BP 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 201386

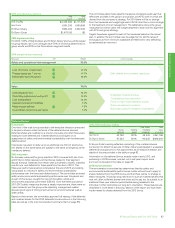

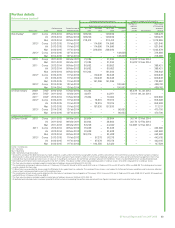

2013 outcomes

Overall group performance outcomes for the year are summarized in the

table above.

S&OR management performance, weighted at 30%, was positive.

Process safety events declined significantly to amongst the lowest of the

oil majors. Loss of primary containment did not meet its target but still

showed an improvement of more than 10% over 2012. Recordable injury

frequency continued to show marked improvement.

Performance related to value measures were similarly positive. Underlying

replacement cost profit and total cash costs both came in better than plan

targets while operating cash flow met its plan level. Major projects met plan

with one exception and Upstream unplanned deferrals exceeded target

with a 30% improvement compared to 2012. Finally, Downstream net

income per barrel was below target reflecting difficult trading conditions.

Based on these results, the group performance factor is calculated at 1.32

times target. The committee, as is its normal practice, considered this result

in the context of the underlying performance of the group, competitors’

results, shareholder feedback and input from the board and other

committees. After review, it concluded that this represented fairly the

overall performance of the business during the year and confirmed the

score for group purposes.

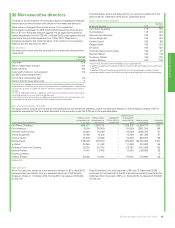

In the Downstream segment, safety results were good with improvement

in most areas of process and personal safety. Performance related to value

measures was negatively impacted by compression of fuel margins and so

operating cash flow was below plan level, but other operating measures

were at or better than plan. A performance score of 1.13 times target was

achieved.

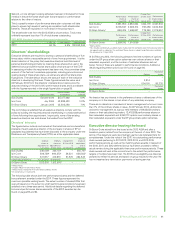

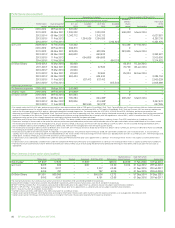

Overall bonus is determined by multiplying the group score of 1.32 times

target by the on-target bonus level of 150% of salary. Bob Dudley’s total

overall bonus therefore was 198% of salary (1.32x150%). The same score

was applied to each of the other executive directors for group outcomes

resulting in both Dr Brian Gilvary and Dr Byron Grote also receiving an

overall bonus of 198% of salary. Combined with the results for his

segment (accounting for 30% of his bonus), Iain Conn’s total overall score

was 1.26 times target, resulting in a bonus of 189% of salary.

Of the total bonuses referred to above, one-third is paid in cash, one-third

is deferred on a mandatory basis, and one-third is paid either in cash or

voluntarily deferred at the individual’s election. Dr Byron Grote, who retired

mid-year, was not eligible for deferral and so his entire bonus (reflecting his

six months of service) was paid in cash.

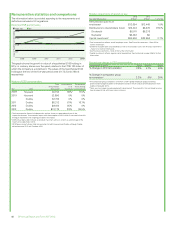

Total remuneration in more depth

Salary and benefits

2013 outcomes

Salaries were reviewed in May 2013 using a number of internal and

external comparisons. Externally, the competitiveness of salaries and of

overall packages relative to other oil majors, other large UK and Europe-

based international companies and related US companies were

considered. Internally the committee reviewed three distinct groups – the

overall level of increases for all employees in both the UK and the US, the

distribution and average level of increases for ‘group leaders’ comprising

around 500 top executives in the company, and finally the individual and

average increases for the top executive team.

Based on this review, salaries were increased by 2.8% for Bob Dudley

(to $1,800,000), 2.9% for Iain Conn (to £774,000) and 2.9% for

Dr Brian Gilvary (to £710,000) effective 1 July 2013.

Total benefits received by executive directors included car-related benefits,

security assistance, insurance and medical benefits. The total value of

taxable benefits is included in the summary table on page 85.

2014 implementation

The remuneration committee intends to review salaries in May 2014 and

will again consider both internal and external comparisons. Benefits will

continue unchanged.

Annual bonus

Framework

All executive directors were eligible for an overall annual bonus, including

deferral, of 150% of salary at target and 225% of salary at maximum –

unchanged since 2010.

Bob Dudley’s annual bonus was based entirely on group results, as was

Dr Brian Gilvary’s and Dr Byron Grote’s. Iain Conn’s was based 70% on

group results and 30% on his Downstream segment results.

Measures and targets for the annual bonus were set at the start of the year

and were derived from the company’s annual plan which, in turn, reflected

the company’s strategy and KPIs. Measures were grouped under the

dominant themes of S&OR management, and restoring value. Targets

were set so that meeting the plan equates to on-target bonus.

At group level, S&OR was set to account for 30% of total bonus and

included targets for loss of primary containment, process safety tier 1

events and recordable injury frequency. Value measures were set to

account for 70% of total bonus and included targets for operating cash

flow, underlying replacement cost profit, total cash costs, Upstream

unplanned deferrals, major project delivery and Downstream net income

per barrel.

Additional measures and targets were set for Iain Conn’s Downstream

segment. These focused on safety, operating efficiency and profitability.

As well as the specific measures set out, the committee considers any

other results or factors it deems relevant and applies its overall judgement

in determining final bonus outcomes.

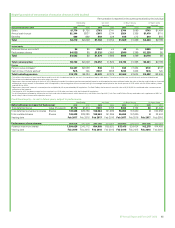

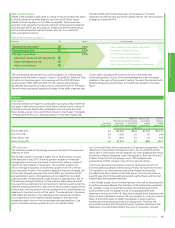

2013 annual bonus outcomes

Measures Weight

Safety and operational risk management 30.0% Threshold Target Max Result

x target

Loss of primary containment 10.0% 0.60

Process safety tier 1 events 10.0% 2.00

Recordable injury frequency 10.0% 1.55

Value 70.0% Threshold Target Max

Operating cash flow 16.3% 1.05

Underlying replacement cost profit 16.3% 1.65

Total cash costs 16.3% 1.50

Upstream unplanned deferrals 7.0% 2.00

Major project delivery 7.0% 0.50

Downstream net income per barrel 7.0% 0.68

Overall outcome 1.32