331,585

Dr Brian Gilvary 90,000 102,550 £504,509

Dr Byron Grote 654,498 293,232 $2,224,653

Dr Brian Gilvary’s vesting reflects awards granted prior to him joining the

board under equivalent plans below board level which have vested in early

2014. Dr Byron Grote’s award has been prorated to reflect his service prior

to retirement.

Information on performance shares awarded in early 2013, relating to the

2013-2015 period, was set out in last year’s report and a summary is

included in the table on page 85.

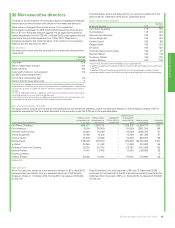

2011-2013 performance shares outcome

Measures Weight Outcomes

Threshold Max Result %

of max

Total shareholder return 50.0% 0%

Reserves replacement 20.0% 70%

Strategic imperatives 30.0%

Safety and operational risk management 10.0% 95%

Rebuilding external reputation 10.0% 80%

Staff alignment and morale 10.0% 80%

Overall outcome 39.5%