BP 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

BP Annual Report and Form 20-F 2013 97

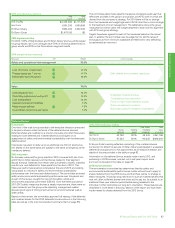

Flexibility, judgement and discretion

The committee is empowered to undertake quantitative and qualitative

assessments of performance in reaching its decisions. This involves the

use of judgement and discretion within a framework that is approved by,

and transparent to, shareholders.

The committee considers that the powers of flexibility, judgement and

discretion are critical to successful design and implementation of the

remuneration policy. This approach is supported in the UK by the ABI’s

principles of remuneration and the GC100 and Investor Group’s guidance

on directors’ remuneration reporting.

In framing this policy, the committee has therefore taken care to ensure

that these existing and important powers are continued in the future.

• The committee considers that an effective remuneration policy needs

to be sufficiently flexible to take account of future changes in the

industry environment facing BP and in remuneration practice generally.

The policy is therefore sufficiently flexible so that the committee can

react to changed circumstances (for example in applying particular

performance measures within schemes which may need to evolve with

the strategy of the company), without the need for a specific

shareholder approval.

• The policy preserves the committee’s long-standing power to exercise

judgement in making a qualitative assessment in certain circumstances.

For annual or long-term bonus awards a number of metrics are used.

Many are numerical in nature and require a quantitative assessment.

Some will be qualitative, for example the maintenance or improvement

in the company’s reputation. Here an impartial assessment will

be required.

• This policy sets out various areas where the committee has discretion,

mainly where it is desirable to vary a formulaic outcome that would

otherwise arise from the policy’s implementation. The committee

considers that the ability to exercise discretion, upwards or downwards,

is important to ensure that a particular outcome is fair in light of the

director’s own performance and the company’s overall performance and

positioning under particular performance metrics. In accordance with UK

regulations, areas where the remuneration policy provides for the

exercise of discretion are identified in the report.

This policy sets out the areas where the committee wishes to have

flexibility or use discretion in its implementation. Each year, the committee

will report to shareholders on the use of these powers.

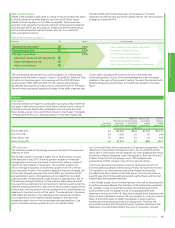

Key considerations

The committee considers a wide range of factors when developing the

remuneration policy for executive directors. The competitive market for top

executives both within the oil sector and broader industrial corporations

provides an important context. The committee believes that it has a duty to

shareholders to ensure that the company is competitive so as to attract

and retain the high calibre executives required to lead the company.

The committee also considers employment conditions within the company

when establishing and implementing policy for executive directors to

ensure alignment of principles and approach. In particular the committee

reviews the policy for the group leaders of around 500 top executives to

ensure that policy for both groups is aligned and reflects consistent

standards and approach.

Decisions regarding remuneration for employees outside the group leaders

are the responsibility of the group chief executive. Employees are not

consulted directly by the committee when making policy decisions

although feedback from employee surveys provide views on a wide range

of points including pay which are regularly reported to the board.

The committee has a long-standing and active programme of engaging

with key shareholders that includes one-on-one meetings with them each

year. This engagement programme complements the overall investor

relations and board engagement efforts of the company, and focuses

mainly on our largest shareholders and main proxy advisers. Feedback

from shareholders on executive director remuneration forms an important

component of the committee’s considerations when establishing policy.

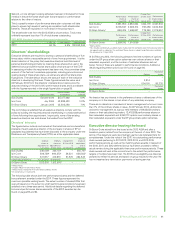

Implementation matters

This policy is a forward-looking document, but it is a requirement of the

regulations that, if obligations under the company’s previous remuneration

policy are to remain in force, these must be stated and certain information

must be provided. In view of the long-term nature of BP’s remuneration

structures – including obligations under service contracts, pension

arrangements, the executive directors’ incentive plan (EDIP) and other

incentive awards – a substantial number of pre-existing obligations will

remain outstanding at the time that this policy is approved, including

obligations that are ‘grandfathered’ by virtue of being in force at

27 June 2012. It is the company’s policy to honour in full any pre-existing

obligations that have been entered into prior to the effective date of

this policy.

Finally the new regulations require detailed information on performance

measures and targets to be included in the report unless the directors

consider that information to be commercially sensitive. The directors are

committed to full and transparent disclosure to shareholders and will seek

to provide the information wherever possible. However, the directors have

determined that the current targets for short- and long-term incentives are

commercially sensitive and should not be disclosed at the commencement

of any relevant performance period as they believe this is not in the

interests of the company. The directors will review such targets at the end

of each relevant performance period and determine whether any target

may be disclosed.

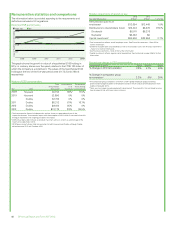

Executive directors’ incentive plan

The EDIP was first approved by shareholders in April 2000 and has since

provided the umbrella framework for share based remuneration for

executive directors. With the introduction of the new UK regulations on pay

reporting, the prime shareholder approval for all elements of remuneration

policy, including share based elements, will now be via the policy report.

The EDIP will continue to provide the vehicle to implement the share based

elements of policy that have been approved by shareholders, the EDIP will

continue to require a separate shareholder approval under UK Listing Rules,

and its renewal has been brought forward to the 2014 AGM to coincide

with the approval of this remuneration policy. Given the duplication of the

two regulatory regimes, the remuneration committee will ensure that any

actions taken in future under the EDIP will be consistent with the policy

approved by shareholders.